Trump to Meet Putin

Friday, October, 17th, 2025

World News — Trump to Meet Putin in Budapest

FT

Donald Trump announced he will meet Vladimir Putin in Budapest within two weeks following a Thursday phone call, their first direct contact since August talks in Alaska, as the US president seeks to end the war in Ukraine. The planned meeting comes amid Trump’s growing frustration with Putin’s intransigence and his consideration of selling Tomahawk missiles to Ukraine—a move experts believe pushed Russia to accelerate diplomatic engagement. The announcement preceded a Friday White House meeting between Trump and Ukrainian President Volodymyr Zelenskyy, who is seeking additional military support as several European nations pledge to fund weapons purchases under the Purl initiative.

Tech — Apple’s Upcoming Touchscreen MacBook

Bloomberg

Apple is preparing to launch its first touch-screen MacBook Pro in late 2026 or early 2027, reversing a longstanding position held since Steve Jobs declared touch surfaces shouldn’t be vertical. The revamped models will feature OLED displays, thinner and lighter frames, M6 chips, and a hole-punch camera design replacing the notch, while retaining full trackpad and keyboard functionality like other PC manufacturers. Prices are expected to increase by a few hundred dollars above current models due to premium components, and Apple plans to gauge market reaction before expanding touch capabilities to other Mac products.

The Market — The Market Can’t Get Enough of Gold

Bloomberg

Gold has surged to record highs above $4,200 per ounce in 2025, driven by investors seeking refuge amid Trump’s trade war, US debt concerns, Federal Reserve independence questions, and a weakening dollar, with total ETF holdings reaching their highest level in over three years. Central banks, particularly in emerging markets, have accelerated their gold purchases to diversify away from dollar dependency following Russia’s invasion of Ukraine and subsequent Western sanctions, buying over 1,000 tons annually for three consecutive years. While gold’s valuation appears stretched by historical metrics and could decline if tariffs de-escalate or geopolitical tensions ease, the metal continues to outpace equities as both institutional and retail investors pile into the traditional safe-haven asset.

The Daily Spark

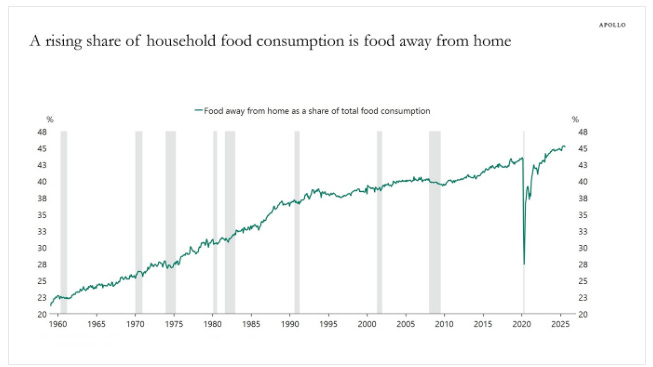

Households now spend almost as much on restaurants, takeout and delivery as on groceries eaten at home.

Quote of the Day

“Always laugh when you can, it is cheap medicine.”

― Lord Byron