India-China Partnership

Thursday, August 21st, 2025

World News — Why China and India Needs Each Other Right Now

Bloomberg

India and China are navigating a tense yet deeply interconnected relationship that has grown more complex amid recent geopolitical shifts. Despite long-standing border disputes and deep mistrust that have flared into violence and driven both sides to restrict foreign investment and technology, each country recognizes its urgent need for the other. India relies heavily on Chinese technology, raw materials, and expertise for its ambitions in manufacturing, green energy, and pharmaceuticals, while China depends on India’s vast and fast-growing consumer market to counter domestic economic slowdowns and maintain growth for major firms in electronics, automotive, and tech investment. Recent diplomatic engagements and steps to restore trade and travel—like loosened export restrictions, resumed visas, and upcoming leader summits—signal cautious cooperation, largely accelerated by the Trump administration’s more confrontational trade stance toward both nations. However, deep strategic anxieties persist: India fears overdependence and supply shocks, while China worries about empowering a future competitor. Ultimately, although full reconciliation remains elusive given unresolved grievances and the risk of rivalry, India and China are compelled to engage closely, as their economic and developmental aspirations are tightly intertwined in today’s shifting global landscape.

Tech — China Turns Against Nvidia Chips Against Lutnik’s Remarks

China has moved to restrict the purchase of Nvidia’s H20 AI chips after senior US official Howard Lutnick made remarks about selling only “watered-down” technology to China, comments that Chinese regulators found “insulting.” In response, agencies including the Cyberspace Administration of China (CAC), National Development and Reform Commission (NDRC), and Ministry of Industry and Information Technology (MIIT) issued informal guidance asking domestic tech firms to halt new H20 orders and prioritize Chinese-made processors. This regulatory push intensified after Lutnick’s comments and concerns that Nvidia chips might have location tracking or remote shutdown features, though Nvidia disputes these claims. The guidance signals higher pressure for Chinese tech giants to accept domestic alternatives like Huawei and Cambricon, especially for AI inference tasks. While some government ministries remain open to Nvidia’s business for international negotiation purposes, hardline agencies are aiming for further chip independence amid tensions over US export controls and Trump’s tariff policies. As China ramps up domestic chip production, room for further policy shifts remains, with the nature of restrictions still informal and potentially subject to change depending on trade talks and future US actions.

Business — Meta Inflated Ad Performance and Bypassed Apple’s Privacy Rules

FT

Meta is facing allegations from former product manager Samujjal Purkayastha that it inflated the performance metrics of its “Shops Ads” product by nearly 20% and deliberately circumvented Apple’s privacy rules on iPhones to increase revenue. According to filings in a London employment tribunal, Meta calculated ad performance using gross sales figures, including shipping and taxes, unlike its usual net metric or the approach of rivals like Google, without informing advertisers about the discrepancy. Additionally, Meta is accused of secretly linking user data to track activity across external websites without consent, despite Apple’s App Tracking Transparency feature introduced in 2021 that requires explicit user approval for such tracking. Purkayastha claims that Meta was especially motivated to promote Shops Ads to offset estimated $10 billion in annual revenue losses from Apple’s privacy restrictions and that the company subsidized ad placements to boost results. Meta responded that the complaints involve routine commercial issues and denied any breach of legal obligations, further stating the claimant was dismissed for performance and personal reasons unrelated to these complaints. The tribunal found the case could succeed on its merits but did not approve interim relief; a full hearing is expected later this year.

Shopping — Not Hitting Targets

FT

Target shares dropped over 6% after the retail giant announced chief operating officer Michael Fiddelke would succeed veteran CEO Brian Cornell in February 2026, a move aimed at sparking a turnaround following two years of disappointing sales. Fiddelke, who has a 20-year history with Target across several roles including finance, merchandising, and operations, said he would focus on sharpening product design, enhancing shopper experiences, and accelerating technology investments to return the business to profitable growth and restore its “swagger.” While Fiddelke’s deep company knowledge earned the board’s unanimous support, some analysts expressed doubt about the effectiveness of shifting strategies he helped create. Amid post-pandemic consumer belt-tightening, inventory missteps, and competition from ecommerce and discount rivals, Target’s comparable sales fell 1.9% in Q2 and the stock is down 28% this year, though the company’s $25.2bn in Q2 net sales beat estimates. Cornell, praised for driving growth and bolstering the digital business, will become executive chair as Fiddelke takes over at a challenging point for the retailer.

The Daily Spark

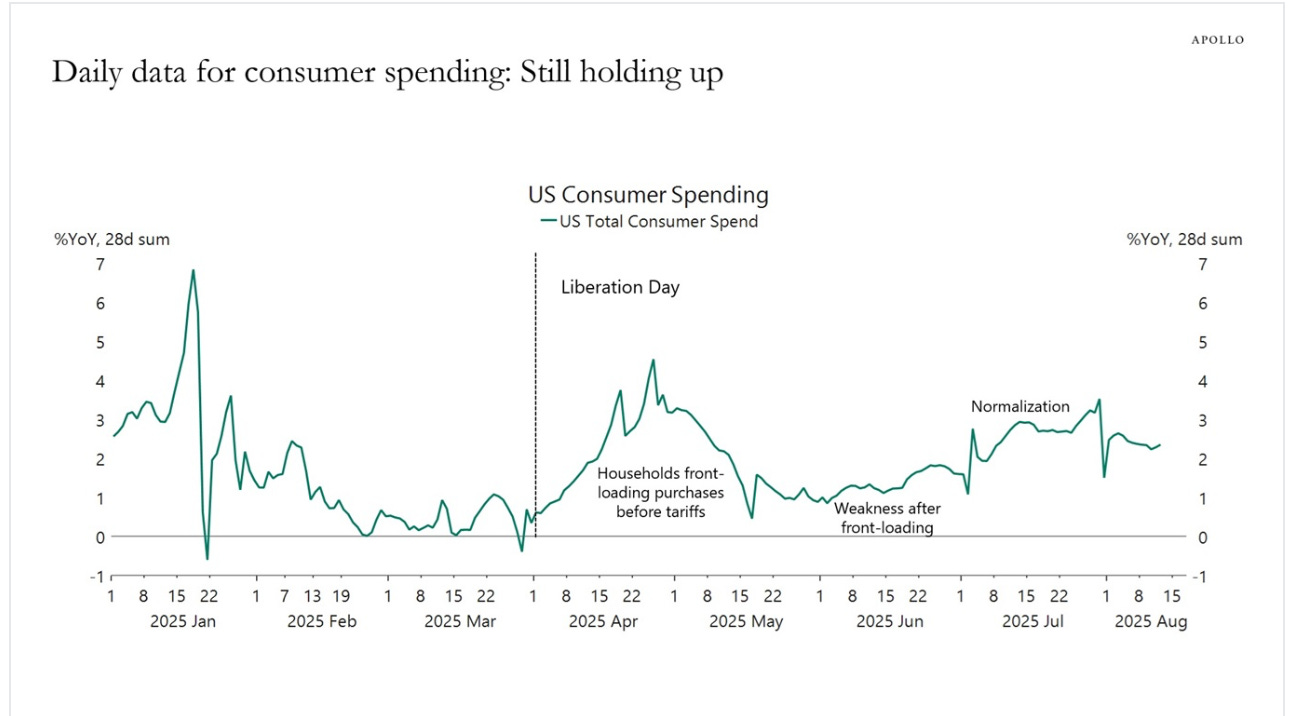

Consumer spending is under downward pressure from slowing job growth, student loan payments restarting and deportations lowering the number of consumers.

To carefully monitor these headwinds, we have put together this chart book with daily data for consumer spending on discretionary spending/essentials and consumer spending impacted by tariffs/not impacted by tariffs.

Song Recommendation — A Little More

Quote of the Day

“Just about a month from now I'm set adrift, with a diploma for a sail and lots of nerve for oars.”

― Richard Halliburton