Bumper Bank Earnings

Wednesday, October 15th, 2025

World Events — Trump Threatens China’s Cooking Oil

Bloomberg

President Trump announced he’s considering halting cooking oil trade with China in retaliation for Beijing’s refusal to buy American soybeans, which he called an “Economically Hostile Act” harming US farmers. The threat reignited US-China trade tensions, causing the S&P 500 to turn negative, just hours after both sides had expressed optimism about ongoing negotiations. This development came as American farmers continue struggling with low crop prices and China’s avoidance of US soybean purchases, while both nations have been imposing tit-for-tat restrictions on critical materials ahead of potential November trade talks.

Tech — Apple Pivoting to Vietnam For Manufacturing

Bloomberg

Apple is expanding its Vietnam manufacturing operations to produce new smart home devices, including a home hub display and security cameras set for 2026, as well as a tabletop robot with a motorized arm planned for 2027, marking a significant shift from its traditional practice of initially building new products in China. The company is partnering with Chinese firm BYD for final assembly and also expanding iPad production in Vietnam as part of its ongoing effort to diversify away from China amid geopolitical tensions, though products from Vietnam still face 20% US tariffs under the Trump administration’s reciprocal tariff policy. The home hub, priced around $350, will feature a 7-inch display with an improved Siri assistant and FaceTime camera, while the more expensive tabletop robot will include a 9-inch screen on a motorized arm capable of moving around workspaces.

Finance — Bumper Earnings From the Banks

FT

JPMorgan Chase, Goldman Sachs, and Citigroup reported strong quarterly earnings that exceeded analyst expectations, driven by a resurgence in dealmaking and trading volatility, with net income rising 12%, 37%, and 18% respectively, as Wall Street’s anticipated revival under the Trump administration finally materialized after early-year uncertainty over trade wars. However, executives at all three banks warned that investor exuberance is pushing asset valuations into potential bubble territory, with JPMorgan’s Jamie Dimon noting “a lot of assets out there which look like they’re entering bubble territory” and Citi’s Jane Fraser cautioning about “pockets of valuation frothiness,” even as they expect the momentum in dealmaking to continue through 2026 amid what Fraser described as a more resilient global economy than anticipated.

Economics — The Most Dangerous Corner of the Balance Sheet

Economists

Receivables—money owed to companies by customers but not yet collected—have played an understated but recurring role in major financial collapses, from Enron and Carillion to recent concerns about American car-parts firm First Brands, which is being investigated for potentially borrowing against the same receivables multiple times. These assets are difficult for auditors to scrutinize and have been used to disguise struggling business models or facilitate outright fraud, as rising receivables can mask revenue problems while fake invoices can create illusory growth. The $4 trillion factoring industry, which purchases receivables at a discount, has amplified these risks, and analysts warn that China’s local-government-financing vehicles—holding 22.7 trillion yuan in receivables owed largely by financially stressed local governments—could represent the next major receivables-related crisis.

The Daily Spark

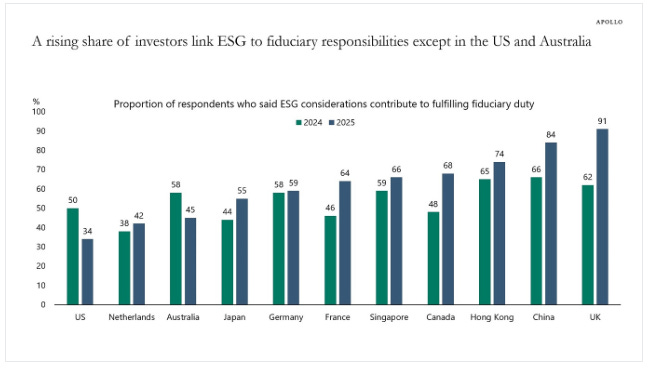

According to a recent Morningstar survey, the proportion of investors who view ESG as part of their fiduciary duty has increased in most surveyed countries, with notable declines in the US and Australia, see chart below.

Quote of the Day

“It is a strange thing, but when you are dreading something, and would give anything to slow down time, it has a disobliging habit of speeding up.”

― J.K. Rowling, Harry Potter and the Goblet of Fire