Challenging Trump

Wednesday, April 16th, 2025

World Events — China Hits Back on American Firms

The Economists

After decades of American political support for U.S. firms in China, the relationship has sharply deteriorated as the trade war escalates, leaving companies like Apple, Boeing, Nike, and Starbucks caught in the crossfire. The Trump administration’s aggressive tariffs—now at 145% on Chinese imports—have been met with nearly equivalent Chinese tariffs of 125%, alongside regulatory crackdowns and blacklists targeting American firms. China’s aviation regulator, for instance, has halted Boeing deliveries, and other U.S. companies face investigations, export controls, and the threat of being added to the “unreliable entities list,” which can effectively bar them from the Chinese market. These measures have already led to falling orders, operational uncertainty, and a chilling effect on future investment. While American firms have long relied on China for growth—Apple, Tesla, and Starbucks generate significant revenue and employ thousands locally—the new environment is forcing many to reconsider their supply chains and investment strategies, with some accelerating diversification to other countries. Yet, the complexity and cost of such moves are high, and the risk of further retaliation looms, especially as China signals willingness to target American intellectual property, services, and even consumer brands. The trade war, once seen as a tool to address imbalances, now threatens to unravel decades of commercial integration, with American executives describing the situation in a single word: “destruction”.

Tech — Zuckerberg on Trial For Anti-Trust

Meta’s antitrust trial, which began on April 14th, centers on the Federal Trade Commission’s claim that Meta illegally maintained a social media monopoly by acquiring Instagram and WhatsApp, moves the FTC now seeks to unwind despite having approved them over a decade ago. The FTC’s case relies on a narrowly defined “personal social networking” market that excludes major competitors like TikTok, YouTube, and X, even as the social media landscape has become more fragmented and competitive, with TikTok alone amassing over 1.5 billion users worldwide. Meta argues that the FTC’s case is outdated and ignores the reality of today’s dynamic market, where innovation and competition are fierce, and where consumer engagement with social media is higher than ever, despite concerns about content and advertising. With the fate of TikTok in the U.S. still uncertain and new platforms constantly emerging, the FTC’s argument that Meta faces insufficient competition appears increasingly tenuous, making the case for breaking up Meta weaker now than when it was first filed.

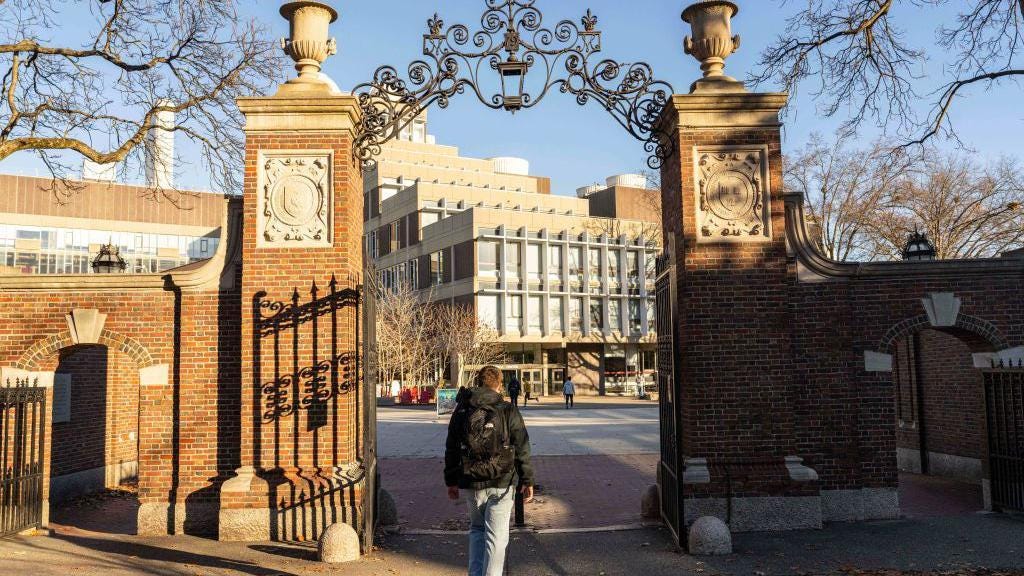

Business — Can Harvard’s Billion Survive Trump’s Funding Withdrawal

Bloomberg

Harvard University, despite its $53 billion endowment and robust financial planning, faces a significant test as the Trump administration freezes $2.2 billion in federal funding—about 11% of its revenue—jeopardizing critical research in fields like AIDS, cancer, and organ transplants. While Harvard’s endowment is vast, over 80% of its funds are restricted to specific purposes such as scholarships, professorships, and targeted programs, limiting the university’s ability to freely reallocate resources to cover the sudden loss of federal grants. In response, Harvard has tapped short-term borrowing, including a recent $750 million bond sale, and imposed hiring freezes to shore up its finances. However, the endowment cannot fully replace the scale or flexibility of federal research support, and prolonged funding cuts could force Harvard to scale back research, delay projects, and potentially impact student opportunities and faculty retention. While Harvard’s financial strength provides a buffer against immediate crisis, a sustained federal funding freeze—especially if coupled with threats to its tax-exempt status—would pose a serious, long-term challenge even for the world’s wealthiest university.

Psych — Why Doom Spending Isn’t the Stress Relief You Need

Verywell Mind

Doom spending, the act of compulsively spending money in response to anxiety, hopelessness, or dread about the future, is a coping mechanism employed by as many as 1 in 5 Americans to deal with economic uncertainty and other stressors; while it provides a temporary sense of relief by triggering the release of dopamine, it's followed by feelings of guilt, remorse, and intensified anxiety, potentially leading to a cycle of emotional instability and financial strain, including credit card debt, which reached $1.21 trillion in December 2024. To combat this, experts recommend practicing mindfulness to make deliberate purchasing choices, engaging in self-care activities like physical activity and balanced nutrition, and implementing financial planning strategies such as detailed budgeting, identifying spending triggers through journaling, unsubscribing from retail newsletters, and using cash instead of credit cards to curb impulse buys.

Recipe — Lime Green Smoothie

Start your day with a burst of sunshine in this bright green lime smoothie! Its tangy citrus notes, perfectly balanced with sweet vanilla, create a flavor reminiscent of a refreshing creamsicle.

Song Rec — Waiting on a Wish (Disney’s Snow White)

Quote of the Day

“If any organism fails to fulfill its potentialities, it becomes sick.” ― William James