Ceasefire in Gaza

Friday, October 9th, 2025

World News — Ceasefire in Gaza

FT

Israel has approved the first phase of President Trump’s plan to end the two-year Gaza war, with Netanyahu’s cabinet voting early Friday to implement a ceasefire and hostage release deal with Hamas. The agreement will see 48 Israeli hostages freed starting Monday or Tuesday in exchange for nearly 2,000 Palestinian prisoners, while Israel withdraws troops from front lines and allows increased humanitarian aid into Gaza. However, significant uncertainty remains about the deal’s second phase, which envisions Hamas’s disarmament and full Israeli troop withdrawal, with Netanyahu’s far-right coalition partners threatening to collapse the government if the war doesn’t continue until Hamas is destroyed.

Tech — The Demand For Compute Keeps Growing

Bloomberg

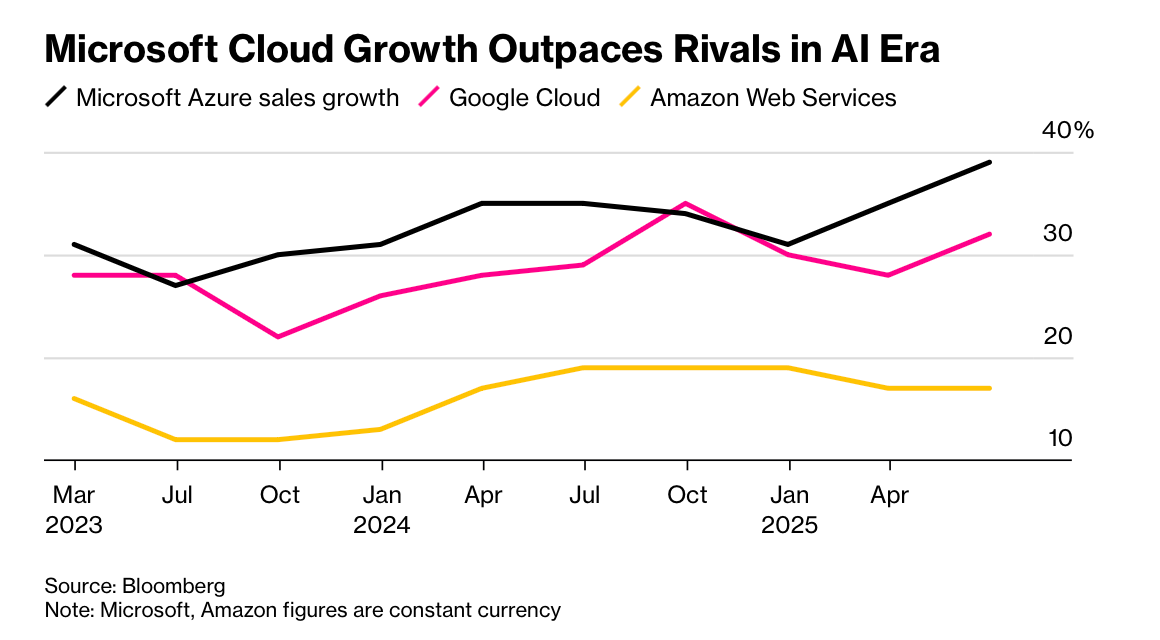

Microsoft’s data center capacity shortage will extend into the first half of 2026, longer than previously forecast, with critical Azure cloud service regions in Northern Virginia and Texas facing restrictions on new subscriptions due to shortages of both physical space and servers. The constraints affect both AI-focused GPU systems and traditional CPU-based infrastructure, forcing the company to redirect customers to alternative regions despite increased costs and latency, while some customers take their business to competitors. Despite adding over two gigawatts of capacity in the past year and spending heavily on expansion, Microsoft’s CFO acknowledged the company has repeatedly underestimated demand growth driven by AI workloads and traditional cloud services, with the shortage affecting even internal Microsoft projects that have been closed to preserve capacity for paying customers.

Markets — Cracks in the Credit Market

Bloomberg

First Brands Group, an auto-parts supplier, collapsed into bankruptcy last month owing over $10 billion to major Wall Street firms including Jefferies, UBS, and Millennium, with one financial partner alleging $2.3 billion has “simply vanished” and federal prosecutors now investigating the circumstances. The implosion has sent shockwaves through the private financing industry, forcing Raistone (which derived 80% of its revenue from First Brands) to cut half its staff, threatening UBS’s sale of its O’Connor hedge fund to Cantor Fitzgerald, and triggering redemption requests at Jefferies’ Point Bonita Capital which had $715 million exposed to the company. The collapse exposes critical weaknesses in the opaque private financing market, where red flags—including off-the-books financing, late supplier payments, and management stonewalling investor requests for documentation—went undetected because the closely-held company operated as a “black box” with minimal regulatory oversight, even as it raised hundreds of millions from retail investors through platforms like Yieldstreet under code names like “Mango.”

The Daily Spark

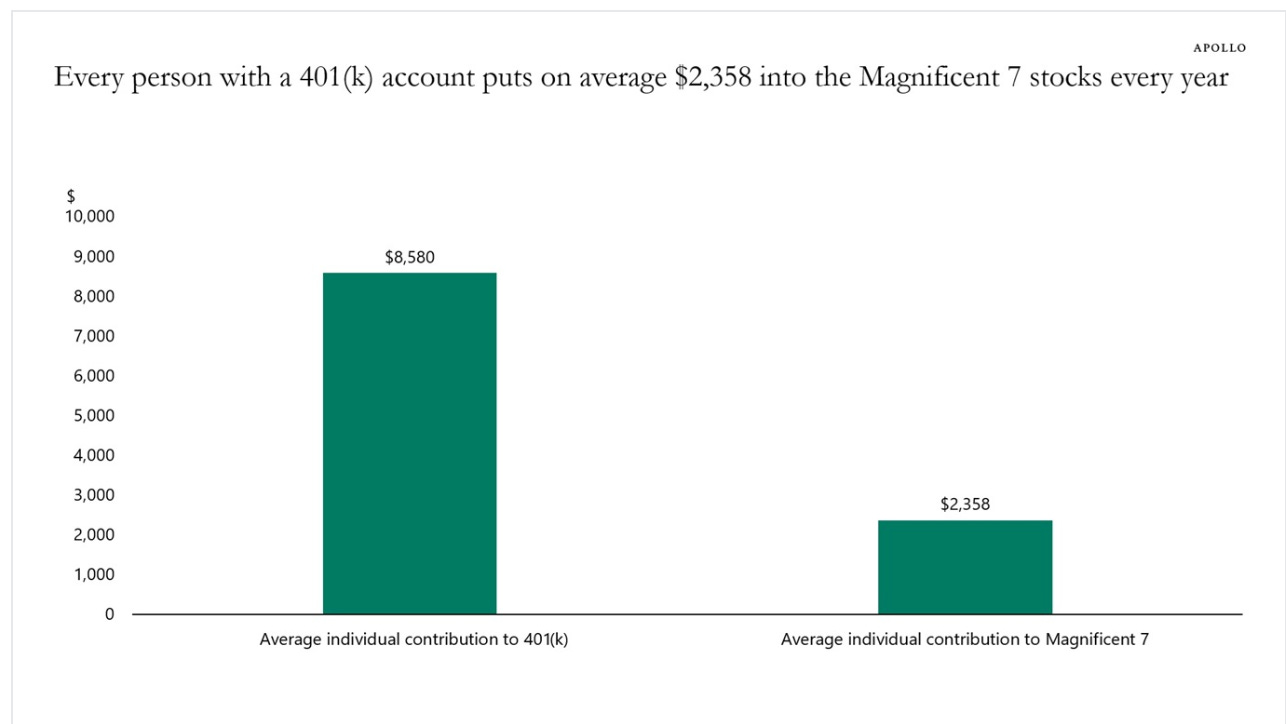

US workers contribute on average around $8,500 to their 401(k) accounts every year, and with 71% of 401(k) assets allocated to equities—and the Magnificent Seven having a weight of almost 40% in the S&P 500—the bottom line is that each worker in the US puts an estimated $2,300 into the Magnificent Seven stocks every year, see chart below.

This is passive money going into the Magnificent Seven regardless of whether their outlook is good or bad.

Quote of the Day

“If we admit that human life can be ruled by reason, then all possibility of life is destroyed.”

― Leo Tolstoy, War and Peace