AI Spending Spree (Bubble)?

Thursday, October 30th, 2025

Good morning! Yesterday was a jam-packed day with Big Tech earnings, Trump finally sitting down with Xi after months of trash talk, and market-shaking moves across the board.

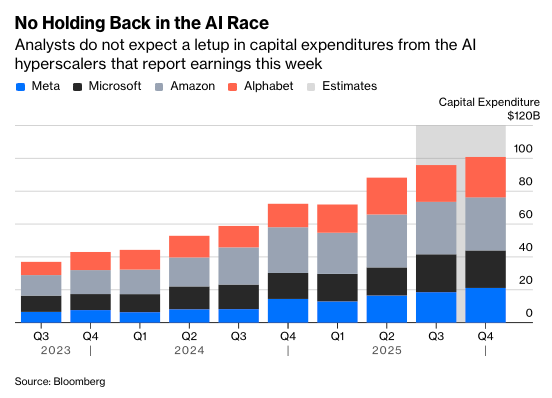

Can Trump and Xi strike a deal before their November 10th trade truce expires, or are we headed back to economic war? And is Nvidia’s mind-blowing leap to $5 trillion in just 16 weeks—while Big Tech burns through $78 billion on AI in a single quarter—the future of computing or the biggest bubble since dot-com?

World News — Trump and Xi to Meet to Discuss Trade

US President Donald Trump met with Chinese President Xi Jinping in South Korea for crucial trade negotiations that will determine whether the two nations extend their current trade truce beyond the November 10 deadline or resume economic hostilities. Trump praised Xi as a “great leader” at the summit’s opening, while Xi acknowledged that disagreements between the world’s two largest economies are natural, comparing their relationship to steering a giant ship through turbulent waters. The leaders are discussing a tentative framework deal that includes China approving American control of TikTok, purchasing US soybeans, and postponing its rare earths export restrictions, following a period of severe tariffs that created what US Treasury Secretary Scott Bessent called a de facto trade embargo.

Tech — Capital Expenditure Explosion From Meta, Alphabet and Microsoft

Major tech companies are testing investor patience with unprecedented AI spending, as Alphabet, Meta, and Microsoft collectively spent $78 billion on capital expenditures last quarter—an 89% increase from the previous year—primarily for data center construction and AI infrastructure. While Google’s stock rose over 6% after its earnings report, Meta and Microsoft shares fell despite executives insisting they cannot meet surging AI demand, with Microsoft’s CFO stating “we are not” catching up to demand even after tens of billions in spending. Meta faces particular scrutiny since, unlike Microsoft and Google who can sell excess computing capacity through their cloud services, it relies primarily on advertising revenue and must justify why spending will continue to grow “significantly faster” in 2026, though CEO Mark Zuckerberg insisted the bigger risk is underinvesting rather than overspending on AI.

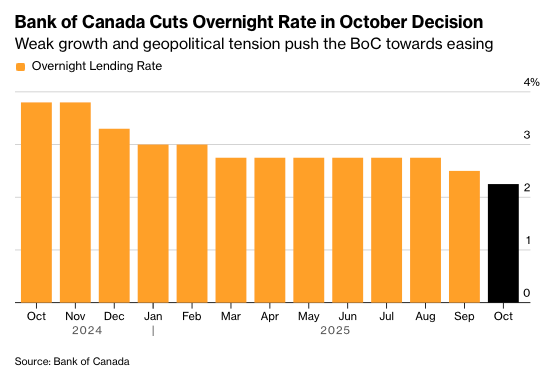

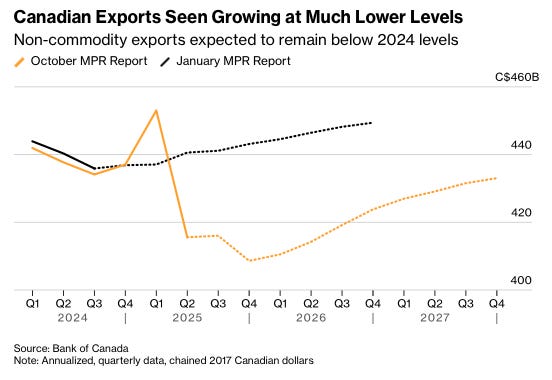

Economics - Bank of Canada Cuts Rate

The Bank of Canada cut its benchmark interest rate by 25 basis points to 2.25%—the lowest since July 2022—while signaling that rates are now “at about the right level” and pushing back against expectations for further cuts, causing the Canadian dollar to strengthen and swap markets to reduce bets on a December rate reduction. Governor Tiff Macklem described the US trade conflict as a “structural transition” that has diminished Canada’s economic prospects, with the bank slashing growth forecasts to 1.2% for 2025 and 1.1% for 2026 (down from 1.8% previously) and projecting the economy will be 1.5% smaller by end-2026 than January forecasts predicted.

While policymakers acknowledged the economy remains under “immense strain” and some analysts believe further cuts may be needed, the central bank emphasized that the supply shock from tariffs limits monetary policy’s ability to stimulate growth without risking inflation, and officials will wait to see how Prime Minister Mark Carney’s upcoming infrastructure-heavy budget affects the outlook before making further moves.

Business — What Is Money Even More, Nvidia?

Nvidia reached a historic $5 trillion market valuation on Wednesday, becoming the world’s first company to hit that milestone after leaping from $4 trillion in just 16 weeks, with the chipmaker now representing over 8% of the S&P 500 and powering everything from Uber’s self-driving cars to Eli Lilly’s pharmaceutical research. As Amazon, Alphabet, Meta, Microsoft, and Apple—which crossed $4 trillion on Tuesday—report earnings this week amid sky-high optimism about AI investments, analysts note that what makes Nvidia’s success unprecedented is its integral role in the global economy’s AI transformation, making it simultaneously a revolutionary force and “a potential $5 trillion single point of failure.”

Chart of the Day

Quote of the Day

“An education is not so much about making a living as making a person.”

― Tara Westover, Educated