The Return to Chinese Bonds

Friday, Sept, 12th, 2025

World News — Israel’s Qatarstrophic Error

Economists

Israel’s airstrike on Hamas officials in Qatar marks a grave strategic error that risks undermining efforts to end the Gaza war and destabilizing broader regional progress. While targeting terrorists who exploit foreign sanctuary sometimes meets a legitimate security test, the Doha operation violated established norms, jeopardizing Qatar’s critical mediation role—a function tacitly supported by both the US and Israeli intelligence services. The strike, undertaken against the counsel of the Mossad and Israel’s military, alienated Qatar and inflamed Gulf tensions, complicating peace negotiations and shifting Hamas’s leadership dynamic further toward Gaza’s militant command. As Gulf states weigh America’s muted response and the viability of its security guarantees, the Abraham Accords—the region’s best hope for future cooperation and stability—grow ever more fragile. In seeking to assert power and satisfy political imperatives, Israel has isolated itself and eroded trust among its allies, with long-term consequences for its own security and for American influence in the Middle East.

Tech — SK Hynix Leads Breakthroughs in Memory

SK Hynix shares surged to a record high on Friday after the company announced it had completed development of HBM4, the next generation of high-bandwidth memory vital for artificial intelligence, with plans for mass production now underway. The Seoul-based chipmaker, whose market value has climbed to nearly $170 billion on the back of a roughly 90% rally this past year, has outpaced bigger rival Samsung Electronics to become the leading supplier of HBM chips for Nvidia. The breakthrough product doubles bandwidth over the prior version while cutting power use by more than 40%, with SK Hynix estimating that the improvements could boost AI data center performance by nearly 70%. Having already delivered the world’s first 12-layer HBM4 samples earlier this year, SK Hynix is cementing its technological edge in what has become one of the fastest-growing and most lucrative segments of the semiconductor industry.

Economics — Return to Chinese Bonds

Global investors are returning to Chinese government bonds after a recent selloff pushed yields to multi-month highs, with firms like Allianz Global Investors, AllianceBernstein, and Aberdeen Investments viewing current levels as attractive entry points. Benchmark 10-year yields, which briefly touched 1.9% this week, are near their highest since December, spurring expectations that future monetary easing will drive them lower. While JPMorgan and UBS remain cautious due to potential headwinds such as new mutual fund fees and a tax on bond interest income, Allianz, AllianceBernstein, and Aberdeen are selectively adding positions, citing ample banking system liquidity, persistent deflationary pressure, and limited fiscal expansion as factors likely to support the market. The shift highlights how China’s bond declines are drawing bargain hunters back, even as demand for riskier assets like equities remains strong.

The Daily Spark

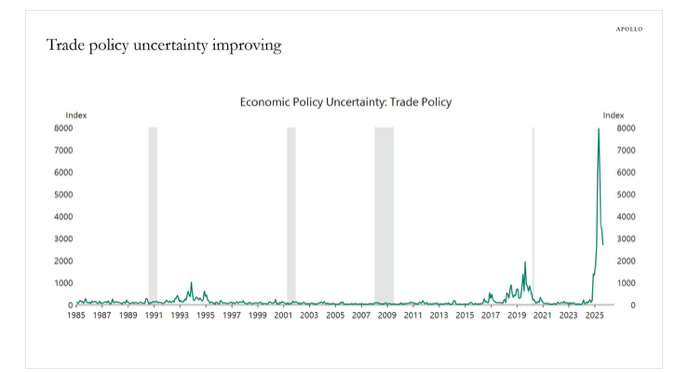

Trade policy uncertainty is returning to more normal levels

Quote of the Day

“Longing is the agony of the nearness of the distant.”

― Martin Heidegger