Unrest In Indonesia

Monday, Sept 1st, 2025

World News - Unrest In Indonesia

FT

Crowds in Indonesia have looted the home of finance minister Sri Mulyani Indrawati amid intensifying protests over a new $3,000 monthly housing perk for members of parliament, reflecting widespread economic frustration caused by job losses and declining spending power. The demonstrations, spurred on further by the killing of a motorbike taxi driver during a rally in Jakarta, have resulted in multiple deaths, destruction of public property, and attacks on the homes of prominent politicians. In response, President Prabowo Subianto has authorized strong police and military action, announced cuts to parliamentary benefits, and cancelled a planned foreign trip to manage the escalating crisis, which has also rattled markets and put Indonesia’s fiscal policies under public scrutiny.

Tech - Alibaba AI With Strong Growth

Alibaba’s shares surged more than 9% after the company reported a triple-digit percentage increase in AI-related product revenue and a 26% jump in cloud sales, signaling strong progress in China’s AI sector despite intense competition in e-commerce and food delivery. While Alibaba’s overall revenue growth was modest at 2%, investors were encouraged by its advances in AI, development of large language models, and ongoing investment in cloud infrastructure, which the company sees as a new engine for growth. These AI gains are helping the company outpace rivals and weather the impact of margin pressures in its core commerce divisions, reflecting optimism about Alibaba’s push to lead in artificial intelligence even as the broader sector remains fiercely competitive.

Business - The Fate of the Market Comes Down to the Next 14 Days

The fate of the stock market over the next 14 trading sessions will hinge on upcoming pivotal events—including jobs data, inflation reports, and the Federal Reserve’s interest rate decision—arriving as the S&P 500 enters September, historically its weakest month, following its smallest monthly gain since March and an extended period of unusually low volatility. Investors are adopting a cautious stance as Wall Street’s optimism is challenged by seasonality, growing concerns of overvaluation, and the possibility of a 5–10% pullback if economic data disappoints or the Fed’s policy guidance shifts. With volatility expected to spike around key data releases and “triple witching” options expiration, market participants will be closely watching whether recent resilience can withstand looming macroeconomic and policy headwinds.

Arms - The Two Hottest Upstar Weapons Dealer

Economists

The global arms race is intensifying as countries respond to geopolitical tensions with record military spending, creating lucrative opportunities for upstart arms exporters like South Korea and Turkey. South Korea, leveraging its NATO-standard weaponry and advanced programs such as the KF-21 fighter, has landed major deals including a $22 billion contract with Poland, signaling its ambition to join the top ranks of global arms suppliers. Meanwhile, Turkey has rapidly expanded its arms exports from $2 billion to over $7 billion by developing competitive drones, armored vehicles, and fighter jets, targeting markets in Europe, the Middle East, and Africa. This shift reflects a broader realignment as traditional suppliers like Russia prioritize domestic forces amid sanctions and diminished exports, while rising powers capitalize on growing demand for modern weapons driven by conflicts like the war in Ukraine and concerns over China-Taiwan tensions.

The Daily Spark

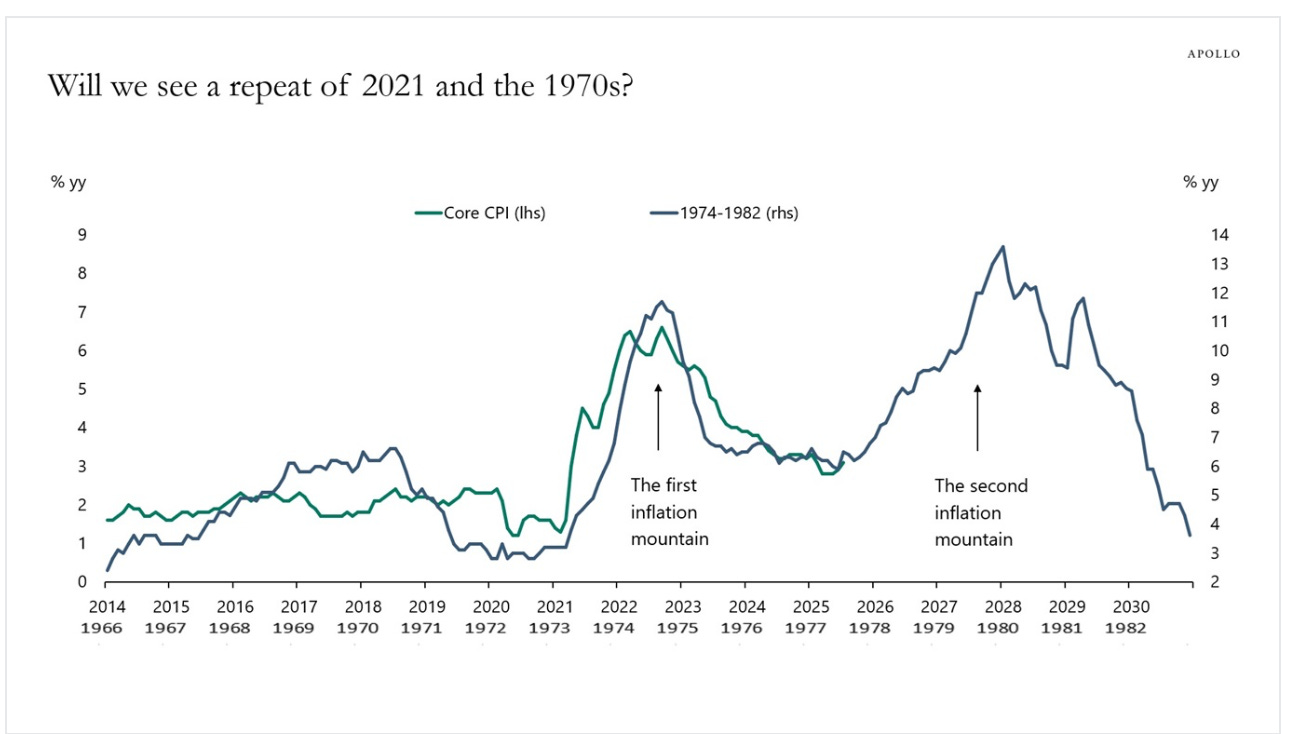

There is upside pressure on inflation and inflation expectations from tariffs, dollar depreciation and growing disagreement on the FOMC about how much weight to put on rising inflation relative to slowing employment.

The risks are rising that we could see another “inflation mountain” emerge over the coming months, see chart below.

Quote of the Day

“Our wretched species is so made that those who walk on the well-trodden path always throw stones at those who are showing a new road.” ― Voltaire