Zelensky In Tiger's Den

Tuesday, August 19th, 2025

World News — Zelensky Survives Another Episode of the Trump Show

Economists

In a carefully stage-managed day at the White House on August 18th, Donald Trump and Volodymyr Zelensky struck a surprisingly positive tone as Europe’s leaders rallied to support Ukraine, despite deep uncertainties over substance. Mr Zelensky, having changed from his trademark military garb into a more conventional suit to placate the American president, praised Mr Trump’s efforts amid talk of future three-way peace negotiations involving Vladimir Putin. While Mr Trump dangled notions of security guarantees “Article Five-like” in nature and suggested that territorial concessions could be left to Kyiv and Moscow, European counterparts pressed him on whether sidestepping a ceasefire or legitimizing land swaps would fatally weaken Ukraine. Russia, meanwhile, swiftly rejected the idea of any NATO-backed presence in Ukraine. For all the contradictions—between vague promises of support, resistance in Kyiv to ceding ground in Donbas, and Moscow’s rejection of Western security commitments—the spectacle of Mr Trump at the center of a possible Zelensky-Putin summit underscored both the fragility of the process and its potential to reshape the war’s trajectory.

Tech — Private Credit Powered AI Boom Risks Overheating

Bloomberg

UBS Global Research has warned that the surge of private credit fueling artificial intelligence investment could be overheating, as non-bank lenders increasingly bankroll massive tech projects once reliant on traditional financing. Private debt in the tech sector has swelled to about $450 billion as of early 2025, with business development company lending nearly doubling to $150 billion, according to UBS estimates. Giants like Microsoft, Amazon, Alphabet and Meta are leading a more than $344 billion AI spending spree this year, while OpenAI’s Sam Altman is seeking ways to finance trillions in data center infrastructure. The boom has attracted private credit firms such as Pimco and Blue Owl, which recently helped arrange Meta’s $29 billion data center deal, with investors pouring another $70 billion into funds in just the first quarter. But UBS cautions that “payment in kind” arrangements, which allow borrowers to delay interest payments, are rising fast—signaling mounting pressure in the system and underscoring risks that unchecked credit growth could destabilize both AI’s expansion and the broader credit market.

Equity Market — Pump and Dump With Meme Stocks

FT

In July, billions of dollars were wiped out as a wave of “pump and dump” scams targeting U.S.-listed Chinese microcap stocks left retail investors reeling, highlighting an alarming resurgence of stock manipulation schemes amplified by social media. Seven Nasdaq-listed firms, including Ostin Technology and Pheton Holdings, soared before collapsing by more than 80% in days, erasing $3.7 billion in value, after being aggressively promoted in WhatsApp groups, Facebook ads, and Reddit posts that mimicked advice from fake brokers and analysts. Victims ranged from first-time traders to professionals, many of whom were duped by what appeared to be legitimate investment communities. Predictive analytics firm InvestorLink flagged unusual activity in advance, but regulators have so far been slow to act, even as the FBI reports a 300% surge in related fraud complaints. Analysts warn that the proliferation of Chinese IPOs in U.S. markets since 2024 has given scammers easy vehicles for manipulation, while platforms such as Meta insist they are expanding enforcement against financial fraud. Still, with evidence of coordinated activity traced to foreign actors and past examples of market bubbles fueled by hype, the latest crashes underscore how vulnerable retail investors remain to sophisticated digital-era pump and dump schemes.

Housing — Housing Construction In Canada Gains Momentum

Bloomberg

Canada’s housing market showed unexpected momentum in July as housing starts surged to an annualized 294,100 units — the highest since September 2022 and above all economist forecasts. The increase was fueled by a jump in multi-unit construction in Ontario, Quebec, and Atlantic Canada, offsetting sharp declines in Alberta and British Columbia. While the Canada Mortgage and Housing Corp. data suggest robust near-term activity, economists caution that slowing population growth, easing rents, and an oversupply of condominiums could cool activity by 2026. With housing affordability still a pressing national issue, CMHC estimates the country would need to add nearly half a million units annually to restore pre-pandemic balance — a target Prime Minister Mark Carney has tied to his housing push ahead of October’s federal budget.

The Daily Spark

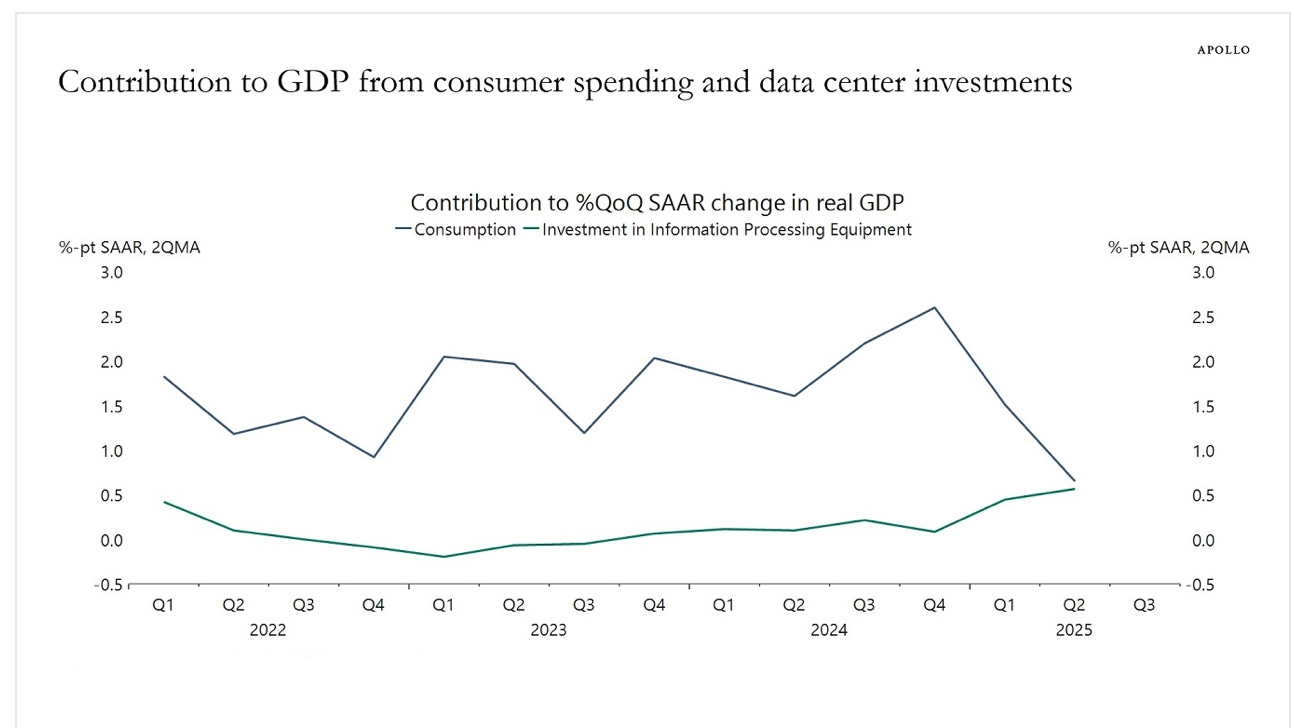

Consumer spending makes up 70% of GDP, and private consumption is usually the key driver of GDP growth.

But that has changed in 2025.

Over the first half of this year, the contribution to GDP growth from data center investments has been the same as the contribution from consumer spending, see chart below. The contribution from consumer spending has been decreasing, and the contribution from data center construction has been increasing.

Song Recommendation — Always

Quote of the Day

“Price is what you pay. Value is what you get. Honesty is a very expensive gift, don't expect it from cheap people.” — Warren Buffett