New Tariff Regime (Last Time?)

Friday, August 1st, 2025

World News — New Tariff Regime

Bloomberg

President Donald Trump has introduced a sweeping set of new tariffs, significantly increasing the average US tariff rate on goods from many countries as part of an aggressive effort to reshape global commerce. The average US tariff is set to rise to 15.2% if all rates are fully implemented, up from 13.3% earlier this year and well above the 2.3% seen before Trump took office. While baseline rates for most partners are holding at 10%, selected countries are facing much steeper increases: Canadian goods will be hit with a 35% tariff, Swiss products face 39%, Indian exports 25%, Taiwan 20%, South Africa 30%, and several Southeast Asian nations receive around 19% to 20%. These tariffs, praised by Trump as a means to reduce trade deficits and revive domestic industry, will mostly take effect after midnight on August 7, 2025. They come after months of negotiations and delays, with exemptions for certain goods under existing trade pacts and some temporary reprieves. While the administration projects increased government revenue, critics warn these tariffs will raise costs for American consumers and businesses and could contribute to ongoing inflation.

Tech — Earnings Continue, Amazon in Focus

Amazon shares fell sharply after the company issued a lower-than-expected profit outlook and reported cloud growth that lagged behind its biggest rivals. For the quarter ending June 30, 2025, Amazon’s revenue grew 13% to $167.7 billion, beating estimates, and operating profit surged to $19.2 billion. Despite this, the company’s guidance for the third quarter—operating income between $15.5 billion and $20.5 billion—disappointed Wall Street, which had expected $19.4 billion at the midpoint, causing investor concern over the heavy capital spending required to compete in the AI arms race. Amazon Web Services (AWS) posted 17–18% revenue growth to $30.9 billion, just ahead of estimates, but well below the far stronger growth reported by Microsoft’s Azure (39%) and Google Cloud (32%). Although CEO Andy Jassy defended AWS’s market position and touted advances in AI, investors remained wary as Amazon’s huge infrastructure investments pinched near-term profitability, sending the stock down more than 7% in after-hours trading.

Econ — Canada’s Economy Grew in June

Canada’s economy avoided a widely expected contraction in the second quarter of 2025, showing slight but positive momentum despite trade war headwinds and back-to-back declines in April and May. According to Statistics Canada’s advance data, GDP edged up 0.1% in June, offsetting previous monthly dips and putting quarterly output on track for a modest 0.1% annualized increase—better than the Bank of Canada’s forecasted 1.5% decline and economists’ expectations of a 0.5% drop. Growth was fueled by stronger retail and wholesale trade, a rebound in manufacturing, and robust job gains in June, even as sectors like mining and public services lagged. With the tariff impact proving less severe than first feared and some restoration of business and consumer confidence, Canada’s economy is proving resilient for now, though it continues to stall overall and remains vulnerable to continued trade uncertainty and inflationary pressures.

Opinion — America’s Is Easing Chip Control At Exactly the Wrong Time

Economists

America’s decision to ease AI chip export controls for China comes amid rapid Chinese advances in artificial intelligence, notably after breakthroughs like DeepSeek and the release of top-tier models that now rival or surpass U.S. capabilities.In April, the Trump administration had blocked the sale of Nvidia’s H20 chips to China, which had proven highly effective for inference—running, though not training, advanced AI models—significantly constraining China’s ability to commercialize its AI breakthroughs. However, following pressure from Nvidia’s CEO and a White House meeting, restrictions were lifted in July, allowing exports to resume. While U.S. officials argue that making China reliant on American chips may inhibit the rise of domestic Chinese competitors, critics—including major Western media analysis—warn that relaxing controls now helps China overcome a critical bottleneck, bolsters its AI industry at a vital moment, and undermines the leverage that export restrictions were providing, especially with the geopolitical and military stakes of the AI race rising sharply.

The Daily Spark

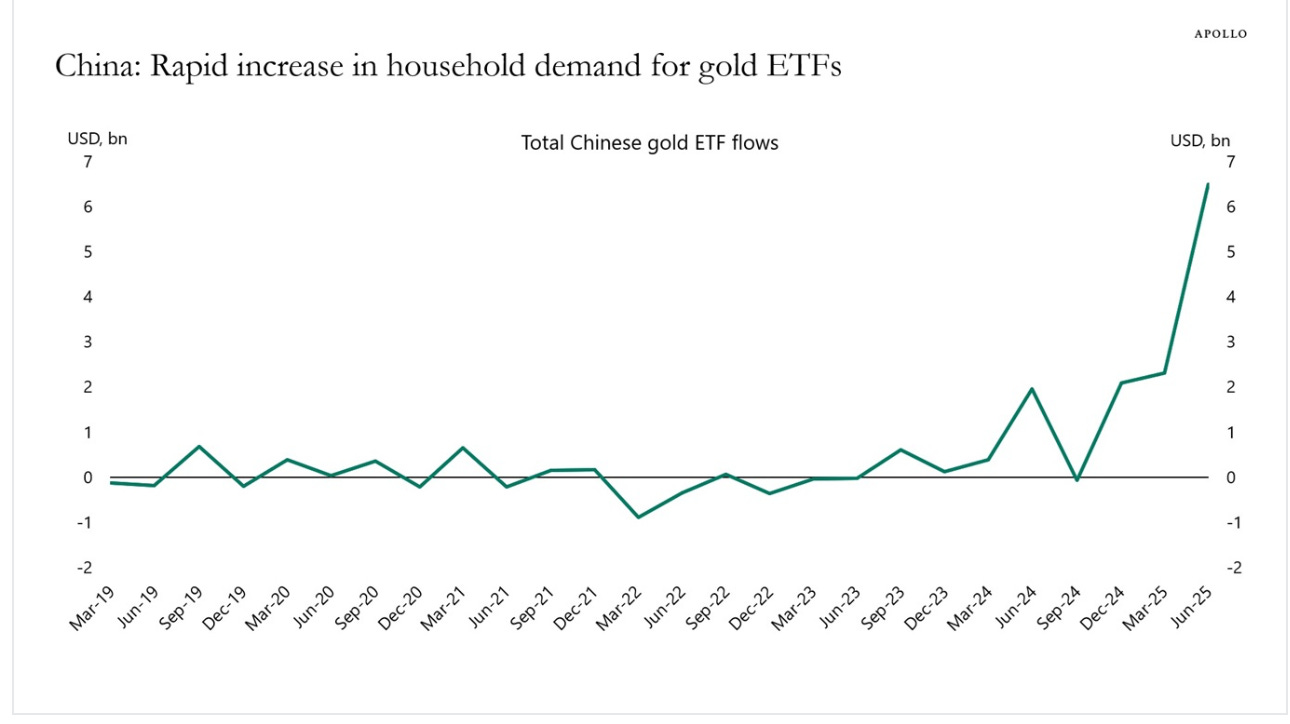

Demand for gold has increased significantly among households in China. This trend likely reflects the strong rally in gold prices, concerns about the ongoing decline in home prices, and worries about deflation and the weakening of the yuan, see chart below.

Song Recommendation — Perfect

Quote of the Day

“Kindness is a language which the deaf can hear and the blind can see.”

― Mark Twain