AI's Circular Economy

Tuesday, Sept 23rd, 2025

World News — AfD Is Dividing Germany

Economists

The AfD’s advances in Germany reveal not a sweeping national surge but a widening political and social divide, as its growth is concentrated in struggling, post-industrial areas like Gelsenkirchen and parts of the Ruhr while it flounders in wealthier, graduate-heavy western cities such as Cologne and Münster. The party continues to dominate in the east and expand selectively in the west, though often weaker in urban centers and among younger voters. The result is a fragmented political map: in some regions, the AfD is surging on discontent over immigration, welfare, and industrial decline, while elsewhere its appeal is checked by counter-mobilization, entrenched party loyalties, and a clear firewall against forming governing coalitions. Germany’s far right is dividing the country regionally and politically—not conquering it outright.

Tech — Nvidia’s 100Bn Investment in OpenAI Raises More Questions Than Answers

Economists

Nvidia’s proposed $100bn investment in OpenAI underscores both the immense ambition and the circular entanglements of Silicon Valley’s AI boom, tying the fortunes of the world’s most valuable chipmaker, America’s biggest private tech firm, and Microsoft ever closer together. The deal, which would see OpenAI buy up to 5m GPUs—roughly Nvidia’s entire annual shipments—financed partly with OpenAI’s shares, highlights both Nvidia’s shrewd strategy to monetize future demand and OpenAI’s precarious reliance on outside capital to fund ballooning infrastructure needs. Yet the arrangement raises sharp concerns about incestuous “vendor–investor” dynamics, OpenAI’s limited cash flow versus its colossal spending promises, and the enormous power requirements—on the scale of nuclear plants—that threaten to slow the pace of expansion. The tie-up makes the AI stock rally look ever more dependent on a handful of interlocked players, amplifying both their upside and their risks.

Business — China’s Export of Cheap Goods

Bloomberg

China has responded to Trump’s sweeping tariffs by flooding global markets with cheap exports, pushing its trade surplus toward a record $1.2 trillion while redirecting goods to India, Africa, Southeast Asia, and Latin America. This surge is straining foreign industries but most governments, wary of sparking a second trade war alongside their wrangling with Washington, are opting for selective measures rather than broad retaliation—Mexico being a rare exception. Beijing is leveraging diplomacy and threats to deter such actions, while weaker currencies and shifting supply chains make its goods even more competitive. Yet the glut highlights deep contradictions: Chinese firms are slashing prices abroad to offset overcapacity and deflation at home, even as domestic consumption remains weak. For Xi Jinping, proving that China can thrive without U.S. buyers may strengthen his hand in ongoing negotiations with Trump, but the strategy risks hardening global backlash and entrenching China’s dependency on exports at the expense of economic rebalancing.

The Daily Spark

Goods inflation is rising because of tariffs, and services inflation is no longer declining, see the first chart below.

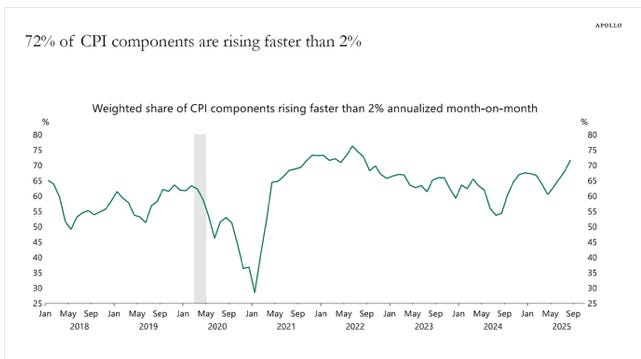

At the same time, 72% of the CPI components are growing faster than the Fed’s 2% inflation target, see the second chart below.

The bottom line is that inflation is still not under control, and this increases the risk of a steeper curve, a higher term premium, and a rise in TIPS and breakevens, see the third chart below.

Quote of the Day

“A revolution is not a dinner party, or writing an essay, or painting a picture, or doing embroidery; it cannot be so refined, so leisurely and gentle, so temperate, kind, courteous, restrained and magnanimous. A revolution is an insurrection, an act of violence by which one class overthrows another.” - Mao Zedong “Report on an Investigation of the Peasant Movement in Hunan”