To Strike or Not to Strike

Thursday, June 19th, 2025

World Events — Strike or Not Strike?

FT

Donald Trump has heightened uncertainty around potential U.S. military action against Iran, stating explicitly that he “may or may not” authorize strikes on Iranian nuclear sites, and hinting that the coming week will be pivotal for the war’s trajectory. Speaking after Iran’s supreme leader, Ayatollah Ali Khamenei, warned of “irreparable damage” if the U.S. intervenes, Trump suggested Tehran is now seeking negotiations—but that it may be too late, as he has told Israeli Prime Minister Benjamin Netanyahu to “keep going” with attacks on Iran and is weighing options with his national security team. Meanwhile, Iran denies any official request to negotiate under duress, and the conflict’s escalation has led both to significant casualties and a tightening of U.S. military posture in the region, with the Pentagon repositioning the USS Nimitz and destroyers toward the Middle East. The situation remains volatile, with both sides exchanging strikes and threats as global powers watch for a potential U.S. decision on direct involvement.

Tech — AI Is Turning Marketing Upside Down

Economists

Artificial intelligence is dramatically reshaping the advertising industry, thrusting executives into a new era where creativity and automation increasingly collide. At the Cannes Lions festival, while traditional agencies celebrate their craft and hand out awards for campaigns promoting everything from beer to public health, the rise of AI is impossible to ignore: tech giants like Meta, Google, ByteDance, and Amazon now dominate over half the global ad market, and their AI-powered tools are making ad creation, targeting, and measurement faster, cheaper, and more effective than ever. Agencies argue that human ingenuity and standout creativity remain irreplaceable—especially as AI-generated ads become ubiquitous—but the reality is that AI is already enabling brands to produce compelling commercials in days for a fraction of traditional costs, and new startups are helping advertisers optimize for AI recommendation engines and chatbots as well as human consumers. As the industry consolidates and agency holding companies face financial pressure, the challenge for traditional admen is not just to keep up with AI but to stay relevant in a landscape where ads may soon be created, targeted, and even consumed by AI agents—making the rosé-fueled celebrations in Cannes both a toast to past glories and a reminder that the party may not last forever.

Economics — Powell on Rates

Bloomberg

Federal Reserve Chair Jerome Powell has signaled that while the path for interest rates remains unclear, the impact of recent tariff increases is set to raise prices for American consumers in the coming months. The Fed held rates steady for the fourth consecutive meeting as policymakers awaited more clarity on whether tariffs would trigger a short-term or more persistent rise in inflation, with Powell noting that some of the tariff costs will inevitably be passed on to consumers—though the exact extent remains uncertain. While the central bank’s latest projections reveal a growing divide among officials—with the median forecast still pointing to two rate cuts this year, but some now expecting no cuts at all—the overall tone is cautious, reflecting heightened uncertainty about the economy and the lagging effects of trade policy. Powell emphasized that the Fed is monitoring incoming data closely, and with inflation expected to rise and economic growth forecasts downgraded, policymakers are in a wait-and-see mode until the full impact of tariffs and other policy changes becomes clearer.

Culture — Can AI Tell Us How Much Art is Worth?

FT

Artificial intelligence is rapidly transforming the art valuation industry by bringing greater efficiency, transparency, and speed to a process long known for its subjectivity and complexity. Startups like Appraisal Bureau are leveraging AI to analyze millions of data points from diverse sources—ranging from gallery exhibitions to economic indicators—to generate more accurate and up-to-date valuations, even for digital assets like NFTs. While AI can automate much of the data gathering and initial analysis, experts emphasize that human judgment remains essential for assessing the unique qualities of individual works and verifying data, ensuring that final valuations are both credible and nuanced. As AI-driven tools continue to improve in accuracy—some now reaching 85% alignment with actual sales—industry leaders believe these technologies will make valuations more accessible and affordable, though the art of appraisal will likely always require a blend of technology and specialist expertise.

The Daily Spark

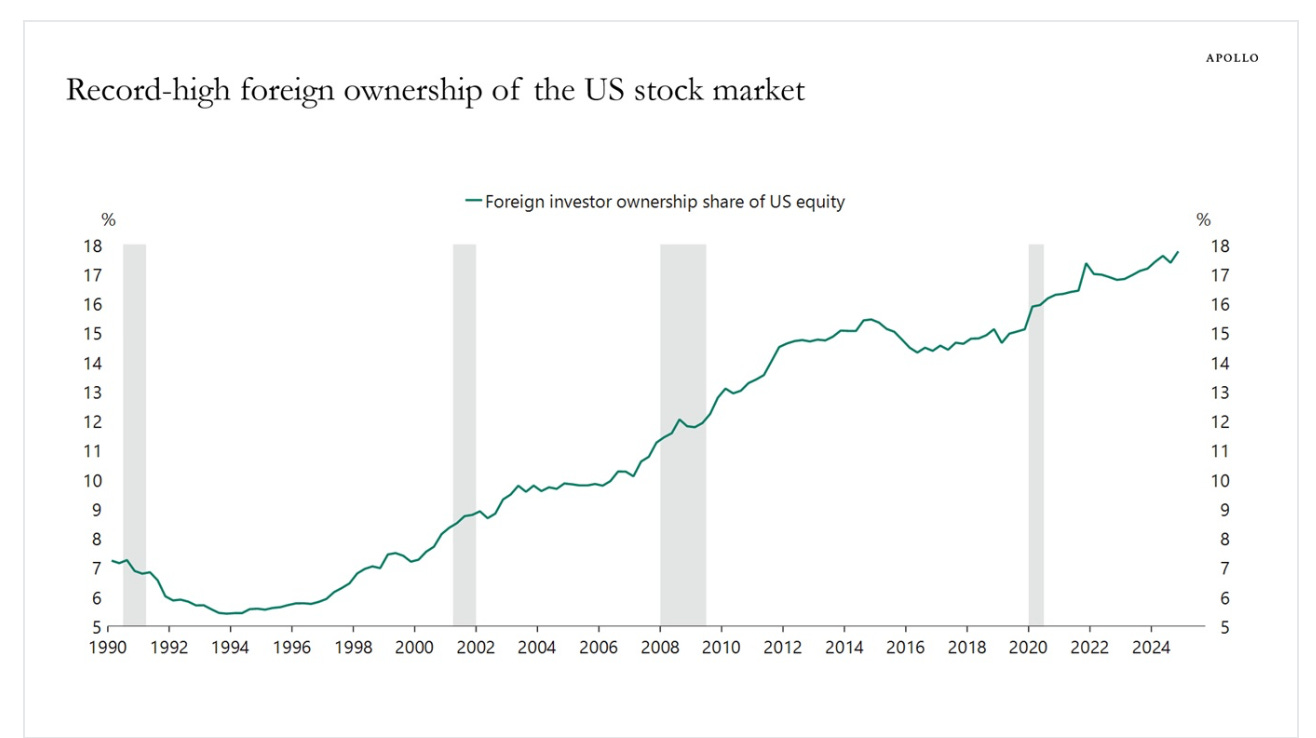

Foreigners have steadily increased their holdings of US equities and currently own 18% of the US stock market, see chart below.

This is the mirror image of a trade deficit. Foreigners selling goods to the US receive dollars in return, which are then used to purchase US assets, including US equities.

If the trade deficit is eliminated, there will be fewer dollars for foreigners to recycle into the S&P 500.

Song Recommendation — The Way I Love You

Quote of the Day

“Remember to celebrate milestones as you prepare for the road ahead.” — Nelson Mandela