PE Fund Raising Slump

Monday, August 25th, 2025

World News — Who Lost Europe?

Bloomberg Opinion

John Authers argues in Bloomberg Opinion that Europe’s current geopolitical weakness in the face of both Russia and the U.S. is not the fault of Donald Trump but rather the result of decades of missteps that trace back to the early 1990s. The hasty reunification of Germany, the premature launch of the euro, and the massive enlargement of the European Union created structural vulnerabilities that left the bloc unable to act decisively in crises, from the eurozone debt meltdown to Russia’s invasion of Ukraine. Instead of becoming a coherent superpower, the EU became unwieldy, divided, and dependent on Russian energy while outsourcing its security to Washington. Now, with nationalist movements rising within member states and both Putin and Trump setting terms over Europe’s future, Authers suggests the continent has effectively “lost itself” through its own short-sighted choices and lack of a unified foreign policy.

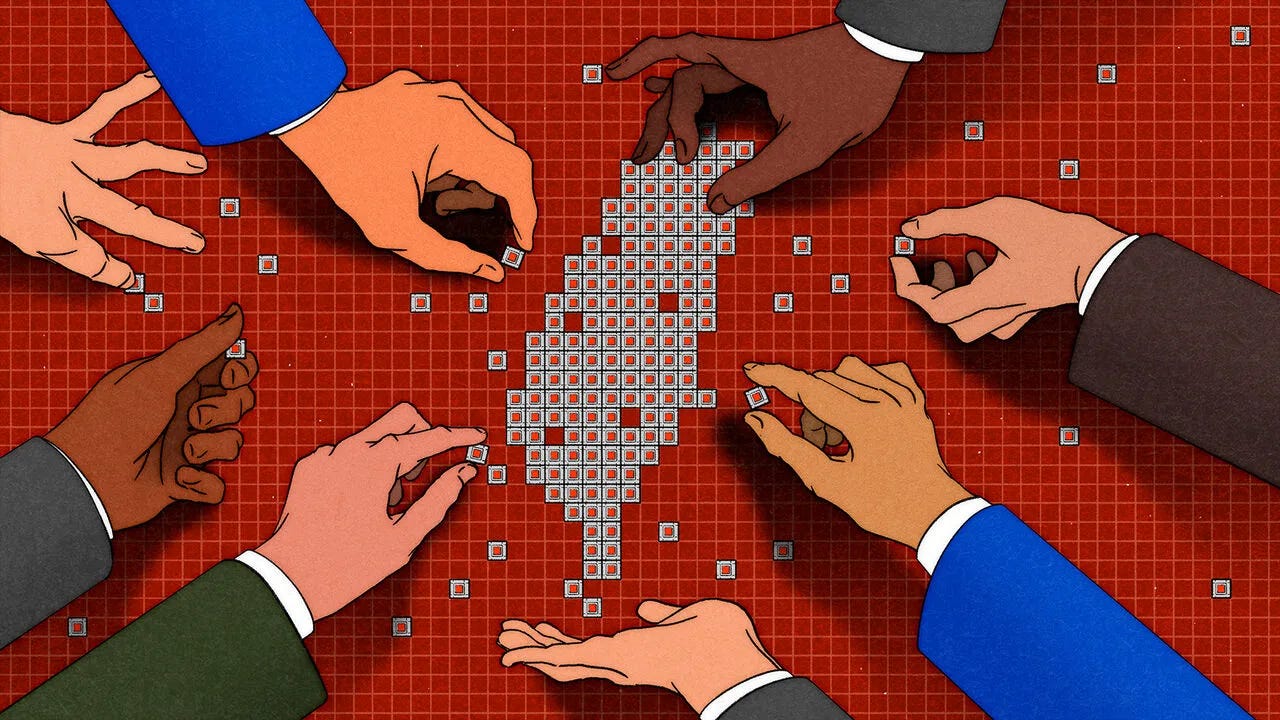

Tech — TSMC Must Move Beyond Taiwan

Economists

TSMC, the world's largest chipmaker, dominates global semiconductor manufacturing with over 90% market share in advanced chips and serves as the exclusive producer for tech giants like Nvidia, Apple, and Microsoft, making it critically important to the global technology infrastructure. Despite its Taiwanese roots and preference for staying low-profile, the company has embarked on a massive $190 billion global expansion, primarily focused on building six advanced fabrication plants in Arizona worth $165 billion, driven by both U.S. government pressure through the CHIPS Act and internal recognition that Taiwan's limited power grid, shrinking workforce, and land constraints cannot support its continued growth. However, this expansion faces significant challenges including higher production costs (up to 20% more expensive than Taiwan), the difficulty of replicating TSMC's intense engineering culture and precision manufacturing processes abroad, and complex geopolitical tensions as Taiwan relies on TSMC as a "silicon shield" against Chinese invasion while simultaneously needing to satisfy allies' demands for supply chain diversification away from the island.

Business — PE Fund Raising Slumps

FT

Private equity firms are experiencing their worst fundraising environment in seven years, raising only $592 billion in the 12 months to June 2024—nearly a third below 2021's record levels—despite offering unprecedented discounts including management fee cuts, early-bird incentives, and expense caps to attract investors. The sector's struggles stem from higher interest rates, a dealmaking slowdown that has left firms unable to sell trillions in aging investments, and market oversaturation with too many funds competing for limited capital, forcing PE groups to return only 11% of industry assets to investors in 2023, the lowest since 2009. Even President Trump's election, which dealmakers hoped would spur deregulation and revival, has failed to materialize expected growth, with his tariff policies actually chilling activity and causing 33% of institutional investors to slow their private market investments, while Europe faces additional pressure from multiple major firms like Advent International ($25bn target) and Permira (€17bn target) simultaneously fundraising in an overcrowded market where many funds may fail to reach their goals.

Climate — Europe Is Ablaze

Economists

Europe is experiencing unprecedented wildfire devastation this summer, with fires burning almost 10,000 square kilometers across the EU by August 19th—more than four times the average since 2006—as the continent warms at twice the global rate (0.53°C per decade since the mid-1990s versus 0.26°C globally). Portugal has been hit hardest relative to its size, with fires consuming 2.9% of its entire territory (2,600 sq km), while Spain has seen 4,000 sq km burned and 30,000 people evacuated, prompting countries to seek EU disaster assistance a record 17 times as blazes of "explosive intensity" threaten major cities from Madrid to Athens. While climate change creates the tinderbox conditions, human activity remains the primary ignition source, with a 2016 European study showing that of fires with known causes, only 4% started naturally from lightning, while 57% were deliberately set—often by farmers clearing land for pasture or developers seeking to reclassify burned areas for construction—highlighting the need for stricter penalties and land-use restrictions alongside the climate adaptation measures needed to address Europe's accelerating fire crisis.

The Daily Spark

With the S&P 500 and credit spreads near record levels, it is clear that there is a lot of confidence in the US economy.

In fact, two pieces of evidence suggest that foreign investors are very excited about the US outlook.

1) US 10-year interest rates are going up during New York trading hours and down outside of New York trading hours, see the first chart below. Simply put, this shows that domestic investors are sellers of US government debt and foreign investors are buyers. Unsurprisingly, foreigners like the higher yields they get in the US, including in private credit.

2) While foreigners were selling US assets in April after Liberation Day, they have come back as big buyers of US assets in May and June, see the second chart. In other words, the “sell America” trade was basically only in April.

The bottom line is that the US is the most dynamic economy in the world with some of the most attractive investment opportunities, and the two charts below show that foreign investors agree.

Song Recommendation — The Man I Need

Quote of the Day

“Do not be afraid; our fate

Cannot be taken from us; it is a gift.”

― Dante Alighieri, Inferno