Two Killed in Manchester

Friday, October, 3rd, 2025

World News — Two Killed in an Attack in Manchester Synagogue

FT

Two people were killed in a knife and car attack at the Heaton Park Hebrew Congregation Synagogue in Manchester on Yom Kippur, which police and Prime Minister Sir Keir Starmer have described as a terrorist incident. The assailant, identified as 35‑year‑old British citizen of Syrian descent Jihad Al‑Shamie, drove a vehicle into worshippers before stabbing others, and was fatally shot by police minutes after the attack began. Although he appeared to wear an explosive vest, it was later deemed non‑viable, and three others have been arrested in connection with the assault. The attack, the deadliest against Jewish people in the UK in at least three decades, comes amid a sharp rise in antisemitic incidents since the Israel–Hamas conflict in 2023, prompting heightened synagogue security and political leaders’ calls for unity against extremism.

Tech — Uber Acquire Segements.ai To Strength Its Data-labelling Unit

Uber Technologies has acquired Belgian startup Segments.ai to strengthen its growing data-labeling unit, Uber AI Solutions, as part of its strategy to sell AI services. Founded by Bert De Brabandere and Otto Debals, Segments.ai specializes in annotating training data from cameras and sensors used in autonomous vehicles, drones, and robotics, and is already cash‑flow positive with backing from Merus Capital and Volta Ventures. By integrating its team and client base, Uber aims to better compete with dominant players such as Meta‑backed Scale AI while expanding its lidar and multi‑sensor data annotation capabilities. The acquisition also bolsters Uber’s broader effort to provide outsourced AI training services to enterprises through a global freelancer platform, which already serves more than 50 clients including Aurora Innovation and Niantic.

Economics — Why China’s Stock Market Surge May Hurt the Economy

Economists

China’s stockmarket has surged about 40% since authorities triggered a rally on September 24th last year through interest rate cuts, looser reserve requirements, and financial incentives for buybacks and leverage, but the broader economy has failed to follow suit. While rising share prices have boosted household risk appetite, driven millions of new trading accounts, and revived brokerage activity, consumer confidence and spending remain weak, retail sales growth sluggish, and corporate investment constrained by stricter listing rules and government efforts to curb overcapacity. The rally now resembles the 2015 bubble, with record levels of margin financing and regulatory unease about instability, raising fears that an attempt to manage exuberance may stifle economic recovery even further amid entrenched deflation and a lingering property slump.

The Daily Spark

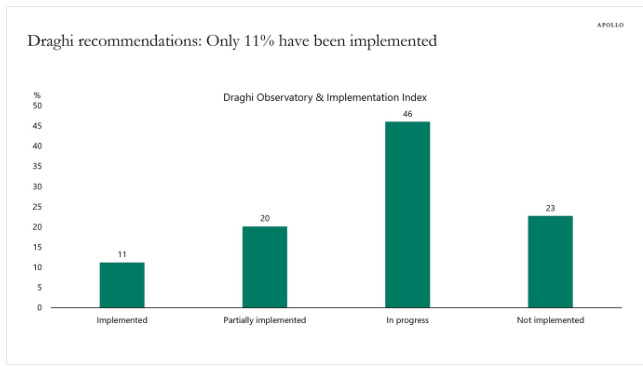

A year ago, former ECB president and Italian prime minister Mario Draghi laid out 383 policy recommendations to make the European economy more competitive, and so far, only 11% of his proposals have been implemented, see chart below.

Growth is weak in Europe, and European politicians need to move much faster if they want to make the European economy more competitive.

Quote of the Day

“Freeing yourself was one thing, claiming ownership of that freed self was another.”

― Toni Morrison, Beloved