State-run Capitalism

Wednesday, August 27th, 2025

World News — “State-run” Capitalism

FT

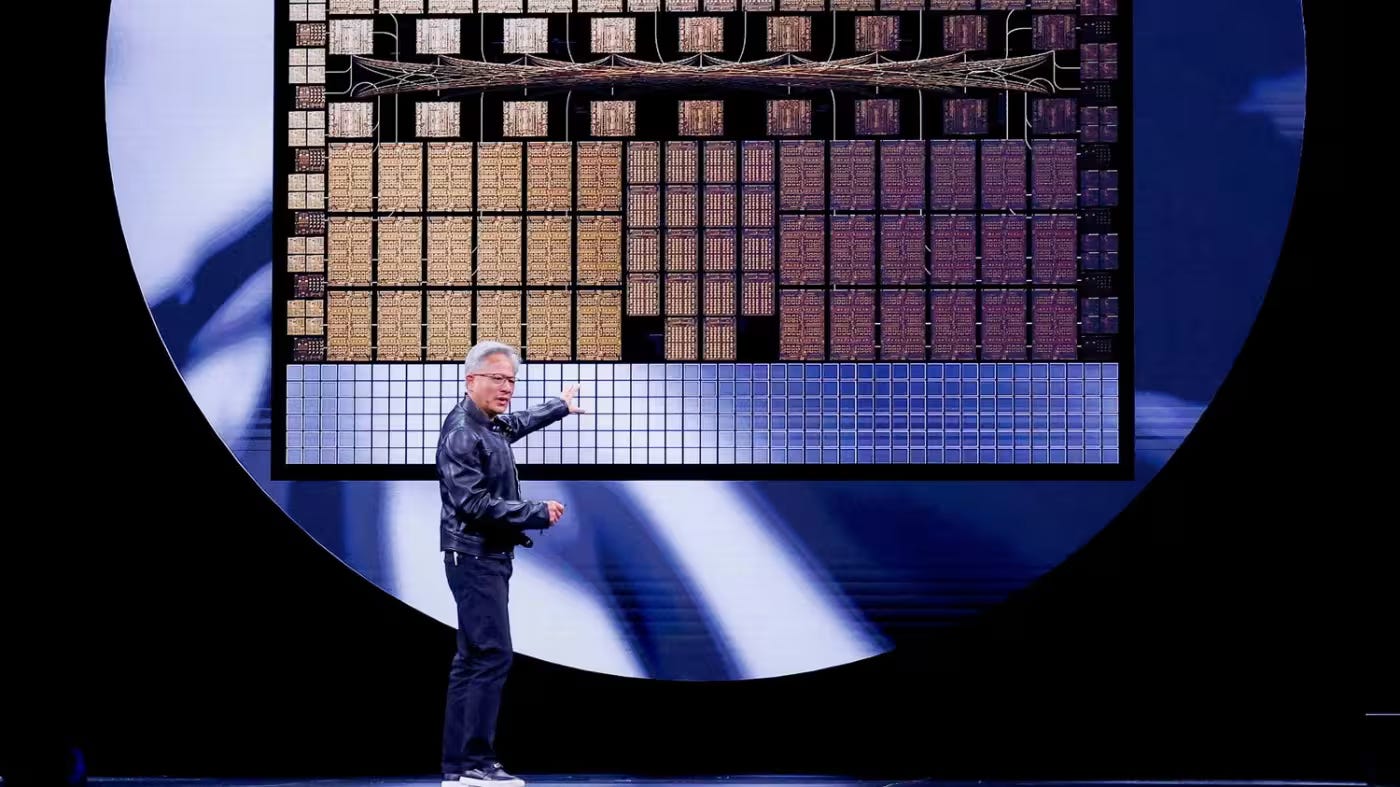

In his second term, President Donald Trump has pivoted from traditional Republican free-market principles towards a more interventionist, "state-run capitalism" approach, leaving many conservatives aghast. This shift is exemplified by several key actions: the US government taking a $8.9 billion, 10% equity stake in chipmaker Intel; acquiring a "golden share" in the U.S. Steel-Nippon Steel merger; and demanding a 15% cut of revenues from Nvidia and AMD's chip sales to China. While libertarian and conservative critics have labeled these moves as "bonkers" and an inappropriate shakedown of private companies, Trump has received praise from unlikely sources like billionaire Mark Cuban and Senator Bernie Sanders, who view the actions as a fair way for taxpayers to get a return on investment. Trump himself has defended these interventions as smart dealmaking to protect national security and has promised more such deals, framing his approach as transactional and beneficial for the country, despite concerns from Wall Street about potential market distortions.

Tech — Nvidia Earnings Tomorrow

FT

Nvidia's upcoming quarterly earnings report is being viewed by Wall Street as a critical test of faith in the entire artificial intelligence boom that has propelled markets to record highs. As the world's most valuable public company at $4 trillion, Nvidia's performance is considered a bellwether for the broader economy, with analysts expecting revenues of $46 billion, representing a significant but slowing year-over-year growth. The stakes are incredibly high, as investors and analysts warn that any failure to meet lofty expectations could "send the market into a tailspin," given the high valuations across the tech sector. Beyond headline numbers, the market will be scrutinizing the company's guidance and its outlook on the China market, where it recently struck a deal with the Trump administration to sell less advanced chips. The report's outcome is uncertain, as even stellar results in the past have not always prevented the stock from falling, underscoring the immense pressure on the chipmaker to justify its valuation and the ongoing AI frenzy.

Economics — Trump’s Fed Gamble Risks Pushing Key Bond Rates Even Higher

Bloomberg

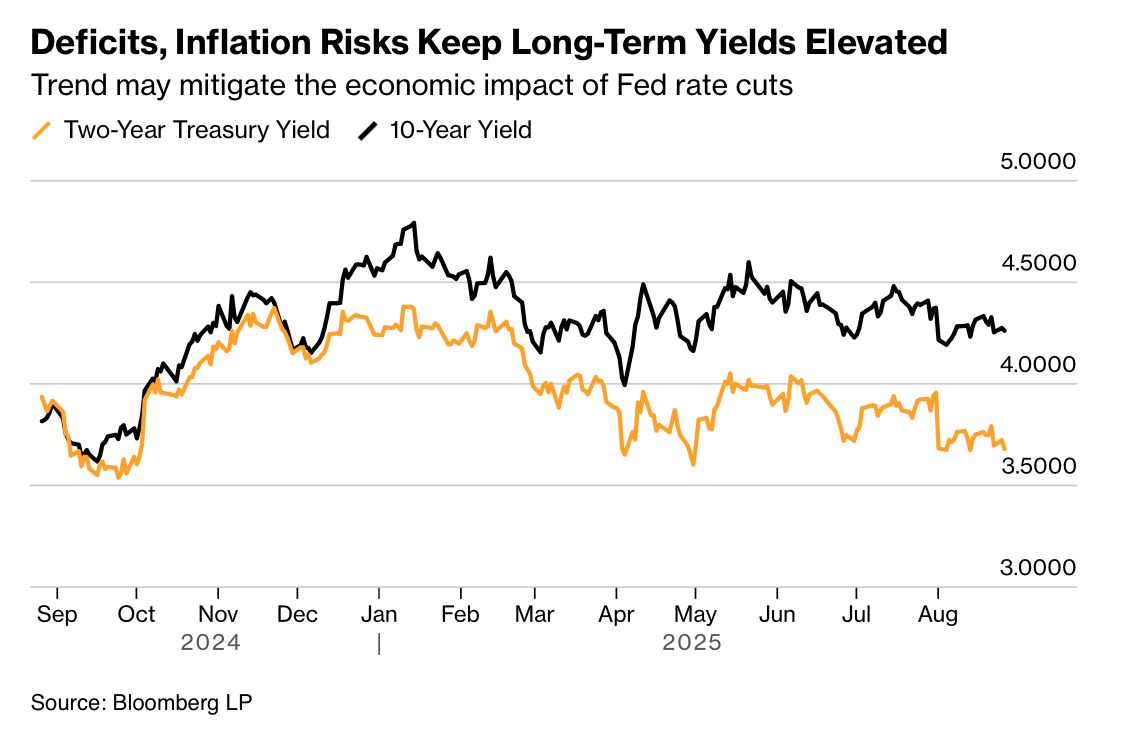

President Donald Trump's escalating attacks on the Federal Reserve's political autonomy risk backfiring by driving up the long-term borrowing costs he aims to lower. While Trump has been publicly lambasting Chair Jerome Powell and attempting to remove Governor Lisa Cook to pressure the central bank into deep interest rate cuts, the key 10-year Treasury yield—which influences mortgages and business loans—remains stubbornly high. This is because bond market investors are concerned about other inflationary pressures, such as tariffs, a massive budget deficit, and the stimulative effect of tax cuts. The primary danger is that Trump's interference could erode the Fed's inflation-fighting credibility, causing investors to demand higher yields on long-term debt to compensate for the risk of future inflation, ultimately squeezing the very economy the president wants to stimulate.

Travel — Have Foreign Tourist Really Avoided America This Year?

Economists

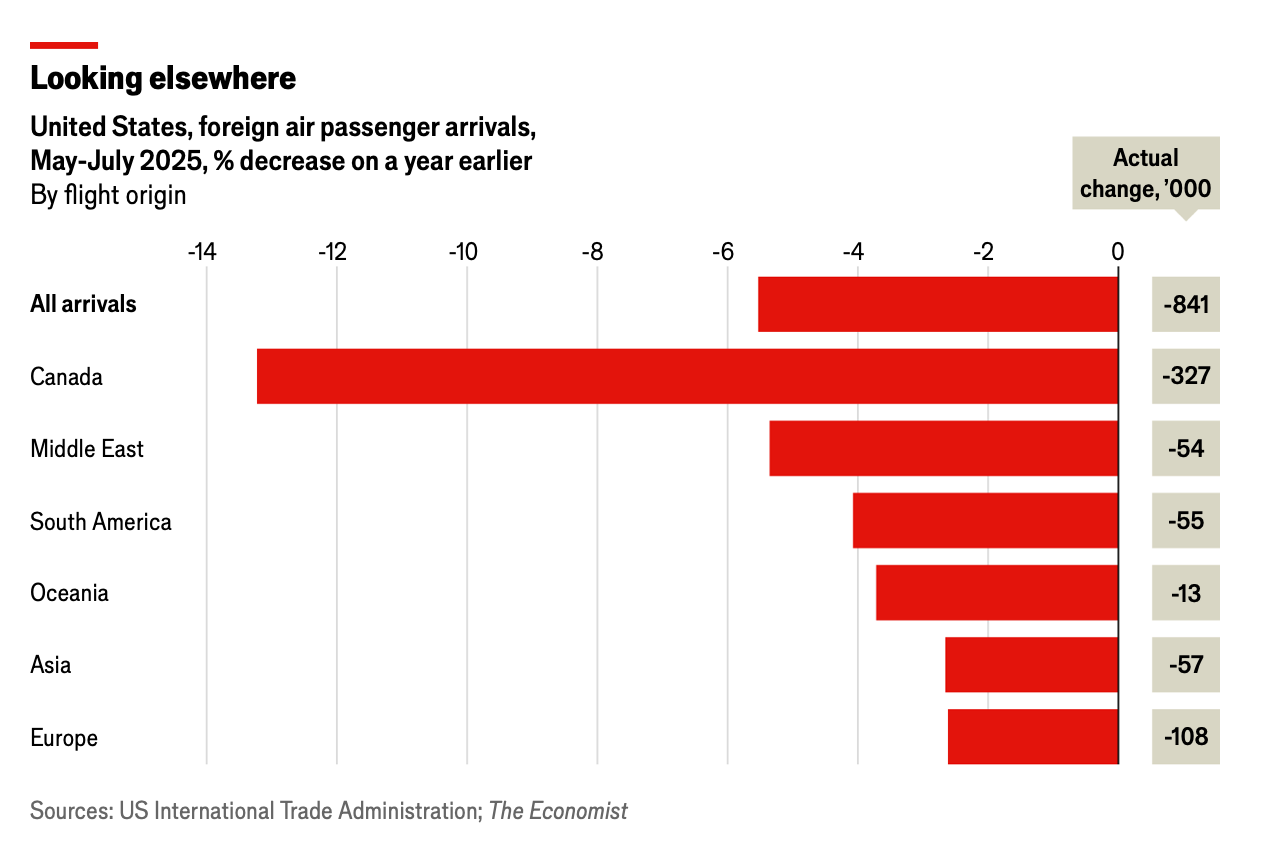

Yes—foreign tourists really have been avoiding America this year, according to data from the U.S. International Trade Administration and industry groups. International arrivals at American airports fell by 3.8% compared with 2024, amounting to around 1.3 million fewer visitors, with the steepest declines coming during the May–July peak season. Canada registered the sharpest drop: entries at U.S. airports fell by 7.4% year-to-date and by more than 13% in the summer months, with car crossings plunging even further amid Canadian anger over tariffs and political tensions. Major hubs like New York, Chicago, and Boston saw drops of around 7–8% in foreign arrivals, though Florida’s resort destinations bucked the trend with slight gains. The World Travel and Tourism Council warns that the downturn could drain $12.5 billion from the U.S. economy in 2025, though more affluent domestic tourists have softened the impact. Still, the growing imbalance—more Americans traveling abroad while fewer foreigners come in—highlights a worrying sign that America’s global appeal as a holiday destination is slipping.

The Daily Spark

The chart below shows that the last time there were three governors dissenting at an FOMC meeting was in 1988.

On the one hand, dissents can enhance the Fed’s credibility by promoting transparency.

On the other hand, frequent or widespread dissents can be perceived as a sign of internal division or weak leadership.

Academic papers find that dissents have a negative impact on stock prices, and that the lack of clarity in FOMC decisions can lead to increased financial market volatility as investors must price in a broader range of potential policy outcomes. Papers also find that disagreement among FOMC members puts upward pressure on inflation expectations.

Song Recommendation — First Love

Quote of the Day

“Instead of worrying about what you cannot control, shift your energy to what you can create.” ― Roy T. Bennett, The Light in the Heart