Tariff, Again?

Tuesday, July 8th, 2025

World Events — Trump Renews Threat to Hit Trading Partners With Stiff Tariff

FT

President Donald Trump has renewed his threat to impose steep “reciprocal” tariffs on major U.S. trading partners, extending the deadline for these levies from July 9 to August 1. Letters sent to Japan and South Korea, among others, warned that 25% tariffs will be imposed on their exports to the U.S. unless new trade deals are reached. South Africa faces a 30% tariff, and similar measures target 11 additional countries, with rates ranging from 25% to 49% depending on the nation. The tariffs mirror those announced in April, which had caused significant volatility in global financial markets before being paused for negotiations. Since then, the U.S. has only secured trade pacts with the UK, China, and Vietnam. Trump indicated that while the new tariff letters are “more or less final offers,” he remains open to further negotiation if countries propose alternative arrangements he finds acceptable. The White House’s executive order specifies that the tariffs will take effect just after midnight on August 1, based on recommendations from senior officials and the status of ongoing trade discussions. Notably, goods already subject to sectoral tariffs—such as vehicles and metals—will not be affected by these new rates. Trump’s move has unsettled markets, but Asian indices showed resilience, and the U.S. dollar weakened slightly. The administration has also warned that any retaliatory tariffs from targeted countries will be met with equivalent increases. While some countries, like Japan and South Korea, have expressed regret and are pushing for further negotiations, the U.S. maintains that these tariffs may be adjusted based on the evolving trade relationship and market openness.

Tech — Samsung Chips Unit in Crisis

Bloomberg

Samsung Electronics’ operating profit plunged 56% year-on-year in the June 2025 quarter, marking its first profit decline since 2023 and underscoring a deepening crisis in its core chip business. The sharp drop was driven by inventory writedowns and weak sales of advanced AI memory chips, compounded by ongoing US export restrictions on high-end semiconductors bound for China. As a result, Samsung’s semiconductor division, particularly its contract chipmaking (foundry) and high-bandwidth memory (HBM) segments, continues to struggle, with the company missing out on critical market share gains enjoyed by rivals SK Hynix and Micron, both of whom have secured key supply positions with Nvidia for next-generation AI accelerators. While Samsung’s revenue held steady at 74 trillion won, its inability to secure early certification for its flagship 12-layer HBM3E chips from Nvidia has allowed SK Hynix to dominate the lucrative HBM market, now holding an estimated 57% share compared to Samsung’s 27%. Despite these setbacks, Samsung expects operating losses in its chip business to narrow in the second half of the year as demand gradually recovers, and it has announced plans to ramp up production of next-generation HBM4 chips in an effort to regain lost ground.

Business - China’s Household Debt Crisis

Economists

Soaring household debt in China has become a widespread crisis, driven by years of easy credit, a booming property market, and government policies that once encouraged borrowing to fuel economic growth. Household debt has surged from less than 11% of GDP in 2006 to over 60% today, approaching levels seen in developed economies. Millions now struggle with defaults or arrears—estimates suggest between 25 and 34 million people are in default, with up to 83 million behind on payments, double the figures from five years ago. The roots of this crisis lie in heavy borrowing for housing (which makes up 65% of household loans), investments in family businesses, and reliance on online lenders. The situation has been exacerbated by high youth unemployment, a property market slump, and the economic fallout from the pandemic. Social stigma, aggressive debt collectors, and weak legal protections compound the distress, pushing some to contemplate suicide while others turn their financial woes into social media content for support or notoriety. Despite high savings rates, the lack of a robust personal bankruptcy system leaves many with little relief, and government reforms have so far offered limited protection against predatory lending and harassment, making indebtedness a growing social and psychological burden for China’s middle class.

Culture - How A-Listers Are Shaping Up Consumer Goods Business

Economists

A new wave of A-list celebrities—including Hailey Bieber, Rihanna, and Ryan Reynolds—is transforming the consumer-goods industry by moving beyond traditional endorsements to become hands-on entrepreneurs with significant equity stakes in their own brands. Unlike past celebrity tie-ins, where stars simply lent their names to products, these modern moguls leverage their massive social media followings and direct-to-consumer distribution to build innovative, authentic brands—like Bieber’s Rhode, Kardashian’s Skims, and Rihanna’s Fenty Beauty—that resonate deeply with fans and drive impressive sales, sometimes reaching billion-dollar valuations. Major consumer companies are taking notice, snapping up successful celebrity brands to refresh their own product lines, as seen in Apple’s acquisition of Beats and Diageo’s deals with Clooney and Reynolds. However, a famous name alone is no guarantee of success; today’s consumers are quick to share reviews online, and only genuinely high-quality, creative products thrive, while lesser offerings risk being quickly relegated to the bargain bin.

The Daily Spark

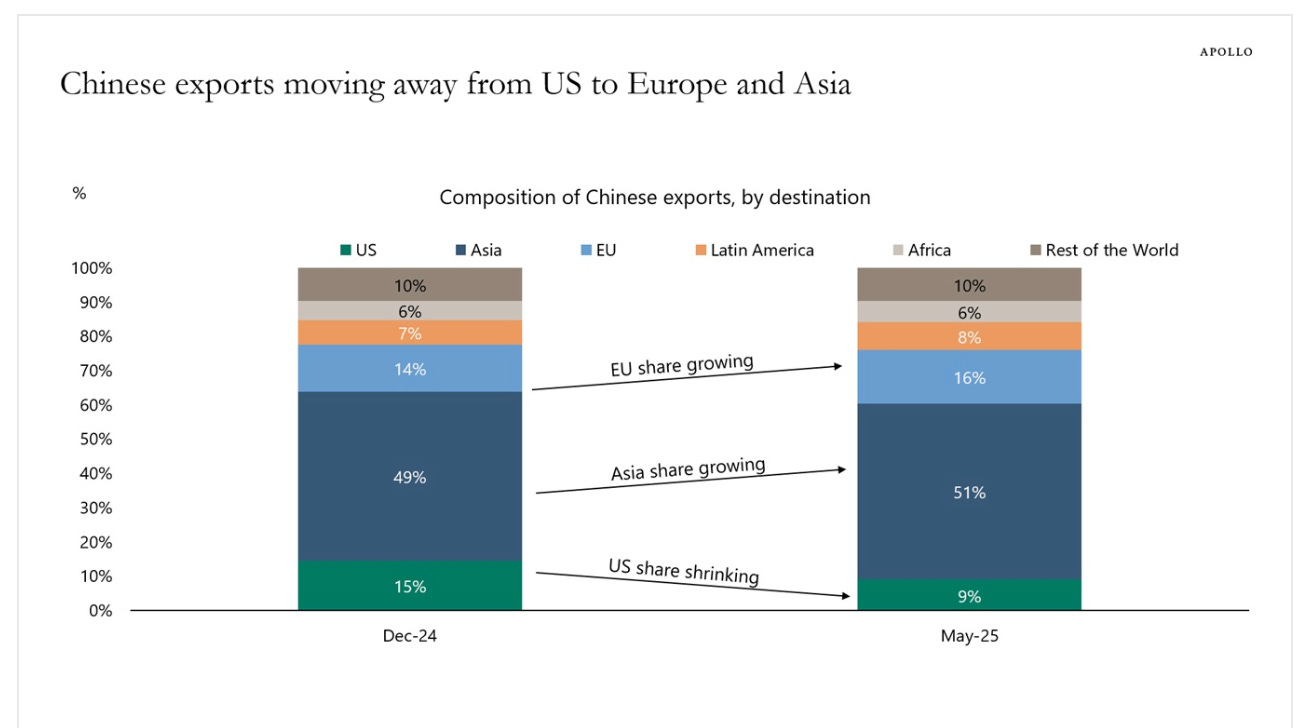

Since December 2024, the share of China’s exports going to the US has declined from 15% to 9%, while the shares of Chinese exports to Asia, Europe, and Latin America have increased, see chart below.

Song Recommendation - No One Noticed

Quote of the Day

“We do not stop playing because we grow old, we grow old because we stop playing!”

― Benjamin Franklin