Stagflation Outlook

Friday, August 8th, 2025

World News — Trump Nominates Stephen Miran to the Federal Reserve Board

FT

Donald Trump announced he will nominate Stephen Miran, chair of the White House’s Council of Economic Advisers and a close Trump ally, to temporarily serve on the Federal Reserve’s board of governors. Miran, an architect of Trump’s tariff policies who has argued they are not inflationary, would take the seat vacated by Adriana Kugler and serve until the end of January, pending Senate confirmation. As a Fed board member, Miran will have a vote on the rate-setting Federal Open Market Committee. He is expected to advocate for lower interest rates, aligning with Trump’s policy preferences, and joins other Trump appointees, Christopher Waller and Michelle Bowman, both of whom have pushed for rate cuts. Miran has been critical of Fed Chair Jay Powell—whose term ends in May 2026—for not acting quickly enough on monetary policy and for supporting fiscal stimulus during the 2020 pandemic. Before joining the Trump administration, Miran called for reforms at the central bank, including shorter term lengths, public oversight of regional Fed banks, and more mechanisms for removing Fed officials. Trump is also expected to use this opportunity to lay groundwork for replacing Powell as Fed chair once his term ends.

Tech — Meta Works with Private Credit and Private Equity for Data Center Deal

Bloomberg

Meta Platforms has chosen Pacific Investment Management Co. (Pimco) and Blue Owl Capital to lead a $29 billion financing package for its expansive new data center project in rural Louisiana, aimed at powering its artificial intelligence ambitions. Pimco is set to provide the majority—$26 billion—through debt financing, likely in the form of investment-grade bonds backed by the data center’s assets, while Blue Owl contributes $3 billion in equity. The move is part of a competitive fundraising process, coordinated by Morgan Stanley, that attracted other major private credit players like Apollo and KKR. This landmark deal will help Meta accelerate costly AI infrastructure development and mirrors a broader trend: tech giants such as Microsoft and xAI are similarly raising massive sums with partners like BlackRock to build and finance next-generation data centers as the AI race intensifies.

Business — Uber is Prepared To Go Driverless, Again

Economists

Uber, having turned a corner into profitability with a $2.8b operating profit in 2024 and strong results in 2025, is aggressively preparing for the driverless future by partnering with a wide array of autonomous vehicle firms rather than building technology in-house. After years of costly investment and a failed self-driving unit, Uber’s new strategy is to integrate robotaxi services from leaders like Volkswagen (set to launch in Los Angeles), WeRide (expanding in 15 cities), Baidu’s Apollo Go (operating across Asia and the Middle East, aiming for Europe), and Alphabet’s Waymo (collaborating in U.S. cities like Atlanta and Austin). Beyond partnerships, Uber is investing in startups such as Wayve (with London trials planned), exploring deals regarding Pony.ai, and has ordered 20,000 robotaxis through agreements with Lucid and Nuro to better understand the economics of running self-driving fleets. Despite regulatory hurdles, consumer wariness, and competitive threats from both established giants like Waymo and possible platform-independent moves by Tesla, Uber aims to remain the central “platform of choice” when robotaxis become mainstream.

Culture — Germans Are Falling Out of Love With Beer

Economists

Germans are falling out of love with beer as consumption has dropped to historic lows, with sales in the first half of 2025 falling below 4 billion liters—a 6.3% year-on-year decline and the lowest recorded since 1993. Per capita, the average German now drinks under 90 liters annually, down from 112 liters two decades ago, driven by an aging population, health-conscious younger generations, and broader economic malaise. Cost isn't the main issue, as beer remains relatively affordable, but changing tastes and struggles in hospitality settings accelerate the decline, while non-alcoholic beer now makes up nearly 10% of production but cannot offset falling traditional sales. Exports are shrinking even faster, in part due to U.S. tariffs, and nearly 100 breweries have closed in five years, with more closures likely.

The Daily Spark

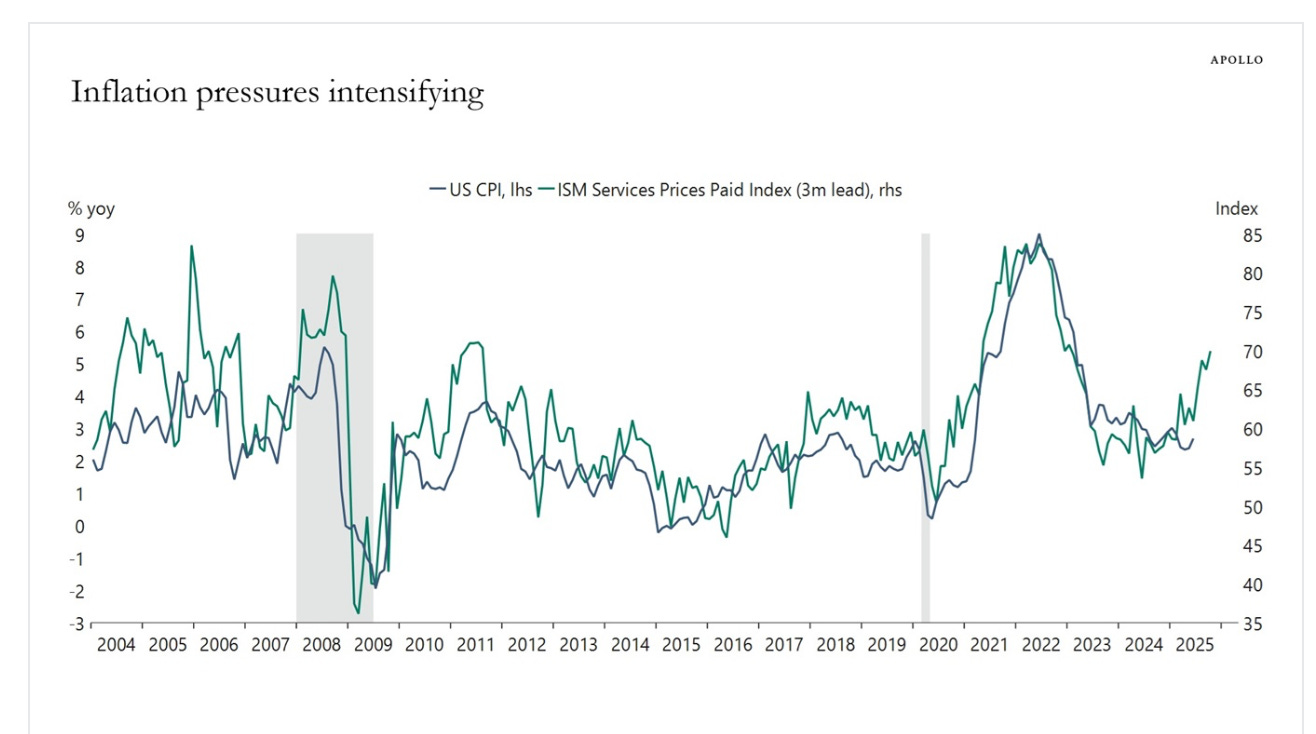

ISM Services Prices Paid for July shows that inflation pressures in the service sector are intensifying, pointing to upside risks to CPI inflation over the coming months, see chart below.

At the same time, employment growth is slowing down and the unemployment rate is rising.

The sources of this stagflation impulse are tariffs, deportations and the depreciation of the dollar.

This is a problem for the Fed. Should the FOMC focus on rising inflation and hike rates, or on slowing growth and cut rates?

The market is clearly expecting cuts, but the upside risks to inflation are significant, and investors should be carefully watching survey-based and market-based measures of inflation expectations.

The bottom line is that the stagflation theme in markets is intensifying.

For more discussion, see our mid-year outlook from June here.

Song Recommendation — Toxic Till the End

Quote of the Day

“Empty your mind, be formless, shapeless - like water. If you put water into a cup, it becomes the cup. You put water into a bottle, it becomes the bottle. You put it in a teapot, it becomes the teapot. Water can flow or it can crash. Be water, my friend." - Bruce Lee

https://open.substack.com/pub/techitalt/p/economic-rundown?r=5jmutn&utm_campaign=post&utm_medium=web&showWelcomeOnShare=true