Inside OpenAI's Megafactory

Tuesday, June 3rd, 2025

World Events — Remaking India to Resemble Gujarat

The Economists

Narendra Modi has largely fulfilled his pledge to make India resemble Gujarat, delivering significant improvements in infrastructure and higher incomes nationwide, much as he did during his tenure as Gujarat’s chief minister. Under his leadership, India has seen ambitious urban development initiatives, rapid industrialization, and a focus on high-tech manufacturing, echoing the “Gujarat Model” that prioritized economic growth, business-friendly policies, and large-scale infrastructure projects. However, this transformation has also brought with it some of Gujarat’s less desirable traits: increased communal segregation, religious tensions, and assertiveness of majority dietary and cultural norms, leading to greater social polarization and discrimination, especially against minorities. While the economic gains are evident, critics note that human development indicators such as health and education have lagged behind, and the inclusive cosmopolitanism that once characterized Gujarat has diminished, with cities like Ahmedabad now among the most religiously segregated in India. In this sense, Modi’s promise has been realized both in the prosperity and the divisions that now define much of India, mirroring the complex legacy of Gujarat itself.

Tech — Inside OpenAI’s Stargate Megafactory

The Markets — Debt is Crushing the Developing World

FT

Joseph Stiglitz, Nobel laureate and professor at Columbia University, warns that the debt crisis gripping developing countries is deepening, not dissipating, with devastating consequences for human development. Despite some claims of improvement, many low- and lower-middle-income countries are forced to divert scarce resources from essential services like health, education, and infrastructure to service debts incurred under more favorable financial conditions. UN data shows that over 3.3 billion people live in countries spending more on debt service than on health, and 2.1 billion in countries spending more on debt than on education, as rising interest rates and a weak global economy exacerbate the problem. Capital flows, which support advanced economies in downturns, tend to abandon developing nations during crises, resulting in net outflows and further undermining growth. Multilateral institutions, once a lifeline, are now seeing their support dwindle, with much of their aid merely enabling debt repayments rather than true development. Stiglitz argues that a systemic response is urgently needed, echoing the late Pope Francis’s call for a “jubilee” of debt justice and announcing the upcoming Jubilee Commission report, which will propose reforms to ensure that debt sustainability does not come at the expense of human dignity and future prosperity. Without decisive action, current policies risk condemning the world’s most vulnerable to a lost decade, or worse, as their futures are mortgaged to repay unsustainable debts.

Culture — Pop Songs are Getting Shorter

The Economists

Pop songs are undeniably getting shorter, but this trend isn’t as dire as some critics suggest. While the average chart-topping hit has shrunk from over four minutes in 1990 to just three and a half minutes today, the shift reflects both technological and cultural changes rather than a decline in musical quality. Streaming platforms like Spotify incentivize brevity, as artists are paid per play, encouraging songs with quick hooks and early choruses to maximize listens. Social media, especially TikTok, has also popularized snappy, easily shareable tracks, though longer songs can still go viral. While some ultra-short songs may lack substance, many concise hits—like Sabrina Carpenter’s “Short n’ Sweet” or classics such as “Hit the Road Jack”—prove that musical impact isn’t measured in minutes. Ultimately, shorter songs can be seen as a form of creative discipline, distilling music to its most memorable moments and ensuring that summer anthems remain catchy, replayable, and far from boring.

The Daily Sparks

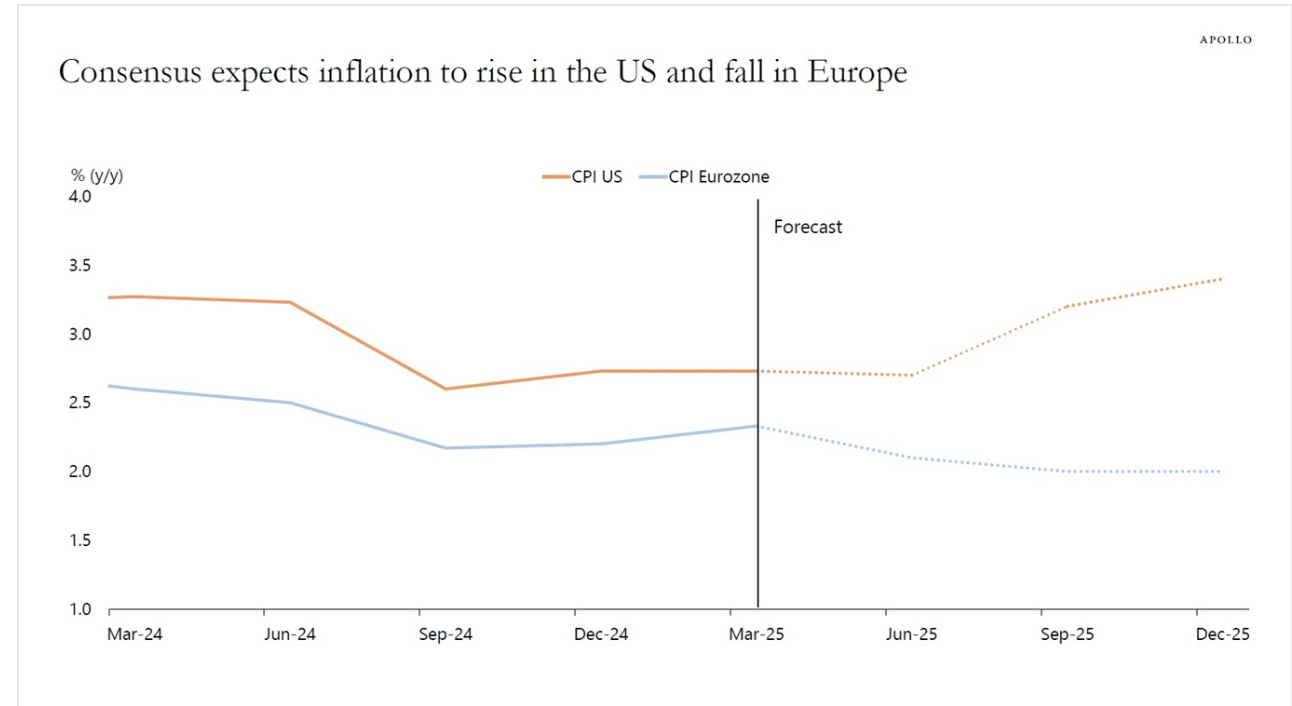

The consensus expects inflation to rise in the US and fall in the eurozone, see chart above. Combined with the worsening US fiscal situation, this highly unusual divergence will continue to put upward pressure on US rates across the curve and downward pressure on rates in Europe.

Song Recommendation — Bliss (Tyla)

Quote of the Day

“My dreams, my dreams! What has become of their sweetness? What indeed has become of my youth?” ― Alexander Pushkin, Eugene Onegin