Is Palantir the Cisco of the 2000s?

Wednesday, August 13th, 2025

World News — Investment Fund OTPP Cuts Dollar Exposure

Bloomberg

Ontario Teachers’ Pension Plan (OTPP) slashed its US dollar exposure by 56% in the first half of 2025, following a surge in the Canadian dollar, which posted its strongest first-half rally against the greenback in almost a decade. OTPP’s net US dollar exposure fell to C$40.2 billion ($29.2 billion) at the end of June—its lowest since mid-2021. This strategic move is part of a broader reduction in total foreign currency exposure, which dropped to C$99.4 billion from C$142 billion at the end of 2024, mostly by trimming US dollar holdings. The fund’s Chief Investment Officer, Stephen McLennan, explained that the US dollar has acted as a headwind for Canadian investors this year, prompting adjustments to currency expectations for the coming years. Analysts note that sizable hedging by Canadian pension funds could further weaken the US dollar as the loonie has rallied more than 5% so far in 2025, buoyed by turbulent US trade policies and spending concerns.

Tech — CoreWeave Drops After Earning

FT

CoreWeave’s shares dropped as much as 11% in after-hours trading after reporting a steeper-than-expected net loss of $291million for the second quarter of 2025, missing analysts' loss forecasts by $50million despite revenue surging 206% year-on-year to $1.21billion and beating expectations. The company, which powers AI firms through its expansive data centre network, saw capital expenditures soar to a record $2.9billion in the quarter to keep pace with massive demand, outstripping its ability to build new capacity fast enough. CEO Michael Intrator highlighted that “the big banks are really starting to show up” among enterprise customers, with $30billion in secured but unfulfilled contracts at quarter end. However, investors remain cautious as the company's rapid growth is funded by substantial debt, and a looming share lock-up expiry could trigger more share price volatility in the coming days.

Tech — Palantir Might Be the Most Overvalued Company EVER

Economists

Palantir’s market value has soared to an extraordinary $430billion in 2025, trading at nearly 120 times sales and over 600 times earnings—more than triple the peak multiples seen by past tech darlings like Cisco or even Nvidia. The company’s explosive 48% year-on-year revenue growth in Q2 and a “rule of 40” score of 94 (far above its competitors) are powered by surging enterprise AI adoption and entrenched U.S. government contracts that provide both a substantial moat and predictable cash flow. Yet, for Palantir to merely justify its current stock price and reduce its price-to-sales ratio to the “Google-at-its-peak” territory, it would need to grow revenue over fivefold in the next several years—translating to sustained 40%+ annual growth at massive scale, a feat matched only by the most exceptional tech giants in history. For risk-tolerant investors, Palantir might only be worth buying if they believe the firm can maintain blistering growth, defend its dominant government position from deep-pocketed rivals, and successfully expand its AI-powered analytics into commercial markets—without a single stumble along the way. Any meaningful slowdown, disruptive competitor, or contract loss could turn the current momentum into a cautionary tale for overvalued tech stocks.

Culture — Britain Is a Global Gaming Superpower

Economists

Britain, long a quiet powerhouse in the global video games industry, ranks as the world’s third-largest exporter behind only the US and Japan, with homegrown hits from “Grand Theft Auto” and “Tomb Raider” to quirky indie titles like “Thank Goodness You’re Here.” Rooted in a 1980s culture of bedroom coding and bolstered by hubs across the country from Dundee to Cornwall, the sector now generates £4.3bn annually—more than film and music combined—and employs 30,000 people. Despite headwinds from venture-capital shortages, post-pandemic overproduction, and global layoffs, Britain’s creativity, rich IP, and adaptability position it to thrive amid AI disruption. Government support via funding, IP protection, and recognition of gaming’s wider benefits—from VR medical training to NHS-prescribed therapy—are helping the industry adapt, while its hallmark eccentricity and storytelling strength remain powerful differentiators in an age of AI-generated sameness.

The Daily Spark

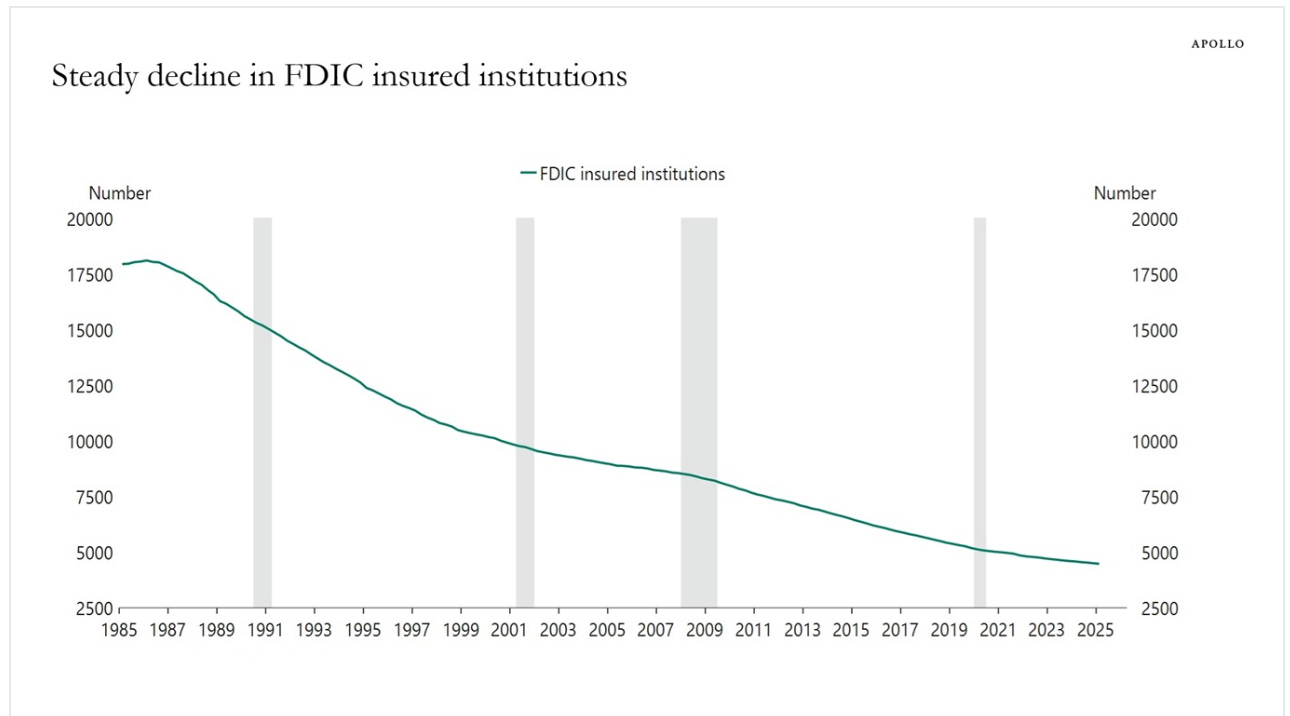

The number of banks in the US has declined significantly over the past 40 years, see chart below.

Song Recommendation — Slow Love

Quote of the Day

“No man ever steps in the same river twice, for it's not the same river and he's not the same man.”

― Heraclitus