Bubble in the Valley

Monday, July 14th, 2025

World News — German Defense Minister Calls Arm Maker to Deliver

FT

German Defence Minister Boris Pistorius has strongly urged Germany’s arms industry to stop complaining and focus on delivering the equipment needed to re-arm Europe, emphasizing that the government has already addressed industry concerns by streamlining military spending and making long-term commitments. Pistorius highlighted that Germany is set to increase its annual defence budget to €162 billion by 2029—a 70% rise from this year—aiming to transform the Bundeswehr and position Germany as a leader in European security. He stressed that industry must ramp up production across all areas, including ammunition, drones, and tanks, to meet these ambitious goals and prevent delays that have previously hampered projects. Pistorius also noted that Berlin has already supplied three of its twelve Patriot air defence systems to Ukraine, with only six remaining in Germany, making further transfers impossible without risking NATO capability targets. While rejecting the idea of joint EU borrowing to fund defence, he outlined plans for long-term procurement contracts to give industry the certainty needed for investment, and pledged to speed up procurement processes and ensure the armed forces receive state-of-the-art equipment. Pistorius, known for his direct approach and strong support for Ukraine, underscored that Germany’s shift in mindset toward re-armament is well underway, with broad public backing for increased defence spending and voluntary military service.

Tech — Why GM’s CEO Is Still Betting on EV

The Verge

General Motors CEO Mary Barra remains committed to an all-electric future for GM, even as shifting U.S. political winds and economic pressures force the company to adjust its electrification timeline. While GM was the first major U.S. automaker to pledge going all-electric by 2035, recent policy changes under President Trump—including the rollback of EV incentives and stricter tariffs—have led the company to soften its language and scale back some EV investments in favor of internal combustion vehicles. Despite these headwinds, GM has surged to become the world’s number two EV seller, with Chevrolet emerging as the fastest-growing U.S. EV brand in early 2025. Barra emphasizes that consumer demand and infrastructure readiness will ultimately dictate the pace of electrification, advocating for a national standard over fragmented state regulations. Meanwhile, GM is leveraging its luxury Cadillac brand’s return to global racing, including a high-profile F1 entry, to boost international recognition and innovation. Amidst ongoing challenges to diversity, equity, and inclusion efforts, Barra stresses the importance of a respectful, inclusive workplace to attract and retain talent, underscoring her belief that GM’s trusted brand and balanced strategy will help it navigate an increasingly volatile political and business landscape.

Silicon Valley and Business — Racing to Build a $1 Trillion Unicorn

Economists

Silicon Valley’s race to create the first $1 trillion unicorn—a privately held startup reaching a trillion-dollar valuation—reflects the explosive optimism and capital swirling around the AI boom, but it also amplifies the risks inherent in venture capital’s new direction. As VC firms pour unprecedented sums into mature startups and hold onto them longer, the industry is becoming more exposed to the dangers of overvalued, unprofitable companies. The abundance of capital, the influx of foreign investors, and the shift toward permanent or continuation funds have fueled ever-higher valuations, but liquidity remains a challenge: secondary share sales offer only a fraction of the flexibility of public markets. If these sky-high valuations prove illusory—as with the “zombie unicorns” of the last cycle—investors could face enormous losses, a wave of failed startups, and a sharp contraction in venture funding. The pursuit of trillion-dollar rewards may be transforming venture capital, but it also risks repeating the cycle of boom, bust, and disillusionment that has haunted Silicon Valley before.

Culture — Japan Is Hit By Investing Fever

Economists

Japan is experiencing a surge in retail investing, fueled by the government’s overhaul of the tax-free Nippon Individual Savings Account (NISA) scheme and rising inflation, which has eroded the appeal of keeping cash in low-yield savings accounts. Bookshops, trains, and social media are now saturated with investment advice, and millions of new NISA accounts have been opened, with assets in these accounts reaching government targets three years early. Historically, Japanese households have been risk-averse, holding over half their assets in cash and deposits, but persistent inflation, concerns about pension sustainability, and corporate reforms boosting shareholder returns are driving a shift toward equities and mutual funds. The next frontier is Japan’s elderly, who control nearly 60% of household assets; the government is considering a “Platinum NISA” to encourage seniors to invest tax-free in monthly dividend funds, making it easier for them to draw down assets in retirement. While some critics note that much of the new investment flows abroad, younger and first-time investors are showing a preference for global diversification, signaling a significant cultural shift in Japanese personal finance.

The Daily Spark

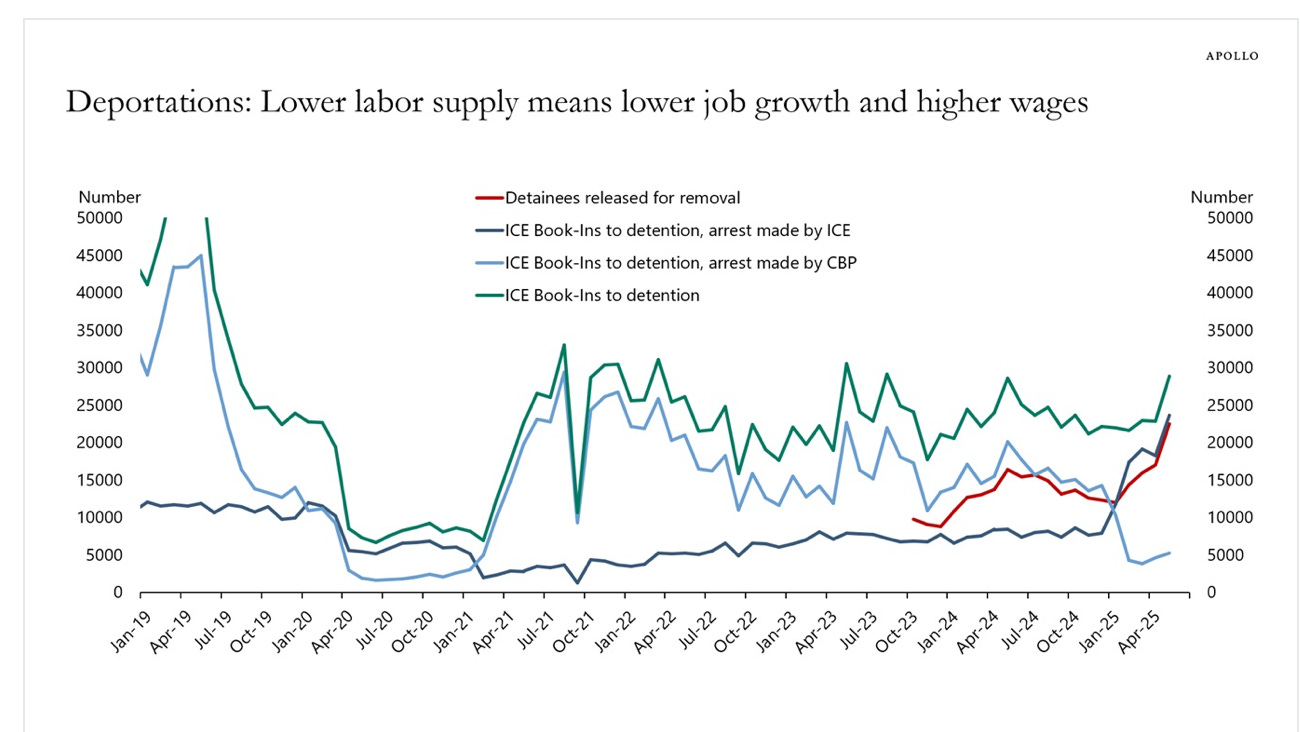

If 3,000 unauthorized immigrants are deported every day, the labor force will decline by roughly 1 million people in 2025.

Lowering the labor force by 1 million will reduce the participation rate by 0.4 percentage points, which will lower the unemployment rate, lower job growth, and increase wage inflation, particularly in the sectors where unauthorized immigrants work—namely construction, agriculture, and leisure & hospitality.

In short, deportations are a stagflationary impulse to the economy, resulting in lower employment growth and higher wage inflation.

For more discussion and quantification, see this new working paper by Edelberg, Veuger, and Watson.

Song Recommendation — Let Me Love You

Quote of the Day

"The best way to predict the future is to create it." - Peter Drucker