Porsche's Getting Slower

Friday, October 31st, 2025

Good morning and happy Friday (and Halloween)

The US and China have agreed to pause their economic warfare for a year, but markets aren’t buying it—the deal feels more like a strategic breather than a breakthrough, especially as Beijing’s rare earth restrictions proved it now holds cards Trump didn’t face in his first term. In corporate news, Amazon just validated its massive AI spending with blowout cloud results while the car industry’s tale of two companies intensifies: BYD is racing overseas as China’s EV market turns brutal, and Porsche is bleeding a billion euros per quarter as its botched EV strategy and Chinese collapse threaten its legendary status.

World News — Trump and Xi Reaches a Trade Truce

The US and China reached a one-year trade truce in South Korea, with Washington cutting fentanyl-related tariffs and suspending expanded blacklist rules while Beijing resumed soybean purchases and rare earth exports. The deal appears designed more to stabilize relations temporarily than resolve fundamental economic tensions, with both nations using the pause to reduce strategic dependencies on each other. While Trump gained political wins like agricultural sales and keeping TikTok operational, China demonstrated newfound leverage through rare earth restrictions that forced the US to back down on export controls, marking a shift in bargaining power since Trump’s first term. Markets showed little enthusiasm, with US futures unchanged and China’s CSI 300 Index down 0.8%, reflecting skepticism that the agreement offers more than a temporary reprieve in the long-term US-China rivalry.

Tech — Amazon’s Bumper Earning

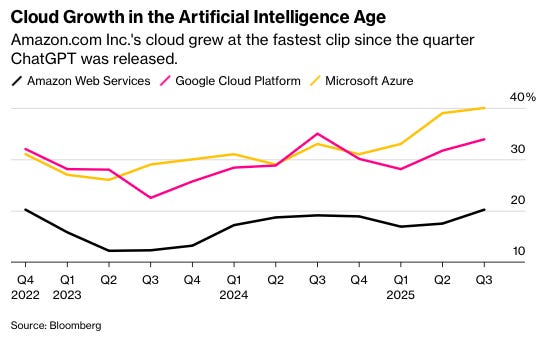

Amazon’s cloud division AWS reported its strongest growth since late 2022, with third-quarter revenue rising 20% to $33 billion and beating analyst expectations of 18% growth, helping ease investor concerns that the company was losing ground to Microsoft and Google in the AI-driven cloud market. The results sent Amazon shares surging 13% in extended trading as CEO Andy Jassy highlighted AI’s growing impact across the business, including projections that the Rufus shopping chatbot will generate $10 billion in additional annual sales and that the Bedrock AI marketplace could eventually rival AWS’s flagship EC2 computing service. Despite record capital expenditures of $34.2 billion—up 61% as Amazon doubles down on AI infrastructure and its $8 billion partnership with Anthropic—the strong performance across both cloud and retail operations reassured investors that massive AI spending wasn’t fueling a bubble but rather driving genuine business momentum.

Business — BYD Doubles Down on Foreign Expansion

BYD’s third-quarter profit plunged 33% to $1.1 billion, missing analyst expectations as China’s largest EV maker struggles with Beijing’s crackdown on aggressive pricing and intensifying domestic competition from rivals like Geely, prompting an urgent pivot toward international expansion. The company, which now accounts for 30% of China’s EV market and 40% of its EV exports, is rapidly building manufacturing facilities across six countries and a fleet of eight dedicated shipping vessels while exports rose 14% to 705,000 vehicles in the first nine months. Despite the profit decline and a 30% stock drop from May’s peak, analysts anticipate BYD will unveil technological breakthroughs including semi-solid-state batteries and Tesla-pioneered gigacasting manufacturing, along with a design refresh in 2026 to address consumer fatigue with its seven-year-old “dragon face” styling, as the company pursues its ambitious goal of 10 million annual sales with half coming from overseas markets.

The Car Industry — Porsche’s Slowing Down

Porsche’s new CEO Michael Leiters faces a crisis as the iconic German sports car maker reported a €1 billion third-quarter operating loss and issued its third profit warning of the year, with operating margins collapsing from a stellar 15-18% range to an expected 0-2% in 2025 while its market value has halved since its 2022 spinoff from Volkswagen. The company confronts three major challenges: reversing its misfired EV strategy after customer resistance forced abandonment of an 80% electric sales target by 2030, leaving its popular Macan SUV stuck as EV-only until a petrol replacement arrives in 2028; salvaging its Chinese business where sales have plummeted from 93,000 vehicles in 2022 to just 40,000 this year due to local competition from rivals like Xiaomi and inadequate infotainment systems; and managing Trump’s new 15% EU auto tariffs that threaten to slash €700 million from profits in America, now Porsche’s largest market where it lacks factories to avoid import levies. The carmaker that once contributed over a quarter of Volkswagen Group’s operating profit from less than 4% of its sales volume now faces an urgent turnaround as it struggles with declining sales across all major markets.

Chart of the Day

Quote of the Day

“It felt like the world had divided into two different types of people, those who had felt pain and those who had yet to.”

― Michelle Zauner, Crying in H Mart