What Now, Ukraine?

Monday, August 18th, 2025

World News — What Now For Ukraine?

Economists

The Alaska summit between Donald Trump and Vladimir Putin has left Ukrainian officials increasingly uneasy, despite initial relief that no sweeping pro-Russian deal was struck. While the meeting's lack of a definitive outcome was welcomed at first, details emerging from the talks—especially Trump's acceptance of Russia's demand for a "comprehensive peace" before establishing a ceasefire—have prompted fears in Kyiv that the U.S. may now back the Kremlin's vision for Ukraine. Russian President Putin reiterated demands for Ukraine to surrender key fortified territories in Donetsk and Luhansk in exchange for small territorial returns, a proposal Ukrainians overwhelmingly reject. There is mounting anxiety that the Trump administration is aggressively pushing for concessions aligned with Russian interests, including sanctions relief and resumed energy trade. As President Zelensky prepares for a tense visit to Washington and a possible three-way summit with Trump and Putin, many in Ukraine fear that the pathway to peace being considered would come at the cost of their sovereignty and set a dangerous precedent for international order.

Tech — Can You Trust Online Reviews?

Economists

It’s wise to use Airbnb’s five-star ratings as a starting point for decision-making, but you should approach them with caution. Online reviews are helpful but flawed: ratings tend to be more polarized and positive than neutral, and those who leave them may not represent the average guest. Ratings on sharing-economy platforms like Airbnb are often inflated—partly because guests rate hosts who, in turn, rate them, making it awkward to leave less than five stars. Studies show that the average score on Airbnb is consistently higher than for hotels elsewhere, suggesting these reviews might be less objective. Fake reviews, biased sampling, and personal tastes complicate things further. Experts recommend looking beyond just the star count: check the number of reviews, read the content for specifics that match your preferences, and treat highly detailed feedback as more trustworthy than generic compliments. Ultimately, paying attention to detailed review content and volume is more reliable than simply trusting a five-star average.

Private Market — The Lure of Free Money Nears Mania

Bloomberg

Investor zeal for "free money" is surging in the private asset secondary market, driven by a wave of buyers exploiting an accounting quirk that lets them snap up fund stakes at a discount and then revalue them at par, instantly boosting apparent returns. The appetite has created near-mania, with transaction volumes expected to top $170 billion in 2025—more than a 70% surge over 2023 levels—while funds specializing in credit secondaries are enjoying especially rapid growth. The practice is fueled by sellers seeking liquidity in the wake of higher interest rates and dealmaking slowdowns, and buyers attracted by the perception of easy gains and the opportunity to mark up assets. Yet, market veterans warn that chasing quick profits based on technical valuations risks misjudging long-term portfolio value, even as major managers like Blackstone, Ares, and Coller Capital pour billions into dedicated secondary vehicles to seize these fleeting opportunities.

Culture — Why America Can’t Shake Off Inflation

Economists

The stubbornness of inflation in English-speaking countries has resembled a “farshlepteh krenk”—a persistent, hard-to-shake malady. Although average OECD inflation dropped to about 2.5% in June 2025, above most central bank targets but sharply down from its peak near 11% in 2022, Anglophone economies like Britain, Australia, and Canada are still battling entrenched price pressures. Core inflation and unit labor costs remain high, with Britain topping the list for inflation entrenchment and Australia not far behind. Lingering symptoms are exacerbated by expansionary fiscal policies and surges in immigration, especially affecting housing costs, while broader OECD and Asian economies are faring much better. Some hope persists: fiscal tightening, slower immigration, and waning inflation expectations suggest the entrenchment may ease. Yet in the U.S., fiscal stimulus and tariffs pose new risks, and Americans expect prices to climb 5.5% over the next year—more than in any other country—underscoring how sticky and potentially worsening inflation remains in much of the Anglophone world.

The Daily Spark

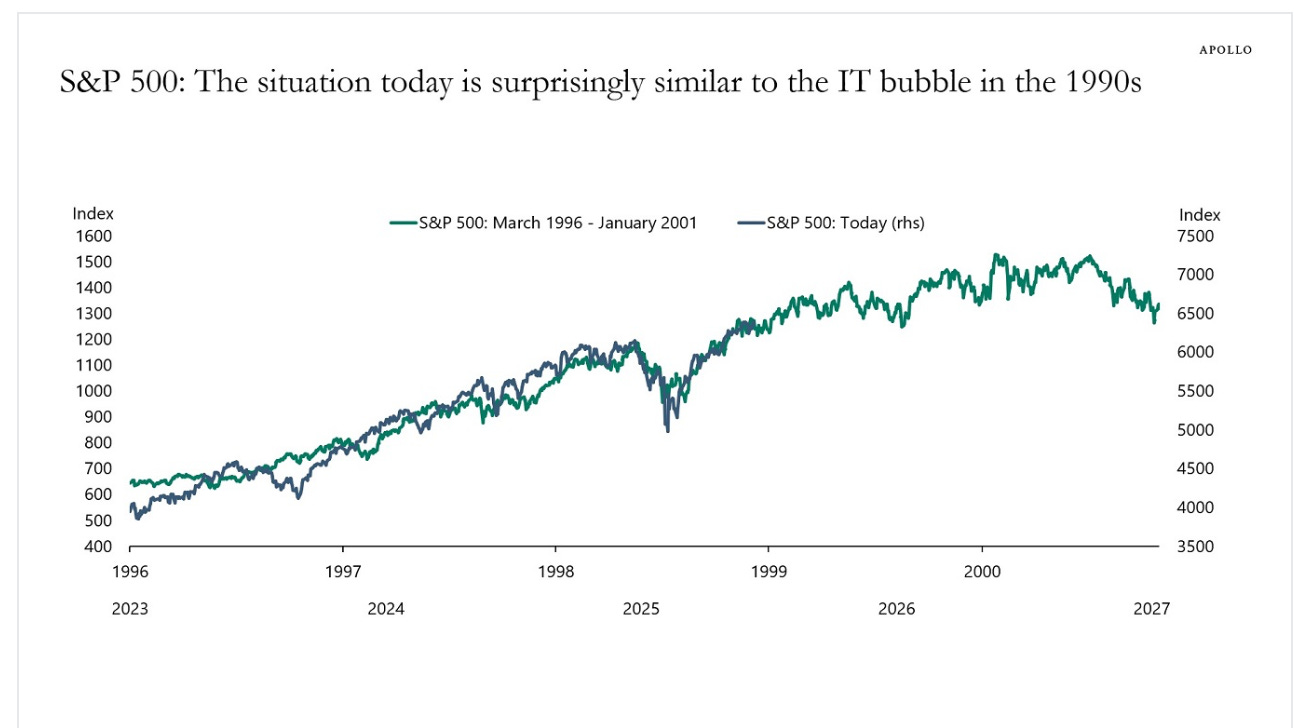

AI will have a significant impact on our lives and productivity. But that doesn’t mean that the tech companies in the S&P 500 are correctly priced.

The P/E ratio for Tesla is almost 200, and the P/E ratio for Nvidia is around 60. Many software companies are likely to go out of business because of ChatGPT.

The bottom line is that it is not clear that the tech stocks in the S&P 500 are the best choices when investing in the AI theme, and the chart below shows that the situation today is surprisingly similar to the IT bubble in the 1990s.

Song Rec — Handlebar

Quote of the Day

“Because one believes in oneself, one doesn't try to convince others. Because one is content with oneself, one doesn't need others' approval. Because one accepts oneself, the whole world accepts him or her.”

― Lao Tzu