Escalation In the Middle East

Wednesday, Sept 10th, 2025

World News — Israel Bomb Qatar

Economists

Since Hamas’s October 7th 2023 massacre, Israel has pursued its leaders across the Middle East, but until now had avoided Qatar given its role as both a U.S. ally and mediator in ceasefire talks; that restraint ended on September 9th, when Israeli jets bombed a villa in Doha where senior Hamas figures were reported to be meeting, an escalation that threatens not only the faltering peace process but also America’s credibility as security guarantor to the Gulf states, with regional powers—from Saudi Arabia to the UAE—denouncing the strike as a reckless provocation that risks deepening the war in Gaza and unsettling Israel’s already fraught relationships with Washington and its Arab neighbours.

Tech - ASML Becomes the Largest Shareholder in AI Startup Mistral

FT

ASML has struck a landmark €1.3bn deal to become the largest shareholder in French AI start-up Mistral, forging a partnership between Europe’s top chipmaking equipment company and one of its fastest-rising artificial intelligence firms at a moment of intensifying US-China tech rivalry; the investment, part of Mistral’s €1.7bn funding round that values the two-year-old start-up at nearly €12bn, reflects ASML’s bet on AI as a strategic technology while also boosting Europe’s push for greater technological independence, though both companies emphasized that the tie-up is driven by complementary expertise—ASML seeking AI tools for chipmaking systems and Mistral aiming to build business-focused AI models—rather than by a political agenda of sovereignty.

Business - Oracle With the Blowout Expectation

Bloomberg

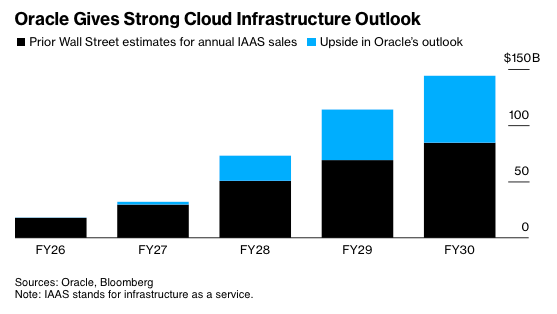

Oracle shares soared to a record after the company issued a bullish forecast for its cloud business, adding roughly $190 billion in market value and underscoring its emergence as a key supplier of infrastructure for AI developers such as OpenAI; cloud infrastructure revenue jumped 55% to $3.3 billion on the back of four multibillion-dollar contracts, with remaining performance obligations swelling to $455 billion, far above last year’s levels, as CEO Safra Catz projected the unit to grow 77% this year to $18 billion and reach $144 billion by 2030, a trajectory that highlights both surging AI demand and the steep data center investment—about $35 billion this year—that Oracle must shoulder to compete with Amazon, Microsoft, and Google in the race to power the world’s AI build-out.

Culture - Who Wants a Thinner iPhone, Anyway?

Bloomberg

Apple’s new iPhone Air is a 5.64 mm-thin device that prioritizes sleekness over substance, asking customers to pay $999—$200 more than the iPhone 17—for a phone that compromises on battery life and camera performance, effectively making it a niche product aimed at image-conscious buyers rather than mainstream users; analysts suggest its real purpose is less about immediate mass adoption and more about testing consumer appetite for ultra-thin designs ahead of bigger innovations, such as Apple’s anticipated folding iPhone, leaving the Air as an experimental stopgap with limited appeal beyond early adopters and Apple loyalists.

The Daily Spark

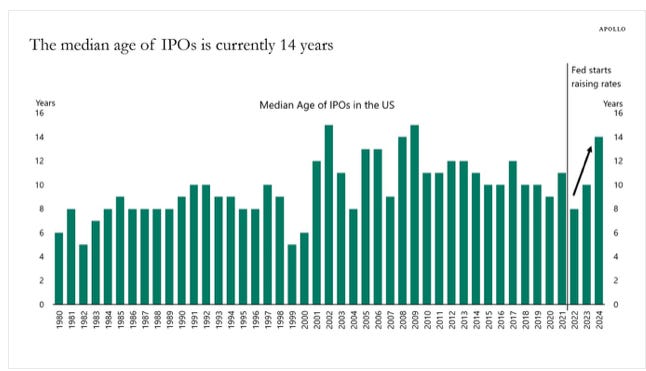

There are fewer public companies to invest in, and firms that decide to do an IPO are getting older and older.

In 1999, the median age of IPOs was five years. In 2022, it was eight years, and today, the median age of IPOs has increased to 14 years, see chart below.

The rise in the age of companies going public is not only a result of the Fed raising interest rates in 2022, but also the consequence of more companies wanting to stay private for longer to avoid the burdens of being public.

Combined with the domination of passive investing, failure of active managers and high correlation in public markets, and high concentration in a few stocks, the reality is that there is no alpha left in public markets.

Quote of the Day

“To the well-organized mind, death is but the next great adventure.” ― J.K. Rowling, Harry Potter and the Sorcerer's Stone