Intel Ain't Turning Around

Friday, July 25th, 2025

World News — The War in Gaza Disgraces Israel

Economists

The war in Gaza has reached a point where it serves no meaningful military purpose for Israel and has instead brought about severe humanitarian suffering and widespread international condemnation. Despite achieving control over most of Gaza and significantly weakening Hamas, Israeli operations persist, resulting in devastated infrastructure, massive displacement, and the looming threat of famine due to inadequate aid. Calls for a ceasefire have grown louder both within Israel and abroad, as the war’s continuation now risks further damage to Israel’s reputation and exacerbates the humanitarian crisis. With diplomatic negotiations narrowing the gap between Israel and Hamas, and the possibility of a new governance structure for Gaza emerging, the onus is now on international actors—particularly Qatar and the United States—to apply decisive pressure for an immediate end to the conflict.

Tech — Intel Can’t Catch a Break

Bloomberg

Intel shares fell sharply after CEO Lip-Bu Tan’s latest update failed to convince investors that a genuine turnaround is underway, with concerns growing that his focus on aggressive cost cutting is coming at the expense of restoring the company’s once-formidable technological edge. Despite Intel benefiting from a rebound in the personal-computer market—helped by PC makers stockpiling ahead of new tariffs—Tan announced further reductions in capital spending and the cancellation of key factory projects, criticizing predecessor Pat Gelsinger’s investments as excessive. Analysts and investors were particularly unsettled by Tan’s hesitation to commit to advanced 14A production capacity without firm customer demand, fueling doubts about Intel’s competitiveness against rivals Nvidia and AMD, which have outperformed Intel in the AI chip race this year. While Intel’s second-quarter revenue exceeded expectations, profit and margins lagged, and the company expects only a break-even third quarter. Major layoffs and a targeted workforce reduction to 75,000 signify ongoing restructuring. Ultimately, with AI chip demand surging globally, analysts warn that Intel must pivot soon to reclaim relevance in the new semiconductor landscape.

Business — Canada Using Pension Plan as Leverage In US Trade Dispute

Bloomberg

Canada is leveraging the massive financial clout of its pension funds—collectively holding more than $1 trillion in US investments—as a bargaining chip in ongoing trade negotiations with the US, aiming to secure more favorable terms from the Trump administration. Minister Dominic LeBlanc highlighted this investment muscle during recent talks in Washington, noting the potential for Canadian pension investments in the US to grow by $100 billion or more annually, though he emphasized there would be no forced government directive for pension funds to increase American holdings. While the US has signaled openness to foreign investment as part of broader trade deals, Canadian funds like the Canada Pension Plan Investment Board (CPPIB) remain independent in their investment choices, with nearly half their assets already allocated to the US. Government officials, meanwhile, are careful to avoid political interference, even as discussions continue about easing US tariffs on Canadian exports in key sectors such as autos, steel, aluminum, and lumber.

Culture — The Economics of Super-Intelligence

Economists

If Silicon Valley’s forecasts are even partly accurate, the arrival of superintelligent artificial intelligence (AI) within the next decade promises extraordinary economic upheaval by vastly accelerating the pace of innovation and growth. Unlike past industrial revolutions constrained by human limits and demographic factors, superintelligent AI could automate discovery and self-improvement, potentially driving global economic growth rates above 20% annually once machines handle a large share of tasks. This explosive growth would transform labor markets, concentrating wealth among AI capital owners and a shrinking class of complementary human superstars while displacing many jobs and reshaping wages. Prices would shift dramatically as AI-produced goods become almost free and human-supplied services scarcer and costlier. Financial markets would see volatile winner-takes-all dynamics, and macroeconomic effects might include soaring interest rates and inflation amid rapid investment needs and changing saving behavior. The social and political challenges accompanying this shift could be profound, requiring new policies on education, redistribution, and governance as humanity adapts to sharing the economy and society with superintelligent machines. Yet, alongside risks, the rise of superintelligence holds the possibility of unprecedented prosperity and breakthroughs, continuing a long history of human progress driven by technological disruption.

The Daily Spark

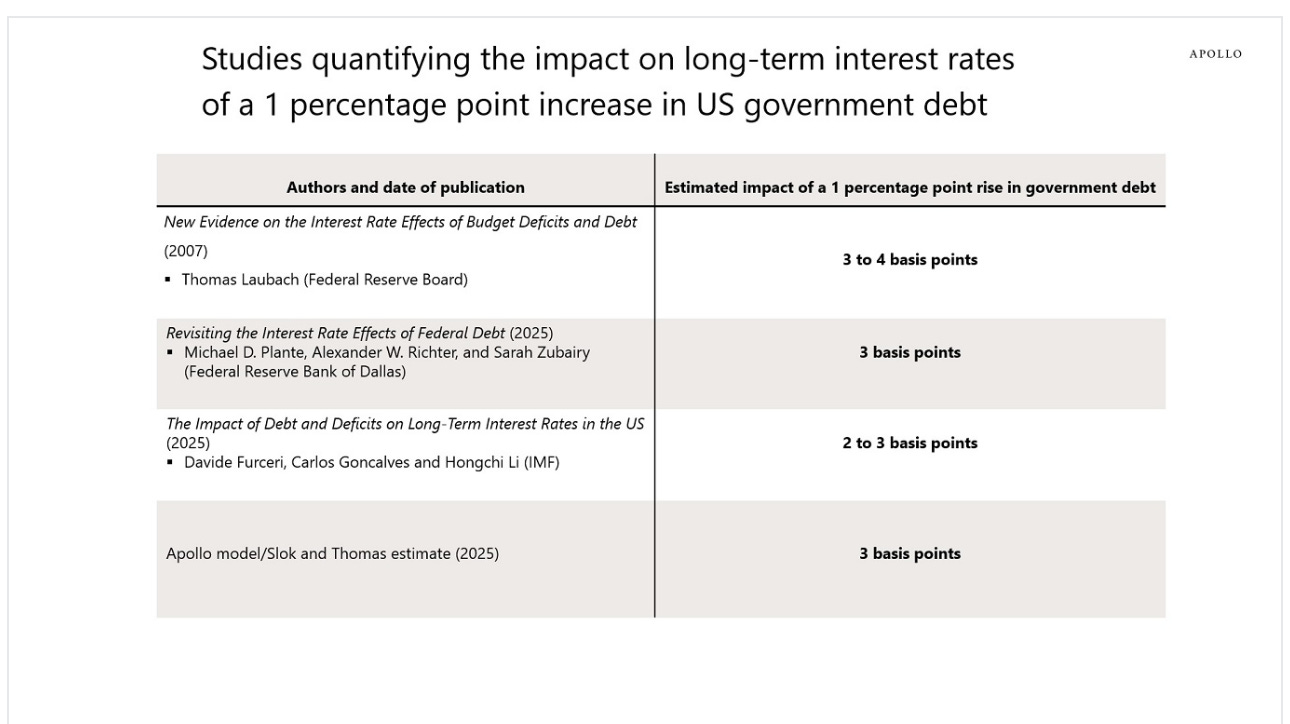

Academic papers quantifying the impact on 10-year interest rates of a one percentage point increase in US government debt-to-GDP find an effect of 3 basis points, see chart below.

The CBO forecasts that US government debt-to-GDP over the coming decade will increase by roughly 20 percentage points, and the estimates below imply that this will permanently increase 10-year interest rates by 60 basis points.

Song Recommendation — Yukon

Quote of the Day

"It is not the critic who counts: not the man who points out how the strong man stumbles or where the doer of deeds could have done better. The credit belongs to the man who is actually in the arena, whose face is marred by dust and sweat and blood, who strives valiantly, who errs and comes up short again and again, because there is no effort without error or shortcoming, but who knows the great enthusiasms, the great devotions, who spends himself for a worthy cause; who, at the best, knows.” — Theodore Roosevelt