Are We Going Back to 1929?

Thursday, October 23rd, 2025

World News — The US Imposes Sanction on Russia

The US just hit Russia’s two biggest oil companies, Rosneft and Lukoil, with major sanctions - basically blocking them from doing business in dollars - to pressure Putin to end the Ukraine war. This is Trump’s first real financial move against Russia since taking office, and it comes after similar sanctions from the UK, with the EU about to drop their own package. Oil prices jumped over 4% because these sanctions could actually cut Russian oil supplies, unlike previous ones that Russia worked around by selling to Asia through sketchy tanker fleets - but now with Trump also hitting countries like India with tariffs for buying Russian oil, Moscow’s running out of workarounds.

Tech — Tesla Profit Drops, Eyeing Robotics For Future Growth

Tesla’s profits dropped 29% even though they sold a record number of cars, because they’re getting crushed by Trump’s tariffs (costing them over $400 million), losing money from emissions credits that basically disappeared after the government stopped fining polluters, and dumping massive amounts of cash into AI and robots. The sales spike only happened because people rushed to buy before a $7,500 tax credit expired in September, but now Musk is trying to get shareholders to approve a $1 trillion compensation package for himself while proxy advisers are telling investors it’s a terrible idea - and he’s calling them “corporate terrorists” and saying he needs the money to keep building his “robot army” without getting kicked out.

Economics — Why Are American Women Leaving the Labor Force

Women are leaving the US workforce at the fastest rate since the 1950s - down almost a full percentage point from last year, meaning over 600,000 women have dipped out - but it’s probably not because of “tradwife” TikTok trends or childcare costs. The real reason seems way simpler: there’s a mini baby boom happening because tons of couples postponed weddings during COVID, got married in 2022, and are now having kids a year or two later, which temporarily pulls women out of work for maternity leave. The question is whether they’ll come back at the same rates now that remote work is disappearing and companies are forcing everyone back to the office, unlike pandemic moms who could work from home and had higher workforce participation rates.

Culture — Revisiting the 1929 Stock Market Crash

Andrew Ross Sorkin, who wrote “Too Big to Fail” about the 2008 financial crisis, just dropped a book about the 1929 stock market crash that basically reads like a thriller even though everyone involved has been dead for decades. He focuses on the banking giants who watched the market implode after it had blown up 500% in the 1920s thanks to everyone and their mom buying stocks on borrowed money - sound familiar? - and then tried desperately to save it by burning through hundreds of millions buying stocks as everything collapsed. The scary part is how similar it feels to today: we’ve got record household debt, margin loans at near-record levels compared to the economy’s size, and everyone’s treating investing like a hobby instead of something only rich people do, which is exactly what set up 1929 for disaster - though Churchill’s take still hits that even when everything goes to hell, the system is “built to survive” crashes, not prevent them.

Interview with Andrew discussing his new book:

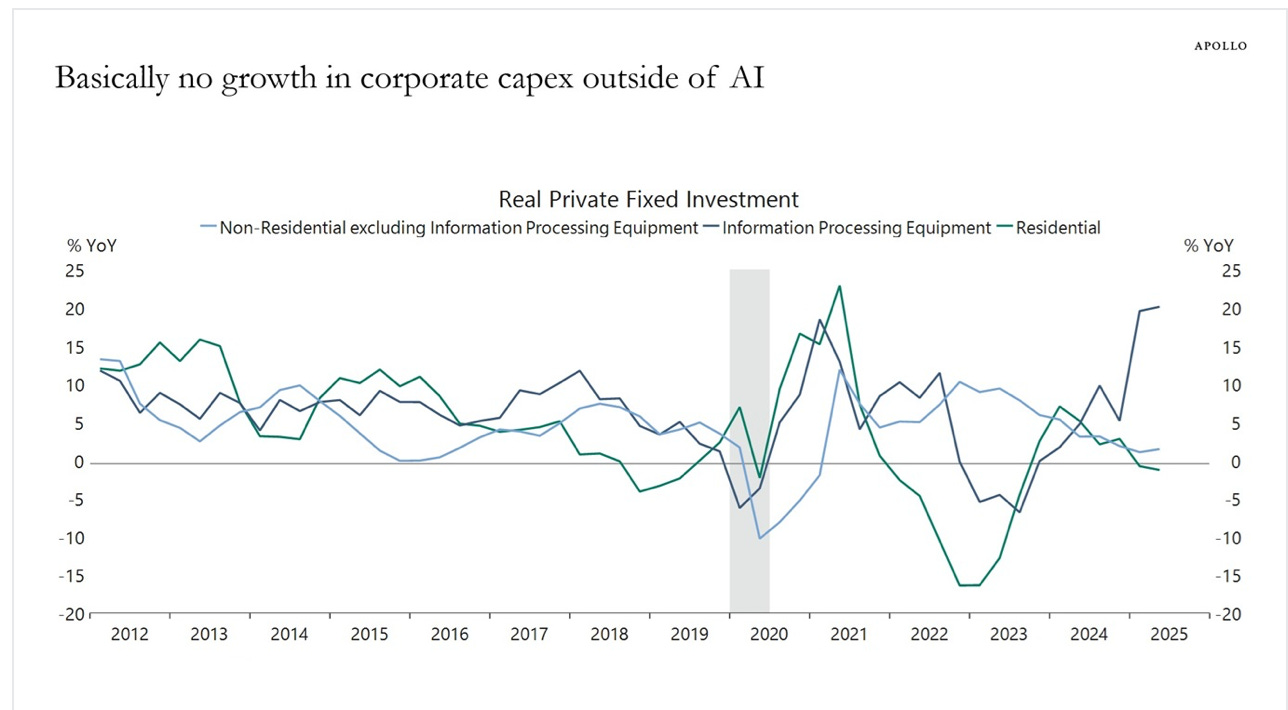

Chart of the Day

Quote of the Day

“While the financial crisis destroyed careers and reputations, and left many more bruised and battered, it also left the survivors with a genuine sense of invulnerability at having made it back from the brink. Still missing in the current environment is a genuine sense of humility.” ― Andrew Ross Sorkin, Too Big to Fail