Trump Visits UK

Wednesday, Sept 17th, 2025

World News — Trump Visits the UK

FT

UK officials are staging Donald Trump’s unprecedented second state visit with elaborate pomp and ceremony, hoping pageantry will overshadow political pitfalls, particularly his links to Jeffrey Epstein, which have resurfaced after Lord Peter Mandelson’s sacking; despite protesters highlighting the issue and opposition MPs pressing Prime Minister Keir Starmer to confront Trump, the government is focused on projecting unity through royal receptions, military parades, and a Windsor Castle banquet featuring top executives like Apple’s Tim Cook, BlackRock’s Larry Fink, Microsoft’s Satya Nadella, Nvidia’s Jensen Huang, and OpenAI’s Sam Altman, while the most perilous moment for Downing Street looms at Thursday’s joint press conference, where Trump’s unscripted style may determine whether the visit is remembered as a diplomatic coup or a political embarrassment.

Tech — The Brutal Fight to Dominate Chinese Car-making

Economists

China’s electric vehicle market, fueled by years of subsidies and overinvestment, has descended into a fierce price war that has slashed average car prices by nearly 20% in two years, battering profits even at giants like BYD and Geely and devastating foreign automakers that can’t match locals’ discounts, while a glut of more than 130 firms—many propped up by local governments—keeps competition alive; despite Beijing’s push to rein in “involution” and engineer mergers, weak firms linger, yet the relentless pressure is fortifying leaders such as BYD, Chery, Geely, Xpeng and Li Auto, as well as entrants like Huawei and Xiaomi, who can absorb lower margins and increasingly rely on booming exports, especially to Europe, where Chinese brands are rapidly gaining ground despite tariffs, posing a grave long-term threat to Western carmakers losing both their share in China and their competitive edge abroad.

Economics — Hedging Against the Dollar

FT

Foreign investors are pouring money into US assets but are increasingly hedging against dollar exposure, reflecting deep unease about the currency’s outlook under Donald Trump’s policies; Deutsche Bank data show hedged flows into US equities now dominate for the first time in four years, with around 80 per cent of recent foreign inflows opting for protection, a shift that has contributed to the dollar’s more than 10 per cent slide against major peers, even as Wall Street has rallied; fund managers from Pictet, SYZ, and others cite weakening institutional credibility, Trump’s preference for a weaker dollar, and geopolitical risks as reasons to shield portfolios, while cheaper hedging costs driven by falling US rates are drawing in pension funds from Denmark, the Netherlands, and Asia, amplifying the greenback’s decline.

The Daily Spark

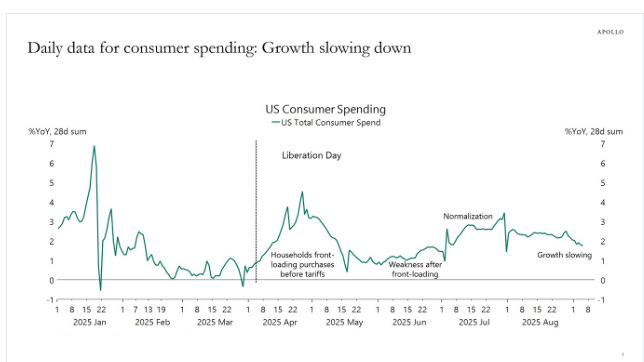

The daily data for consumer spending has slowed down modestly in recent weeks, and the slowdown is more pronounced in sectors impacted by tariffs.

Quote of the Day

“There is no such thing as a quantum leap. There is only dogged persistence – and in the end you make it look like a quantum leap.”

― James Dyson, Against the Odds: An Autobiography