Star War Returns

Thursday, May 22nd, 2025

World Events — Star War Return

Economists

Donald Trump has revived the vision of a space-based missile defense system—first championed by Ronald Reagan—by announcing the "Golden Dome," an ambitious plan to shield the United States from missile attacks using a vast network of satellites and orbital interceptors. Trump claims this system, inspired by Israel’s Iron Dome but on a much larger scale, will offer near-total protection against advanced ballistic and hypersonic threats, with a projected cost of $175 billion and a promised completion within three years—though independent estimates suggest costs could exceed $500 billion over two decades and that the timeline is highly optimistic. The Golden Dome aims to counter the growing sophistication of adversaries like Russia and China, who are rapidly developing anti-satellite weapons and maneuverable space assets, escalating the militarization of Earth’s orbit and raising the risk of a new arms race. Critics argue that the technical and financial hurdles are immense, the effectiveness of such a shield is unproven, and the deployment of space-based interceptors could further destabilize global security by making satellites—crucial for communication, navigation, and military operations—prime targets in a potential conflict.

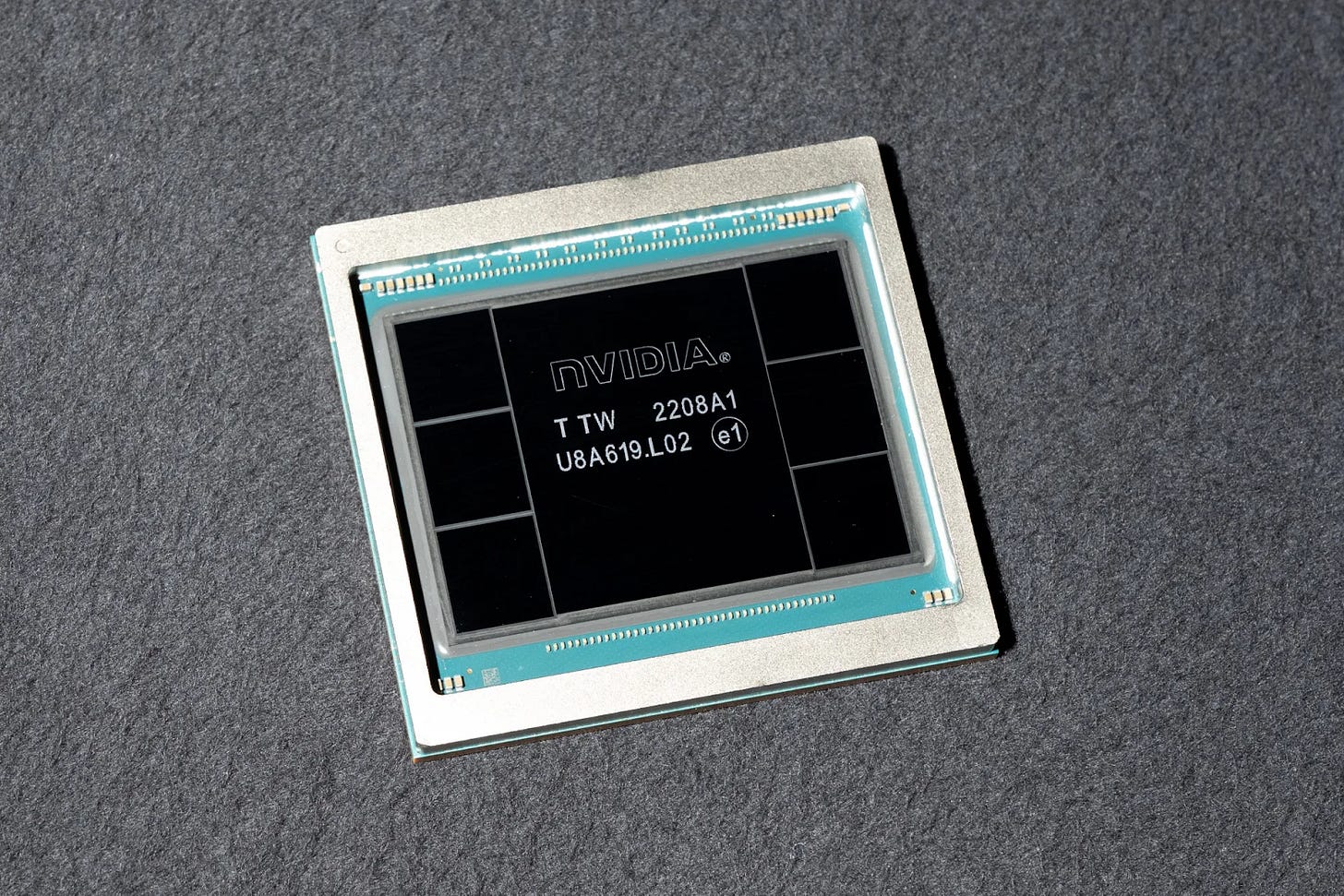

Tech — Why Is Nvidia the King of AI?

Bloomberg

Nvidia remains the dominant force in AI chips, commanding about 90% of the data center GPU market thanks to its relentless innovation, robust hardware-software integration, and early bets on parallel processing for AI workloads. Its flagship Hopper H100 chip and the newer Blackwell series offer industry-leading performance for training and deploying large AI models, with Blackwell delivering 2.5 times the performance of Hopper and leveraging advanced multi-chip packaging for seamless high-speed computation. Nvidia’s CUDA programming language has become a standard in the AI industry, further locking in developers and customers to its ecosystem. While competitors like AMD and Intel are making strides—AMD’s MI350 is touted to be 35 times better than its predecessor—neither has matched Nvidia’s scale or momentum, with Nvidia’s annual AI chip sales exceeding $100 billion compared to AMD’s $5 billion. The company is also expanding its vision beyond chips, aiming to make AI the infrastructure of the future with initiatives like the DGX Spark desktop AI supercomputer and NVLink Fusion, which opens its ecosystem to third-party CPUs and GPUs for greater flexibility and reach. Despite emerging challenges, such as new AI models like DeepSeek’s that require fewer resources, and tech giants developing their own chips, Nvidia’s unmatched pace of innovation, deep software stack, and strategic partnerships keep it firmly at the center of AI development for now.

Market — 30 Year Treasury Hits New High (Fear of Fiscal Expansion Rises)

Bloomberg

Stocks, bonds, and the dollar all fell sharply after a weak $16 billion auction of 20-year U.S. Treasuries, which saw tepid demand amid mounting concerns over the nation’s ballooning deficit and the potential impact of a major tax-and-spending bill advancing in Congress. The auction’s high yield of 5.047%—the highest since the tenor was reintroduced in 2020—signaled that investors are demanding greater compensation to hold U.S. debt, especially as Moody’s recent downgrade of the U.S. sovereign rating has heightened worries about America’s fiscal trajectory. The S&P 500 dropped 1.6%, the Dow slid 1.9%, and the Nasdaq lost 1.3%, marking their worst session in a month, while the 10-year Treasury yield jumped to around 4.6% and the 30-year yield topped 5%. Analysts noted that persistent deficit fears and the prospect of even higher government borrowing costs are making it harder to justify current stock valuations, with some warning that foreign investors may be less willing to finance U.S. deficits at current rates.

Society — Box V. Brands

The Economists

America’s biggest retailers like Walmart, Amazon, Costco, and Home Depot are leveraging their scale and pricing power to shift the burden of higher costs—especially from Trump’s sweeping tariffs—onto their suppliers rather than consumers, intensifying the battle between big-box stores and major brands. While Walmart and others warn that tariffs will inevitably push some prices higher for shoppers, their vast reach and slim margins mean they can negotiate tough terms with suppliers, often forcing brands to absorb much of the cost pressure instead of passing it on to consumers. This growing clout is reflected in the rising share of retail profits compared to suppliers, with retailers’ profit pool expanding over the past decade as consolidation accelerates and private-label offerings encroach on territory once dominated by household names like Nike and Nestlé. As economic uncertainty and tariff volatility persist, brands find themselves squeezed between nimble upstart competitors and the relentless bargaining power of retail giants, while consumers, though offered more product choices, face a marketplace increasingly dominated by a handful of powerful retailers.

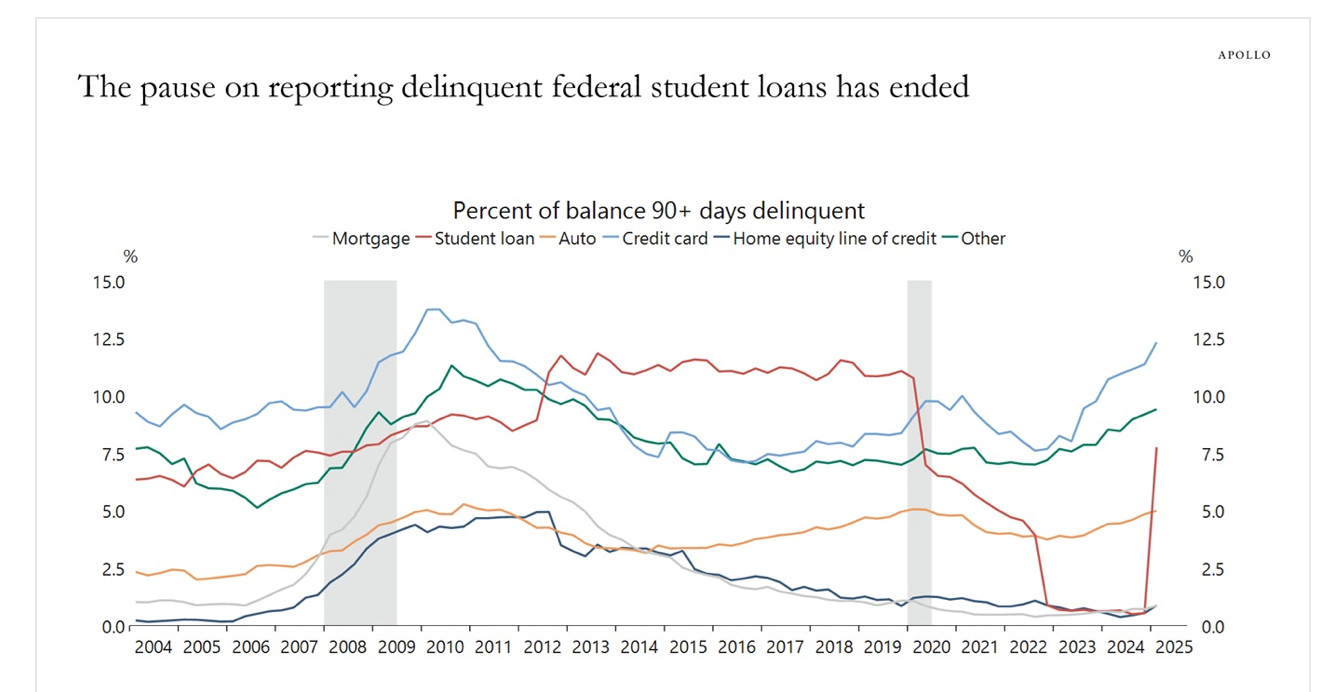

The Daily Spark

The Covid-motivated pause on reporting delinquent federal student loans has now ended. As a result, starting in May 2025, up to 10% of US households may face a steep decline in their credit score, see chart. This means they will no longer be able to get a loan to buy a car, a house, or new furniture. Combined with tariffs and high uncertainty, this is a significant headwind to consumer spending over the coming months. See here for more discussion from the New York Fed.

Song Recommendation — Wrecked (Imagine Dragons)

Quote of the Day

“For fifteen years Mr. Polly was a respectable shopkeeper in Fishbourne. Years they were in which every day was tedious, and when they were gone it was as if they had gone in a flash.” ― H.G. Wells, The History of Mr. Polly