The Powell Hedge

Monday, July 21st, 2025

World News - Inside Gaza’s ‘Death Traps’

FT

Palestinians in Gaza, desperate for food after a prolonged blockade, face extreme danger and chaos when seeking aid from the Gaza Humanitarian Foundation (GHF) distribution sites. The routes to these centers, announced unpredictably via Facebook and sometimes giving less than 30 minutes notice, force hungry people to walk for kilometers through devastated areas, often in the dark. Many are exposed to Israeli military fire, with over 500 people reportedly killed and thousands injured on the designated approach routes, amid constant risks of being shot or robbed. Aid is frequently insufficient, leading to violent scrambles among massive crowds and little protection from gangs outside the sites. Humanitarian organizations have criticized GHF’s approach as dangerous and inadequate, with some alleging it is intended more for control than genuine relief, and refuse to participate in these operations—all while most traditional distribution centers remain shuttered and many Gazans remain on the brink of starvation.

Tech - China’s ‘Dark’ Factories

Finance - The Powell Hedge

Bloomberg

President Donald Trump’s repeated public threats to fire Federal Reserve Chair Jerome Powell have injected significant volatility into financial markets, spurring Wall Street strategists to seek protective trades in anticipation of a potential shift in Fed leadership. Analysts like James van Geelen at Citrini Research have recommended buying two-year Treasuries and selling 10-year notes—a "Powell hedge"—on the theory that a Trump-appointed successor would be more compliant with demands for looser monetary policy, which is expected to lower short-term yields while raising long-term ones due to heightened inflation fears and concerns about eroding Fed independence. Other investors are positioning for these risks by favoring so-called curve steepener trades and bearish dollar bets, while some prefer hedges targeting expected increases in inflation expectations, like breakeven rate trades. Although most on Wall Street doubt Trump could easily remove Powell without facing legal and political hurdles, the rising probability of Powell's departure and the broader specter of political interference in central banking have led investors to brace for further bond market volatility and a potentially more turbulent interest rate environment.

Culture - Is Xi In Trouble? Quite the Opposite

Economists

Despite persistent speculation about his grip on power, Xi Jinping appears to be consolidating, not losing, control as China’s paramount leader enters a new phase of leadership marked by subtle shifts rather than overt challenges. With loyalists firmly installed across the Communist Party’s top ranks and no serious rivals in sight, Xi is delegating more day-to-day responsibilities to trusted lieutenants, convening powerful party commissions less frequently, and wielding authority through regulations that ensure his agenda prevails even when he is not physically present. Recent high-profile purges and ongoing anti-corruption campaigns serve to reinforce party discipline, but also highlight the risks of over-centralized control, such as loss of candor among officials or potential for corruption. By promoting loyal technocrats like Prime Minister Li Qiang and retaining ultimate oversight without naming a successor, Xi seems to be designing a system in which his power is perpetuated—possibly even elevated—through rules and proxies, all but ensuring that, despite his public absence or delegation, his authority over China’s vast government and military remains uncontested.

The Daily Spark

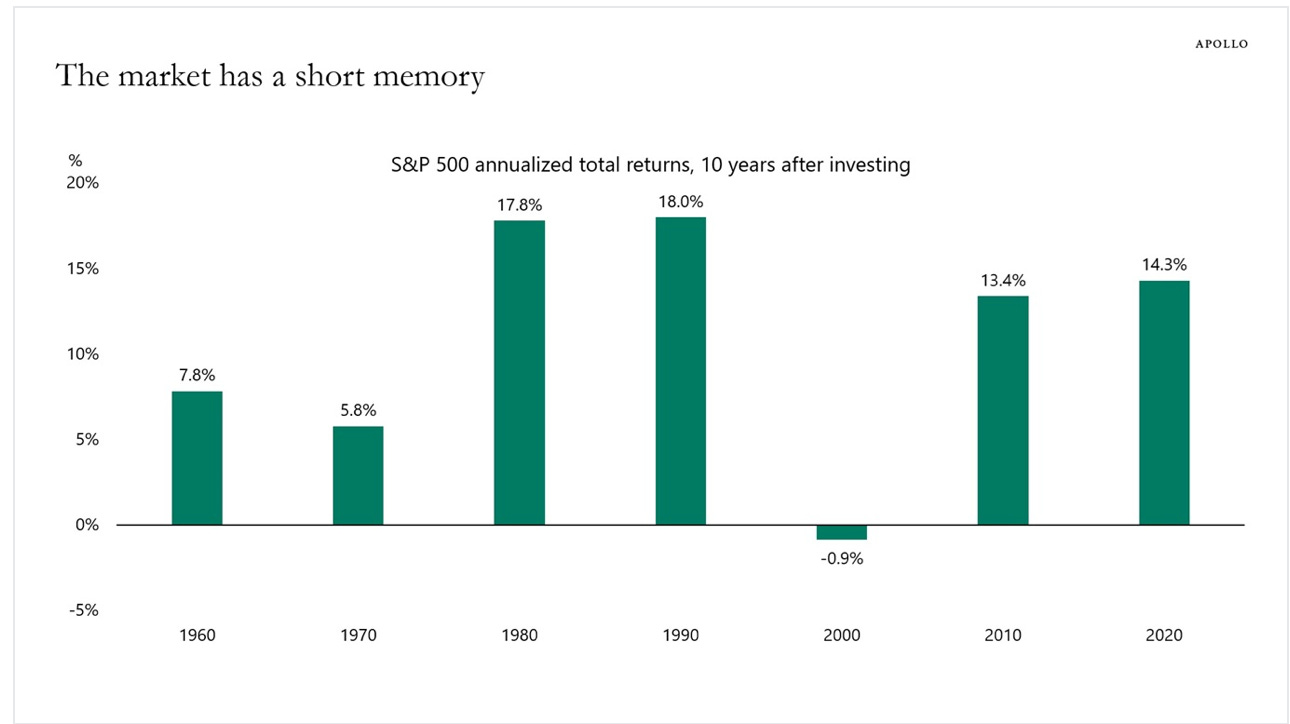

The narrative in bond markets today is that all-in yield levels are high. The narrative in stock markets is that it is a good strategy to buy stocks when the S&P 500 is at all-time highs.

Where are these narratives coming from? They are based on the recent performance of bond markets and stock markets: Yield levels were much lower before 2022, and stock markets continue to go higher and higher no matter what happens.

In other words, the market puts more weight on recent events in investment decisions. In short, the market has a short memory because many traders have never seen anything else.

But what if this way of investing is wrong? What if the stock market is about to enter a high inflation period similar to what we saw in the 1960s and 1970s (as shown in the chart below)? Maybe it was the period from 2009 to 2022 that was unusual in fixed income? If that is the case, then yield levels today are not high. Maybe the market today is putting too little weight on the US fiscal problems?

The bottom line is that markets will continue to hold on to yesterday’s narrative until it becomes completely clear that the narrative has changed.

Song Recommendation - GO BABY

Quote of the Day

“Trust is the glue of life. It's the most essential ingredient in effective communication. It's the foundational principle that holds all relationships” - Stephen Covey