Congratulations on $4T, Jensen

Thursday, July 10th, 2025

World Events — Trump Threatens 50% Tariff on Brazil

Donald Trump announced that the United States will impose a 50% tariff on all goods imported from Brazil starting August 1, citing the Brazilian government’s treatment of former president Jair Bolsonaro as a primary reason, rather than economic concerns or trade imbalances. In a letter posted to social media, Trump accused Brazil of conducting a “witch hunt” against Bolsonaro, who is on trial for allegedly attempting to overturn the 2022 election, and criticized Brazil’s Supreme Court for issuing censorship orders against US social media companies. The move marks a significant escalation in US-Brazil relations, with Brazilian President Luiz Inácio Lula da Silva vowing to respond under the country’s Economic Reciprocity Act and emphasizing Brazil’s sovereignty. The tariff is notably higher than previous levies and comes amid broader US tariff threats against multiple countries, but the justification for Brazil was uniquely political, tied to Bolsonaro’s legal troubles and alleged attacks on free speech, rather than the usual focus on correcting trade deficits—especially as the US currently holds a trade surplus with Brazil.

Tech — Jensen Plans a Beijing Trip

FT

Nvidia CEO Jensen Huang is planning a visit to Beijing next week to meet with senior Chinese officials and reaffirm the company’s commitment to the Chinese market, ahead of the planned September launch of a new artificial intelligence chip specifically designed for China and compliant with tightened US export controls. The new chip is a modified version of Nvidia’s Blackwell RTX Pro 6000 processor, stripped of advanced features like high-bandwidth memory and NVLink, and is expected to be priced significantly lower than the previously restricted H20 model. Chinese clients, including major tech firms, have been testing samples and are interested in significant orders despite the chip’s reduced performance, as switching away from Nvidia’s Cuda software would raise their operating costs. Nvidia’s share of the Chinese AI chip market has dropped from 95% to 50% since US export restrictions intensified, and the company is seeking assurances from US authorities to avoid further bans before commencing sales in September.

Nvidia just reached $4 trillion dollar valuation to become the most valuable company in the world. Is this a bubble? Who knows, but the valuation does not seem overly stretched, yet!

Trade — America Cannot Ignore the Effects of Tariff Forever

Economists

Despite initial market indifference and the perception that tariff threats are mere negotiating tactics, the steady rise in US tariffs under President Trump is already hurting the American economy. The average tariff rate has climbed from 2.5% last year to around 10% in July 2025, with further increases looming, and even trade deals have left barriers much higher than before. While inflation has remained relatively low so far, this is largely because companies stockpiled imports and absorbed costs, but as these buffers run out, consumers will face higher prices and inflation is expected to exceed 3% by year-end. Economic growth has slowed sharply—America is on track to grow at only half the pace of 2024—and weak consumption and retail sales reflect the strain. Although retaliation from trading partners has been limited, the uncertainty and volatility of tariff policy are discouraging investment and encouraging firms to lobby for exemptions instead of focusing on innovation. Over time, this gradual erosion will make the US economy persistently smaller, with real GDP projected to be about 0.4% lower in the long run, and the harm from tariffs will become increasingly difficult to ignore.

Culture — Is Thailand Heading to Another Coup

Economists

Thailand is facing its most severe political crisis in years following the suspension of Prime Minister Paetongtarn Shinawatra over alleged ethical breaches related to a leaked phone call with Cambodia’s former leader, triggering mass protests, coalition defections, and renewed speculation about the risk of another military coup. While Thailand has a long history of coups—twelve since 1932—analysts currently see a military takeover as unlikely, arguing that the royalist-military establishment prefers using legal and parliamentary maneuvers to remove governments it opposes, as seen in recent years. The government’s parliamentary majority is now razor-thin after the Bhumjaithai party’s exit, and opposition parties are calling for snap elections, but the army appears reluctant to intervene directly, given the risks and lack of clear benefit from another coup. Instead, the ongoing instability is expected to persist, undermining investor confidence and hampering Thailand’s ability to respond to economic challenges such as weak tourism and looming US tariffs.

The Daily Spark

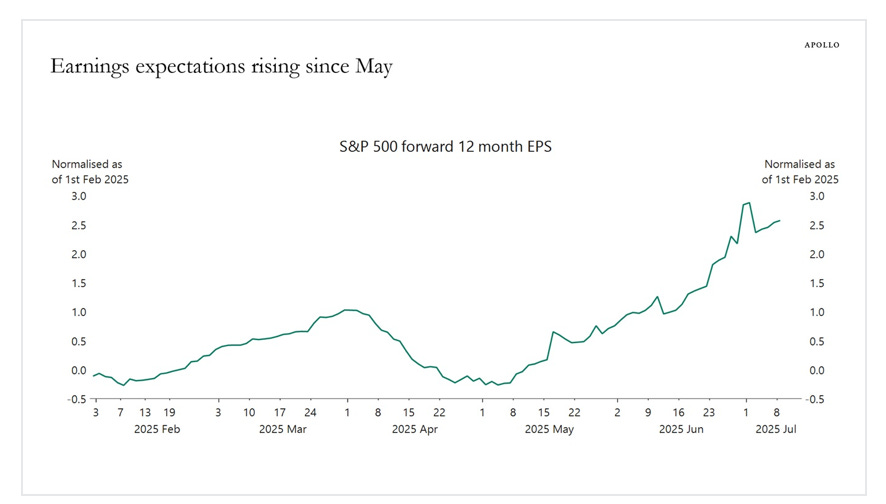

The consensus economic forecast is that growth will slow down over the coming quarters as higher tariffs weigh on earnings, capex spending, and consumer spending.

The consensus equity analyst forecast is that earnings will accelerate over the coming quarters, see chart below.

This is not consistent. Either the MBA forecasters are wrong about corporate earnings, or the PhD economists are wrong about tariffs slowing down growth.

The second-quarter earnings season will start next week and reveal who is right. If earnings continue to be strong, the adverse effects of tariffs, as expected by economists, will prove to be incorrect.

In other words, either the equity analysts are too optimistic, or the economists are too pessimistic.

Song Recommendation — Am I Easy

Quote of the Day

“I want to live my life, not record it.” — Jackie Kennedy