Canada's Inflation Rises

Wednesday, July 16th, 2025

World News - Trumps Reaps $50 Bn Tariff Haul

The latest round of U.S. tariffs imposed by President Trump has generated nearly $50 billion in additional customs revenue, as most of America’s trading partners have refrained from launching significant retaliatory measures. Since the start of Trump’s aggressive tariff policy—featuring blanket tariffs of at least 10% globally, and much higher rates on steel, aluminum, autos, and targeted countries—only China and Canada have responded in kind. China’s retaliatory tariffs, while robust, have failed to match the revenue impact of the U.S. measures, raising its own customs receipts by just 1.9% year-on-year as of May 2025, and Canada’s limited response stands in stark contrast to the scale of U.S. gains.

Other major trading partners, such as the European Union and Mexico, have avoided imposing counter-tariffs or pledged only selective, delayed retaliation, often preferring negotiations to escalation, wary of the threat of even harsher tariffs and possible economic fallout. Experts point out that the reluctance to retaliate is largely pragmatic: given the U.S.’s dominant role as the world’s chief consumer market, most governments view a confrontational approach as high risk for their economies. Moreover, brands such as Apple, Adidas, and Mercedes are managing supply chains creatively to distribute tariff costs globally, insulating U.S. consumers from the full brunt of price increases. Despite the highest U.S. tariff levels since the 1930s, the “chicken out” strategy—in which countries yield to U.S. demands—has, at least for now, prevented a mutually destructive escalation and severe disruption of global trade reminiscent of the interwar era. However, analysts warn that while this cautious stance may shield global supply chains in the short term, it could cement a long-term advantage for U.S. firms at the expense of others, depending on how tariff levels and global alignments evolve in the coming months.

Tech - Chip Equipment Maker ASML Beats Earnings Expectations

Bloomberg

ASML Holding NV reported second-quarter 2025 orders that exceeded market expectations, with net bookings reaching €5.5 billion, significantly above the analyst consensus of €4.8 billion, driven by continued robust demand for advanced chip-making machines used in artificial intelligence applications. Quarterly net sales came in at €7.7 billion and net income was €2.3 billion, reflecting strong performance as AI investment fuels higher demand for ASML’s extreme ultraviolet lithography technology, essential for manufacturing cutting-edge chips by leading clients including Taiwan Semiconductor Manufacturing Co. and Intel. While AI customers’ fundamentals remain strong, CEO Christophe Fouquet cautioned that macroeconomic and geopolitical uncertainties cloud the 2026 outlook; ASML still prepares for growth next year but cannot confirm it. The company forecasts third-quarter net sales between €7.4 billion and €7.9 billion and expects full-year 2025 net sales to grow by around 15%, with a gross margin near 52%.

Economics - Canada’s Inflation Picks Up

Bloomberg

Canada’s annual inflation rate accelerated to 1.9% in June 2025, up from 1.7% in May, as higher prices for new and used vehicles, furniture, and clothing offset cooling food and shelter costs. While gasoline prices remained lower year-over-year, the decline was less steep than earlier months, contributing less to holding down inflation than before. Prices for durable goods such as passenger vehicles (up 5.2%) and furniture (up 3.3%) contributed notably to the increase. The Consumer Price Index excluding energy rose 2.7%, and core inflation measures preferred by the Bank of Canada stayed elevated, with CPI-median at 3.1% and CPI-trim at 3%. This rise, combined with strong jobs data, has solidified expectations that the Bank of Canada will maintain its current policy rate at its July 30 meeting. Persistent underlying inflation and tariff-related price pressures, especially amid ongoing trade tensions with the U.S., are key factors keeping policymakers cautious about any near-term rate cuts.

Culture - Pity France’s Cognac Maker

Economists

France’s cognac producers have secured a reprieve in China after 34 firms, including the industry’s biggest names, agreed to minimum pricing in order to avoid harsh new anti-dumping tariffs, meaning only a handful of exporters will face Beijing’s 35% levy. However, this deal comes at the cost of slimmer margins and does not erase broader challenges: China has doubled its import tax on European brandy and whisky to 10%, and slowing Chinese demand for luxury goods is weighing further on sales. Meanwhile, the U.S.—which accounts for about half of global cognac consumption—poses arguably greater risks. President Trump has threatened to slap tariffs as high as 200% on European wine and spirits, and already imposed a 10% duty since April, potentially rising to 20% or beyond if EU-U.S. talks fail. The uncertainty and cumulative tariff threats have sapped U.S. demand, with cognac sales dropping nearly 12% year-on-year by mid-June, reflecting both higher prices and changing habits among American consumers, who are drinking less and reaching more often for tequila and other spirits instead. For France’s cognac-makers, relief in China is only a temporary solace amid mounting economic, political, and social pressures in their vital export markets.

The Daily Spark

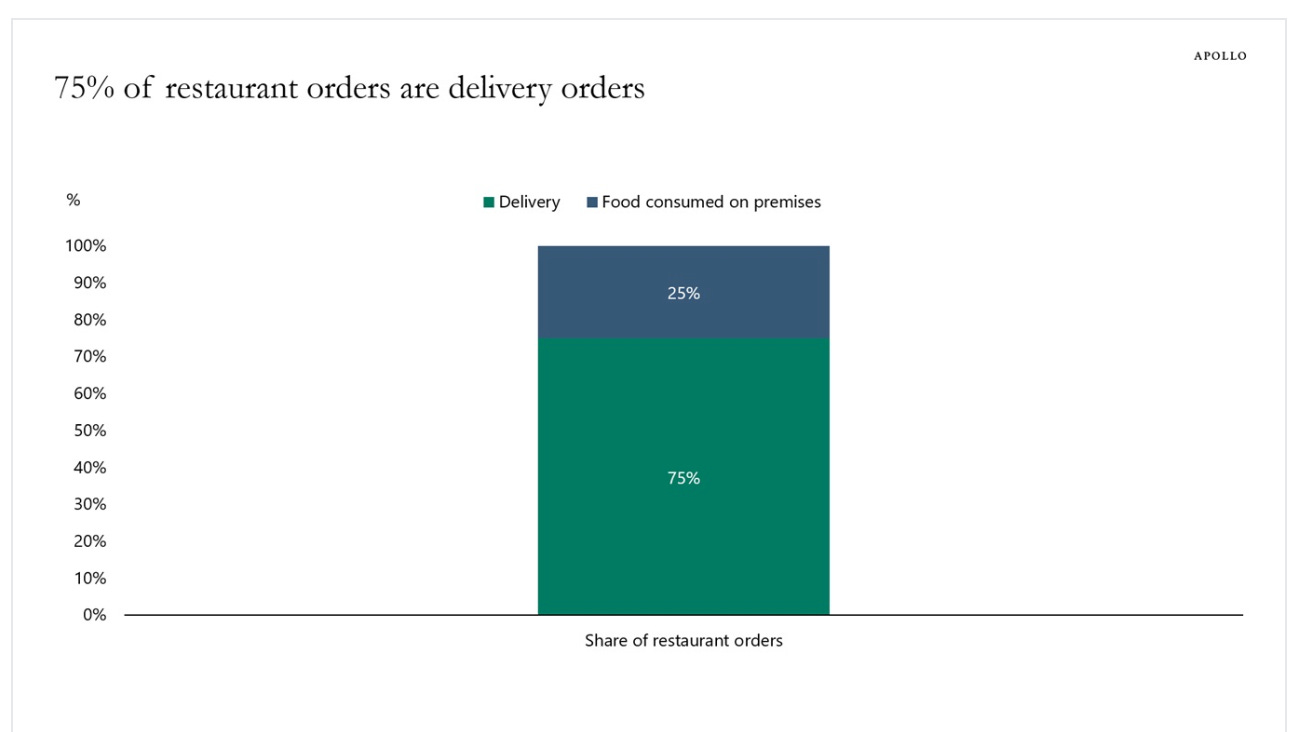

Only 25% of meals sold by restaurants are consumed on premises. The remaining 75% are delivery orders, see chart below and here.

Song Recommendation - Sad Song

Quote of the Day

"Every artist dips his brush in his own soul, and paints his own nature into his pictures." - Henry Ward Beecher