right person, wrong time

Friday, May 30th, 2025

World Events — Trump’s Attack On Harvard Is Sending Chills

Bloomberg

The United States, once the ultimate destination for ambitious Asian students seeking prestigious degrees and global opportunities, is now sending a starkly less welcoming message under President Donald Trump’s administration. Recent moves—including the abrupt pause on new student visa interviews, expanded social media vetting, and threats to revoke visas for Chinese students with alleged Communist Party ties—have created deep uncertainty and anxiety among Asian families who have long viewed an American education as a ticket to success. The administration’s rhetoric, targeting elite universities and questioning the high proportion of foreign students, has left many parents questioning the value and feasibility of investing in costly U.S. degrees, especially as other countries like Canada, the UK, Australia, and regional Asian universities step up their efforts to attract top talent. With over a million international students in the U.S.—more than half from India and China—the chilling effect of these policies risks not only undermining America’s educational soft power and financial model, but also dashing the hopes of a generation across Asia who now see the American Dream slipping further out of reach.

Tech — Dell Technologies Top Estimates

Bloomberg

Dell Technologies raised its annual profit outlook above Wall Street estimates, driven by surging demand for its AI-optimized servers equipped with Nvidia chips, which led to $12.1 billion in AI server orders in the most recent quarter—surpassing all shipments for the previous fiscal year and leaving a $14.4 billion backlog. The company now expects adjusted earnings of $9.40 per share for the fiscal year ending January 2026, up from its earlier forecast and ahead of consensus, while maintaining its revenue projection of about $103 billion. First-quarter sales rose 5% to $23.4 billion, beating expectations, though earnings per share slightly missed forecasts due to weaker consumer PC demand and pricing pressure; however, robust AI server sales more than offset these challenges, propelling Dell’s stock higher in after-hours trading.

Business — American Finance Is Now Uniquely Dangerous

The Economists

American finance, long considered a global safe haven, is now a source of instability as a new, complex financial system dominated by asset managers, hedge funds, and private equity giants like BlackRock, Apollo, and KKR replaces traditional banks and insurers, creating unprecedented risks that remain untested by crisis. These firms, propelled by regulatory advantages and innovation, have grown rapidly and now play a central role in everything from lending to blue-chip companies to dominating trading and insurance markets, yet their opacity, reliance on illiquid assets, and deep interconnections with banks make the system vulnerable to shocks. Under Donald Trump, these risks are magnified by surging government debt, erratic trade policy, and attacks on institutions, all of which could trigger a crisis that exposes the fragility and unpredictability of this new financial order—leaving policymakers and investors dangerously unprepared for the fallout.

Environment — Wildfires In Alberta Poses a Threat to Canadian Oil

Bloomberg

Wildfires raging across Alberta are posing an escalating threat to Canada’s oil industry, with about 5% of national crude output—roughly 245,000 barrels per day—at risk as blazes approach key oil sands production sites. As of May 29, 2025, 26 out-of-control fires, fueled by hot, dry, and windy conditions, have forced evacuations, disrupted operations, and prompted companies like Cenovus Energy to remove non-essential staff from affected facilities, while others such as Canadian Natural Resources are closely monitoring the situation. These fires have not only triggered hazardous air quality across Alberta, Saskatchewan, and Manitoba, but also revived memories of past disruptions, such as the 2016 Fort McMurray wildfire that took over a million barrels per day offline. With inventories already low due to recent trade tensions and the wildfire season just beginning, the risk to Canada’s oil supply and broader energy markets remains high as emergency measures and weather forecasts offer little immediate relief.

The Daily Spark

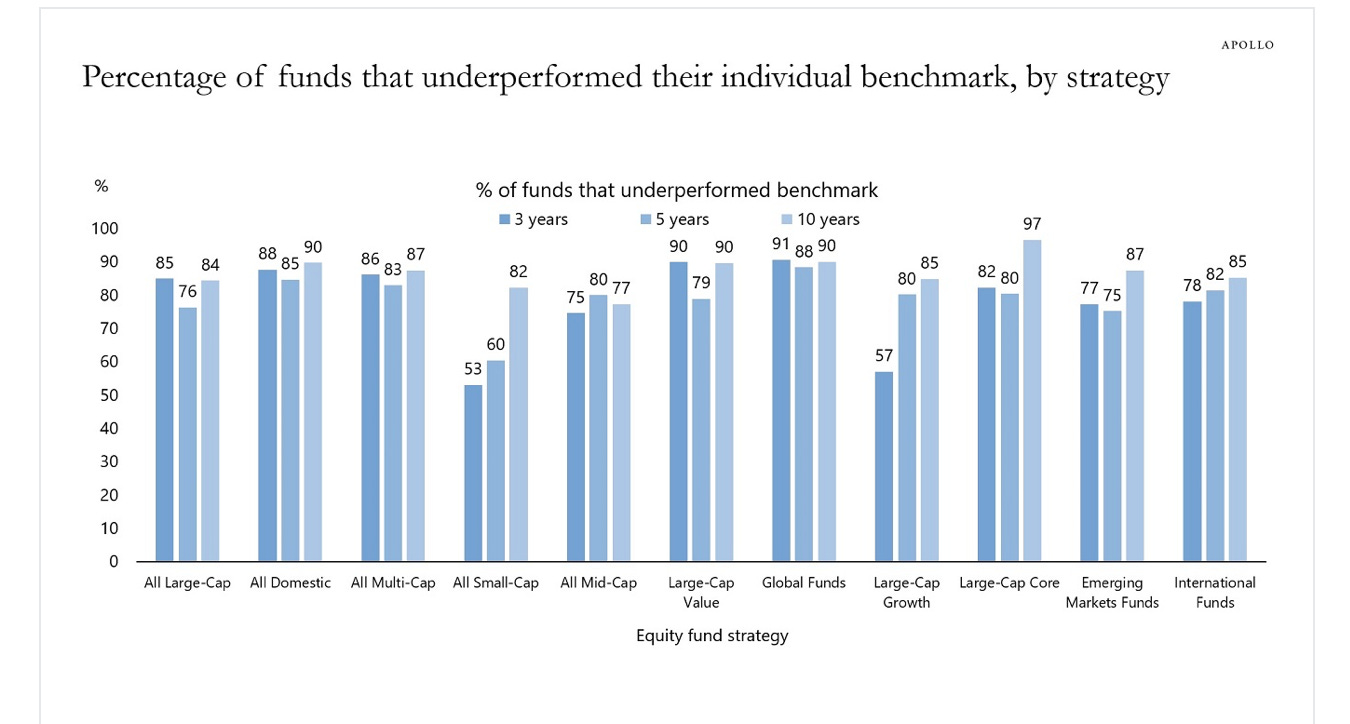

The chart below shows the underperformance of active managers in public equities by strategy. The bottom line is that over the past 10 years, 80% to 90% of active managers have underperformed their benchmarks across all strategies. For more, see the S&P SPIVA data here.

Song Recommendation — right person, wrong time (Harry moodie)

Quote of the Day

"Give me liberty, or give me death!" — Patrick Henry