The Rise of Private Credit

Monday, Sept 29th, 2025

World News — Russian Pounds Ukraine

FT

Russian forces launched one of the heaviest aerial assaults on Ukraine in months, striking Kyiv and several other regions with nearly 500 drones and over 40 missiles in a 12‑hour barrage that President Volodymyr Zelenskyy condemned as “savage” and “deliberate terror against ordinary cities.” The attacks killed at least four people, including a 12‑year‑old girl, injured dozens more, and destroyed residential buildings while temporarily forcing Poland to restrict its airspace. Targeted areas included Zaporizhzhia, Khmelnytskyi, Sumy, Mykolayiv, Chernihiv, and Odesa, as Ukrainian air defences battled to intercept waves of drones and ballistic missiles. Zelenskyy urged tougher international pressure on Moscow, noting that the Kremlin continues to fund its war through energy revenues, and reiterated Ukraine’s urgent need for additional air defence systems, including more Patriot batteries.

Tech — Canada To Lure Tech Workers After Trump’s Changes Made to H1B

Canadian Prime Minister Mark Carney said his government is looking to attract skilled technology workers who might have otherwise pursued U.S. H‑1B visas before President Donald Trump’s new $100,000 visa fees disrupted the program. Carney noted that many of these professionals are programmers and engineers now seeking opportunities abroad, adding that Canada will shape its immigration strategy to provide a “clear offering” for such talent. His comments come as Germany and the UK also position themselves as alternative destinations for global tech workers affected by Washington’s visa clampdown.

Business — Private Credit Is On Its Biggest Year in EMs

Bloomberg

Private credit is set for its strongest year yet in emerging markets, with global heavyweights like Blackstone, Apollo, and KKR deploying record sums into deals across India, Southeast Asia, Eastern Europe, and the Gulf. In the first half of 2025 alone, $11.7 billion was invested—nearly matching all of 2024—driven by demand for alternative financing to support infrastructure, corporate expansion, and real estate projects. India has led activity with multibillion-dollar financings tied to Prime Minister Narendra Modi’s infrastructure push, while landmark transactions in Romania and Southeast Asia underscore growing appetite from private lenders previously wary of EM risk. Although private credit still accounts for less than 10% of the global $1.7 trillion market, inflows are accelerating as investors seek portfolio diversification and higher returns, even as the cost of private money remains higher than traditional bank lending or public debt.

Culture — Free Speech In America

Economists

Donald Trump’s escalating attempts to muzzle critics—from nuisance lawsuits against major newspapers and TV networks to efforts pressuring tech giants and allies to control media platforms—reflect his desire not just to counter old conservative complaints of bias but to demand constant adulation. While his tactics of lawsuits, regulatory threats, and friendly ownership echo models seen in illiberal states, America’s vast, fragmented media landscape and its constitutional protections make full control unlikely; cases against him are being dismissed, late-night hosts are back on air, and independent outlets still thrive. Yet even if Trump cannot dominate the press, the relentless pressure fuels polarization and incentivizes sensationalism, worsening America’s fractured information ecosystem and burdening democracy with an increasingly divisive media environment.

The Daily Spark

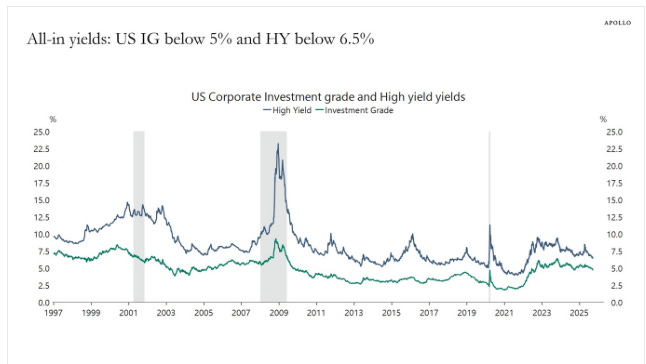

The all-in yield for public IG is now below 5%, and the all-in yield for public HY is below 6.5%, see chart below.

Quote of the Day

“Given a 10% chance of a 100 times payoff, you should take that bet every time.” — Jeff Bezos