Gold Price Slide Below $4,000

Monday, November 3rd, 2025

Good Morning! What do Meta’s $200 billion stock collapse, China’s gold market shakeup, and your neighbor’s FanDuel habit have in common? Today’s biggest stories reveal how massive bets, whether on AI infrastructure, precious metals, or Sunday football, are reshaping markets and draining wallets in ways that should concern us all. From Zuckerberg’s vague promises failing to justify billions in spending to research showing online gambling is quietly decimating retirement savings, the stakes have never been higher.

World News — Police Raid in Rio

A massive police raid in Rio de Janeiro on October 28th targeting the Red Command drug gang has become Brazil’s deadliest police operation in history, with the death toll rising to 121—surpassing the infamous 1992 Carandiru prison massacre that killed 111. The pre-dawn operation, ordered by Rio’s far-right governor Cláudio Castro, resulted in 81 arrests and significant drug seizures, but left scores of mostly young, Black male corpses, some reportedly found with hands tied or shot from behind.

The raid has exposed deep political divisions: conservative leaders including Castro and Rio’s mayor Eduardo Paes have celebrated it as a necessary crackdown on crime, while Brazil’s left-wing President Lula and Justice Minister Ricardo Lewandowski offered cautious criticism, calling it “very bloody” and expressing condolences to families of “innocent people” killed, though neither has taken stronger action despite UN condemnation. With security emerging as a top issue ahead of next year’s elections—nearly half of voters believe safety has deteriorated under Lula—Castro, whose term ends in April, is positioning himself for a congressional run by championing iron-fist policies, having already presided over three of Rio’s four deadliest operations and recently backing legislation to pay police bonuses for every suspect killed in raids.

Tech — Meta’s AI Spending Problem

Meta’s aggressive AI spending sparked a massive investor exodus this week, with the company’s stock plummeting 12% on Friday and wiping out over $200 billion in market value after CEO Mark Zuckerberg revealed soaring costs during quarterly earnings—operating expenses jumped $7 billion year-over-year with nearly $20 billion in capital expenditures for AI infrastructure and talent. Despite posting $20 billion in quarterly profit, Zuckerberg failed to reassure analysts when pressed about returns on investment, offering only vague promises about future products from the company’s newly formed Superintelligence Lab rather than pointing to concrete revenue-generating AI offerings.

Unlike OpenAI, which can justify similar spending with a fast-growing $20 billion annual revenue service, or Google and Nvidia whose AI investments didn’t spook their investors, Meta lacks a breakout AI product—its Meta AI assistant, while claiming over a billion users, appears juiced by Facebook and Instagram’s three billion user base and doesn’t rival ChatGPT, while other efforts like the Vibes video generator and Vanguard smart glasses remain promising experiments rather than fully formed products. With no clear budget projections, revenue forecasts, or defined strategy for whether Meta will compete in consumer AI, enterprise solutions, or entertainment, the market’s harsh response signals growing impatience for Zuckerberg to articulate what role his company plans to play in the AI industry amid an unprecedented infrastructure buildout expected to reach $600 billion across the U.S. over three years.

Economics — Gold Slide Below $4,000

Gold slipped below $4,000 per ounce following China’s decision to eliminate tax rebates for certain retailers, a policy shift that threatens to dampen demand in one of the world’s biggest precious metals markets. Beijing announced it would no longer allow some retailers to fully offset value-added tax when selling gold purchased from major exchanges, reducing the deductible portion from 13% to 6% for non-investment products like jewelry.

The change sent Chinese jewelry stocks tumbling, with major retailers falling between 8-12%, as analysts predict the industry will raise prices to offset the increased costs. While gold had surged to record highs in October—aided by retail buying frenzy and climbing more than 50% year-to-date—it dropped 2.7% last week and traded at $3,997.40 per ounce following the announcement. Despite the pullback, market fundamentals including central bank purchases and safe-haven demand remain supportive, though analysts warn the tax changes in the world’s heaviest gold-consuming nation could further dampen global sentiment and trigger a deeper price correction.

Culture — Sports Gambling is Draining Household Saving

Research from Northwestern’s Kellogg School examining the state-by-state rollout of online sports betting from 2018 to 2023 reveals that legalized gambling is draining household savings, with nearly 8 percent of households spending an average of $1,100 annually on online bets while net investments fell by nearly 14 percent, for every dollar spent on betting, households put $2 fewer into investment accounts.

The study, analyzing transaction data from over 230,000 households representing 60 million Americans, found that the hundreds of billions spent on platforms like FanDuel and DraftKings came predominantly from money previously allocated to stable, long-term investments like retirement accounts rather than displacing other entertainment spending. The impact proved particularly severe for financially constrained households, who experienced decreased credit availability, increased credit-card debt, higher overdraft rates, and greater participation in lottery games, pushing them deeper into debt precisely because those already prone to prioritizing immediate spending over savings are most attracted to gambling.

While some spending patterns could reflect rational decision-making about the value of entertainment, researchers note concerns about impulsive behavior enabled by smartphone-based betting at any hour, lack of transparency about unfavorable odds on popular exotic bets, and the inherent policy tension between states simultaneously legalizing gambling while encouraging retirement savings, suggesting policymakers should consider requiring in-person betting to curb impulse decisions.

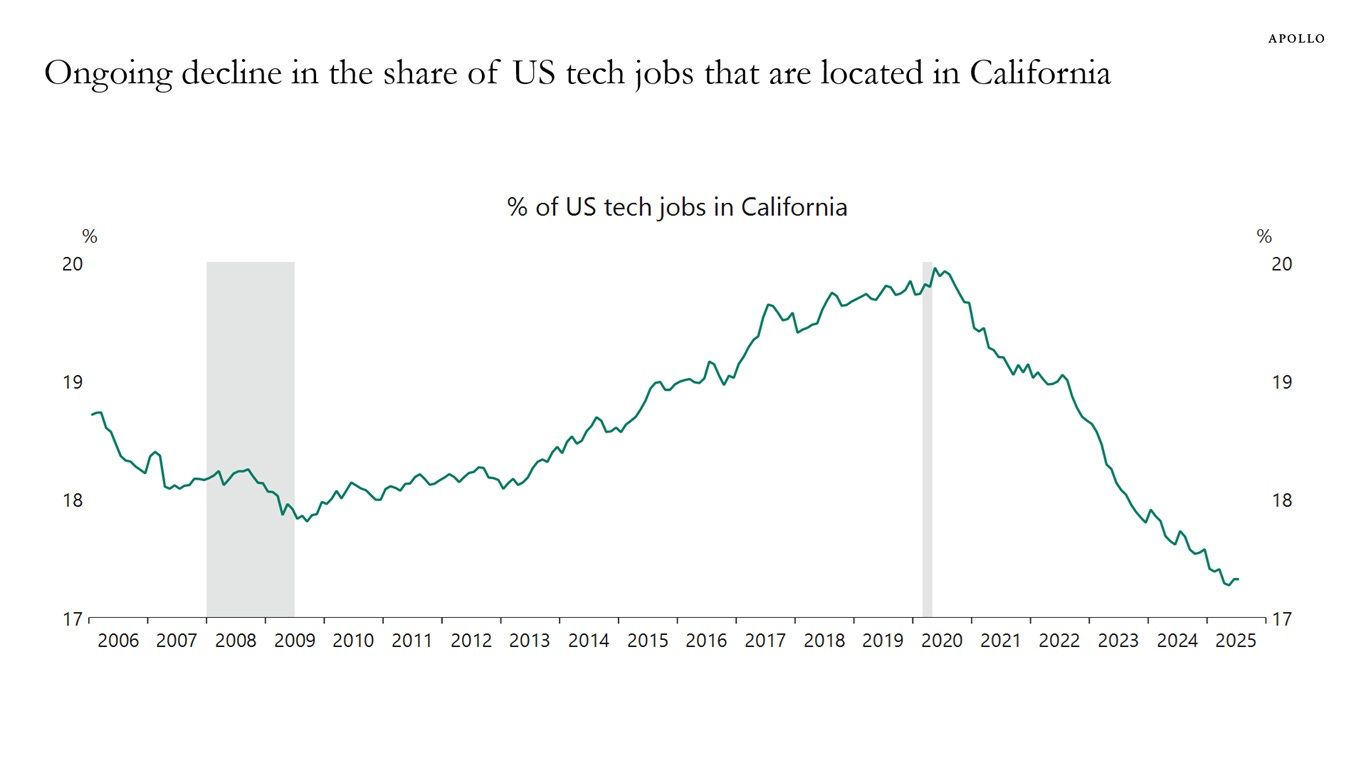

Chart of the Day

Quote of the Day

“If you have to compete based on capital, the giant always wins. If you can compete based on smarts, flexibility, and willingness to give more for less, then small companies like Bloomberg clearly have an advantage.”

― Michael R. Bloomberg, Bloomberg by Bloomberg