Trump Weighs in on the Iran-Israeli War

June 18th, 2025

World Events — Trump Weighs in on the Iran-Israel War

FT

President Donald Trump has called for Iran’s “unconditional surrender” amid escalating conflict between Israel and Iran, fueling speculation that the United States could join Israeli military action against Tehran. Trump’s statements, made after leaving the G7 summit in Canada early to focus on the crisis, included warnings that his patience was “wearing thin” and that Iran’s supreme leader Ayatollah Ali Khamenei was an “easy target,” though he added, “We are not going to take him out (kill!), at least not for now,” emphasizing his demand that Iran stop launching missiles at civilians and American soldiers. Inside the Trump administration, officials have been actively debating whether the US should join Israel in attacking Iran or provide military support, with Trump holding an 80-minute meeting on the issue in the White House situation room. While Israel’s initial strikes have achieved some success, analysts doubt Israel can destroy Iran’s deeply buried Fordow uranium enrichment plant without US involvement, as only the US possesses the necessary bunker-busting munitions. The US has responded by building up its military presence in the region, including redeploying the USS Nimitz aircraft carrier strike group from the South China Sea to the Middle East, a move that will take at least a week to complete and signals heightened military readiness. Meanwhile, US Vice President JD Vance has echoed Trump’s stance, stating that any military action would be focused solely on American interests, while French President Emmanuel Macron has cautioned against seeking regime change in Iran, warning it would lead to chaos and urging for peace talks instead. Despite the rhetoric and military posturing, some leaders, including UK Prime Minister Sir Keir Starmer, have noted there is no clear indication yet that Trump intends to directly involve the US in the conflict.

Tech — Why China is Giving Away Its Tech For Free

Economists

China is giving away its technology for free through a surge in open-source contributions as a strategic response to American tech restrictions and to accelerate domestic innovation while reducing reliance on Western technology. Chinese tech giants like Alibaba, Baidu, and Huawei, along with a vast community of developers, have become major contributors to global open-source projects, particularly in artificial intelligence, with 12 of the top 15 open-source AI models now coming from China. This open approach allows Chinese firms to rapidly adapt and build on existing technologies, attract talent, and cut costs, but it also serves the government’s goal of self-sufficiency in critical sectors like semiconductors by promoting open standards such as RISC-V. However, this embrace of transparency and decentralization is awkward for China’s authoritarian regime, which has shown signs of tightening control—restricting access to platforms like GitHub and imposing official reviews on domestic alternatives—posing a risk to the openness that fuels innovation. Despite these tensions, China’s open-source movement remains largely organic, driven by the practical needs of developers and companies, but its future depends on whether the government continues to tolerate the freedoms essential for open technology to thrive.

Economics — Bank of Canada Faces Difficulty in Cutting Interest Rates

Bloomberg

Bank of Canada officials have indicated that further interest rate cuts will be difficult if core inflation remains elevated, even as they acknowledge that additional easing may be necessary should the economy weaken further. At their latest meeting, policymakers considered a 0.25 percentage point cut but ultimately held the policy rate steady at 2.75% for the second consecutive time, citing persistent core inflation, which reached 3.2% in April—its highest level since March 2024 and above officials’ expectations. While the risk of a prolonged global trade war has diminished, uncertainty around U.S. trade policy and ongoing tariff disputes initiated by President Trump are expected to slow growth and eventually put downward pressure on inflation, though the direct impact on consumer prices is not yet evident. Officials remain concerned that the recent rise in core inflation may persist as businesses and consumers adapt to global trade changes, and they are closely monitoring how tariffs affect export demand, business investment, employment, and consumer prices. The Bank of Canada emphasized that if underlying inflationary pressures continue, rate cuts will be constrained, but if economic data shows further weakness and inflation slows, a rate cut at the next meeting on July 30 is possible. The upcoming May and June inflation reports will be crucial in shaping the bank’s next policy decision.

Culture — The West Has Stopped Losing Its Religion

Economists

After decades of rising secularism, the trend of people leaving Christianity in the West has stalled and, in some cases, reversed, with a notable resurgence of faith among young people, especially Generation Z. This unexpected shift appears to be linked to the COVID-19 pandemic, which left many young adults feeling isolated and searching for meaning, prompting a renewed interest in religion and a rise in baptisms and church attendance. Surveys across America, Canada, Britain, and several European countries show that the share of people identifying as irreligious has stopped growing, while the Christian share of the population has stabilized or even increased among certain age groups. The data suggest that fewer people are abandoning Christianity, and more young adults are embracing faith for the first time, leading to a plateau in secularization. While the long-term significance of this trend remains uncertain, it marks a significant pause in the decades-long decline of religious affiliation in the West, driven less by immigration and more by cultural and existential factors following the pandemic.

The Daily Spark

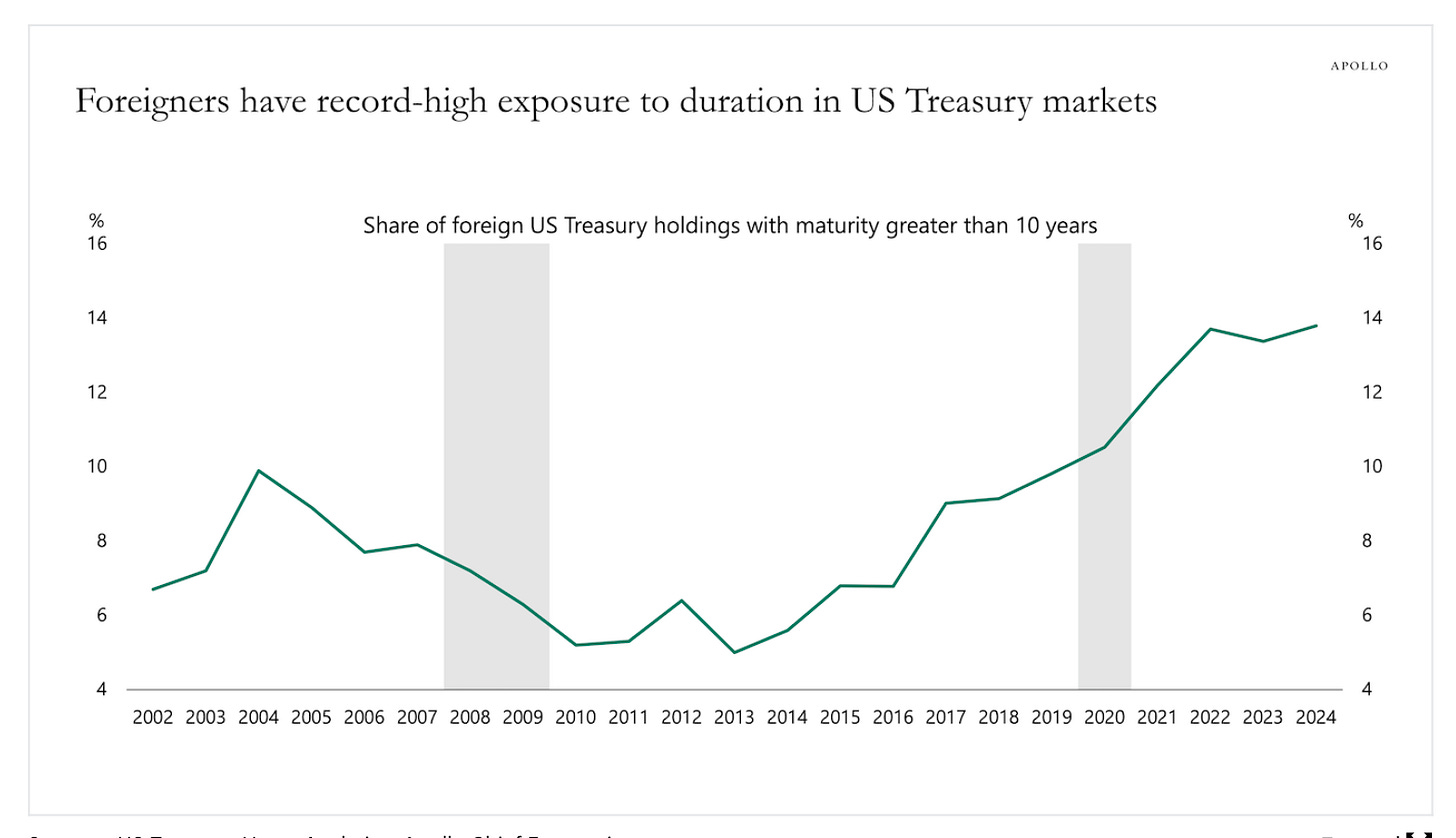

Foreigners have record-high exposure to long-dated US government bonds. Specifically, foreigners have increased their share of holdings of US Treasuries with a maturity greater than 10 years, see chart below.

As a result, foreign portfolios of US Treasuries are more vulnerable to the ongoing rise in long-term interest rates.

Why have foreigners over the past decade increased their exposure to US duration? Because of the prolonged period of low and negative interest rates in Europe and Japan. Global investors like high nominal yields.

Song Recommendation — Ordinary

Quote of the Day

"The future belongs to those who believe in the beauty of their dreams." - Eleanor Roosevelt.