What if the AI Stockmarket Blows Up

Monday, Sept 8th, 2025

World News — The Sinister Brilliance of Donald Trump’s Security Threatre

Economics

Donald Trump’s use of security theatre is less about genuine safety and more about spectacle, exaggeration, and political messaging, in which muscular displays of force—such as raids, harsh detention facilities, and military posturing—are deployed to reassure supporters, intimidate opponents, and stretch presidential power despite shaky legal justifications. These tactics, embodied in stunts like “Alligator Alcatraz,” fireball drone strikes, and staged immigration raids, aim to convey toughness on crime and immigration while masking weak results, shaping public perception, and placing Democrats in a defensive posture. Ultimately, Trump’s strategy thrives on dramatic symbolism, even when the underlying reality is more about cruelty, showmanship, and legal brinkmanship than effective governance.

Tech — Hinton on AI and Wealth Distribution

Geoffrey Hinton, the pioneering computer scientist and Nobel laureate often called the “godfather of AI,” has shifted from championing artificial intelligence to warning of its grave dangers, arguing that while it will make a handful of people vastly richer, it will leave most people poorer and more vulnerable. Over lunch in Toronto, he paints AI as both astonishingly powerful and deeply risky: it could allow ordinary people to create bioweapons or threaten humanity’s survival if superintelligence outpaces human control. He likens humanity’s best chance to teaching AI to act like a protective mother, though he fears the profit-driven race led by men like Sam Altman or Elon Musk will accelerate harms. Reflecting on the capitalist system, he predicts massive inequality as AI replaces jobs and concentrates wealth, leaving society with profound ethical, political, and existential challenges at a moment he calls “amazingly good or amazingly bad”—but undeniably transformative.

Business — What if the AI Stockmarket Blows Up

Economists

The meteoric surge in AI-driven stock valuations—adding $21trn since ChatGPT’s release—has all the hallmarks of a speculative bubble, with investor faith in a coming “Digital God” outpacing real-world revenues that remain modest relative to the massive capital sunk into data centers and chips. History shows that bubbles tied to genuine innovations often burst before the technology matures, wiping out overvalued firms but leaving lasting infrastructure. If the AI boom collapses, losses would fall largely on tech giants, pensions, sovereign wealth funds, and wealthy households rather than banks, meaning the financial system might survive intact—but America’s economy, with household wealth increasingly tied to AI-heavy equities, could see sharp demand shocks. The danger is that if hype fails to match reality, the unraveling could rival some of history’s biggest bubbles, with painful but uneven consequences.

The Daily Spark

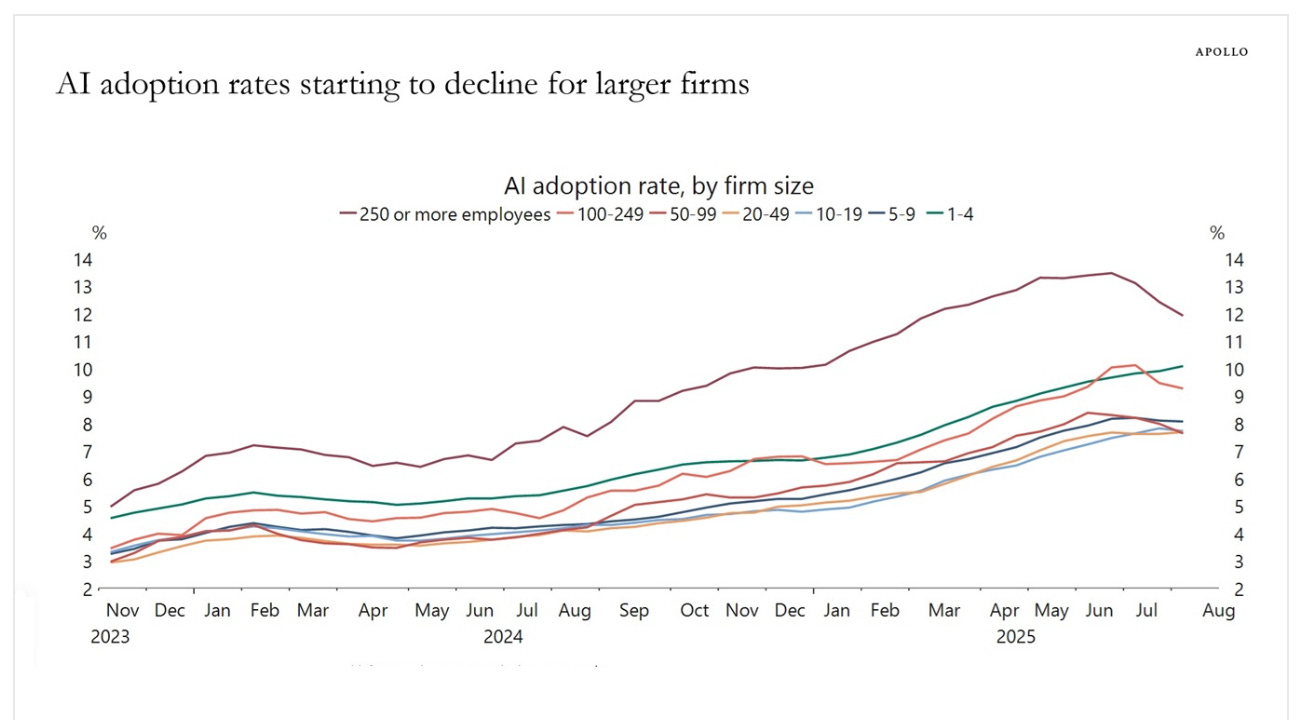

The US Census Bureau conducts a biweekly survey of 1.2 million firms, and one question is whether a business has used AI tools such as machine learning, natural language processing, virtual agents or voice recognition to help produce goods or services in the past two weeks. Recent data by firm size shows that AI adoption has been declining among companies with more than 250 employees, see chart below.

The bottom line is that the biweekly Census data is starting to show a slowdown in AI adoption for large companies.

Quote of the Day

“I attribute my success to this: I never gave or took any excuse.” – Florence Nightingale